Region:Middle East

Author(s):Shubham

Product Code:KRAC3520

Pages:83

Published On:October 2025

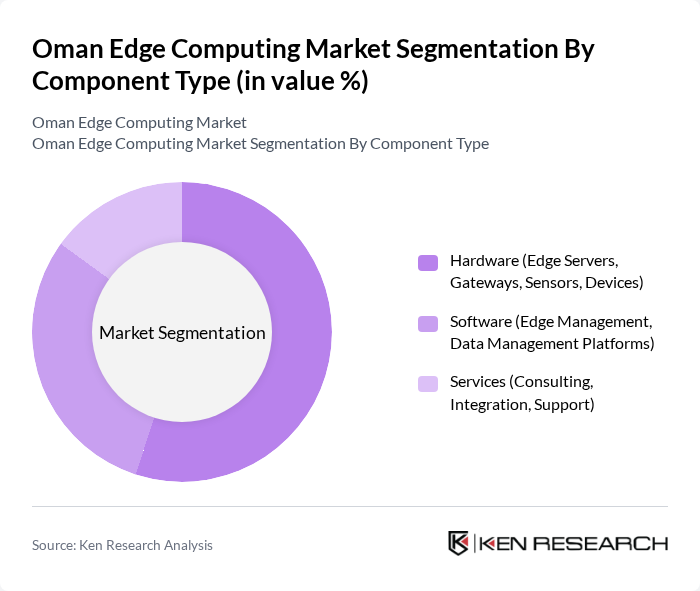

By Component Type:

The component type segmentation includes hardware, software, and services. Among these,hardware, which encompasses edge servers, gateways, sensors, and devices, is the leading sub-segment. The increasing deployment of IoT devices and the need for efficient data processing at the edge are driving the demand for hardware solutions.Softwaresolutions, including edge management and data management platforms, are also gaining traction as organizations seek to optimize their edge computing capabilities.Services, which include consulting, integration, and support, are essential for organizations looking to implement edge computing solutions effectively. This structure aligns with regional and global trends, where hardware accounts for the largest share due to infrastructure investments, followed by software and services .

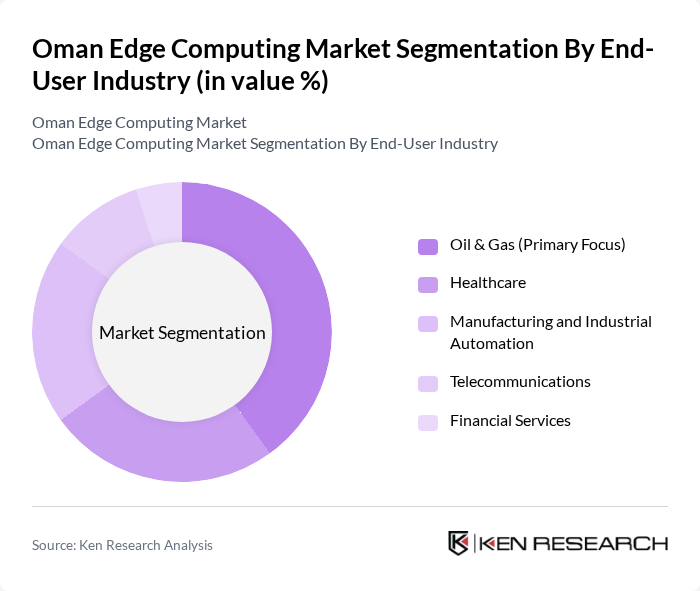

By End-User Industry:

The end-user industry segmentation includes oil and gas, healthcare, manufacturing and industrial automation, telecommunications, and financial services. Theoil and gassector is the primary focus, leveraging edge computing for real-time monitoring and predictive maintenance.Healthcareis rapidly adopting edge solutions to enhance patient care and streamline operations, especially with the rise of telemedicine and remote diagnostics.Manufacturing and industrial automationare increasingly utilizing edge computing for process optimization and efficiency.Telecommunicationsare investing in edge technologies to support 5G networks and network slicing, whilefinancial servicesare exploring edge computing for enhanced security and real-time transaction processing. These trends are consistent with the leading sectors adopting digital transformation and edge computing in Oman .

The Oman Edge Computing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Telecommunications Company (Omantel), Ooredoo Oman, Oman Computer Services LLC (OCS Infotech), Cisco Systems, Inc., IBM Corporation, Microsoft Corporation, Hewlett Packard Enterprise (HPE), Dell Technologies, Oracle Corporation, Huawei Technologies Co., Ltd., Nokia Corporation, Ericsson, VMware, Inc., Schneider Electric SE, ZEDEDA (Edge Management & Orchestration Platform) contribute to innovation, geographic expansion, and service delivery in this space.

The Oman edge computing market is poised for significant transformation as technological advancements and regulatory frameworks evolve. In future, the integration of edge computing with AI and machine learning is expected to enhance data processing capabilities, driving innovation across various sectors. Additionally, the government's commitment to digital transformation will likely foster a conducive environment for edge computing adoption, enabling businesses to leverage real-time data for strategic decision-making and operational efficiency.

| Segment | Sub-Segments |

|---|---|

| By Component Type | Hardware (Edge Servers, Gateways, Sensors, Devices) Software (Edge Management, Data Management Platforms) Services (Consulting, Integration, Support) |

| By End-User Industry | Oil & Gas (Primary Focus) Healthcare Manufacturing and Industrial Automation Telecommunications Financial Services |

| By Application | Real-Time Data Processing and Control Edge AI and Inference Smart City Solutions Predictive Maintenance and Asset Monitoring Remote Monitoring and Surveillance |

| By Deployment Model | On-Premises Cloud-Based Hybrid Edge-Cloud |

| By Geographic Region | Muscat (Capital Region) Salalah (Dhofar Region) Sohar (Batinah Region) Other Regional Areas |

| By Organization Size | Large Enterprises Medium-Sized Enterprises Small and Emerging Businesses |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecommunications Sector Edge Computing | 50 | Network Engineers, IT Directors |

| Healthcare Data Processing | 40 | Healthcare IT Managers, Data Analysts |

| Manufacturing Automation Solutions | 45 | Operations Managers, Production Engineers |

| Smart City Infrastructure | 60 | Urban Planners, Smart Technology Consultants |

| IoT Device Management | 55 | IoT Solution Architects, Product Managers |

The Oman Edge Computing Market is valued at approximately USD 35 million, reflecting a five-year historical analysis and normalization from the GCC regional market size, driven by the demand for real-time data processing and IoT device proliferation.