Region:Global

Author(s):Geetanshi

Product Code:KRAA2277

Pages:96

Published On:August 2025

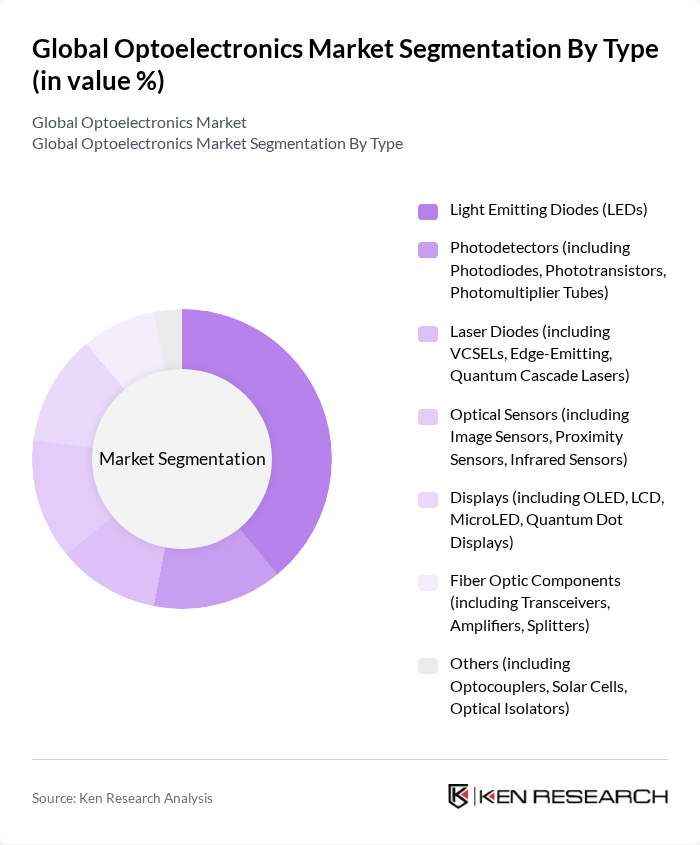

By Type:The optoelectronics market is segmented into various types, including Light Emitting Diodes (LEDs), Photodetectors (including Photodiodes, Phototransistors, Photomultiplier Tubes), Laser Diodes (including VCSELs, Edge-Emitting, Quantum Cascade Lasers), Optical Sensors (including Image Sensors, Proximity Sensors, Infrared Sensors), Displays (including OLED, LCD, MicroLED, Quantum Dot Displays), Fiber Optic Components (including Transceivers, Amplifiers, Splitters), and Others (including Optocouplers, Solar Cells, Optical Isolators). Among these, Light Emitting Diodes (LEDs) hold the largest share due to their extensive application in general lighting, automotive lighting, and display technologies. The increasing focus on energy efficiency and sustainability has accelerated LED adoption across sectors, while optical sensors and advanced display technologies are also experiencing robust growth driven by demand in smartphones, automotive safety, and next-generation displays .

By End-User:The end-user segmentation of the optoelectronics market includes Consumer Electronics, Telecommunications & Data Centers, Automotive & Transportation, Healthcare & Medical Devices, Industrial Automation & Manufacturing, Military & Defense, and Others (including Aerospace, Energy, Security). The Consumer Electronics segment leads the market, propelled by the surging demand for smart devices, televisions, and advanced lighting solutions. Rapid technological advancements, the proliferation of smart home devices, and increased integration of optoelectronic components in wearables and mobile devices have significantly boosted adoption in this segment. Telecommunications and data centers are also major contributors, driven by the expansion of high-speed optical networks and cloud infrastructure .

The Global Optoelectronics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Intel Corporation, Texas Instruments Incorporated, Broadcom Inc., ams-OSRAM AG, Coherent Corp., Lumentum Holdings Inc., Hamamatsu Photonics K.K., STMicroelectronics N.V., Vishay Intertechnology, Inc., Qorvo, Inc., Wolfspeed, Inc., Sony Group Corporation, Panasonic Holdings Corporation, Samsung Electronics Co., Ltd., Mitsubishi Electric Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the optoelectronics market appears promising, driven by technological advancements and increasing demand for sustainable solutions. As industries adopt smart technologies and renewable energy sources, the integration of optoelectronic devices will become more prevalent. In future, the market is expected to witness significant growth in sectors such as telecommunications and consumer electronics, with innovations in AI and IoT further enhancing the capabilities of optoelectronic applications. This evolution will create new avenues for investment and development.

| Segment | Sub-Segments |

|---|---|

| By Type | Light Emitting Diodes (LEDs) Photodetectors (including Photodiodes, Phototransistors, Photomultiplier Tubes) Laser Diodes (including VCSELs, Edge-Emitting, Quantum Cascade Lasers) Optical Sensors (including Image Sensors, Proximity Sensors, Infrared Sensors) Displays (including OLED, LCD, MicroLED, Quantum Dot Displays) Fiber Optic Components (including Transceivers, Amplifiers, Splitters) Others (including Optocouplers, Solar Cells, Optical Isolators) |

| By End-User | Consumer Electronics Telecommunications & Data Centers Automotive & Transportation Healthcare & Medical Devices Industrial Automation & Manufacturing Military & Defense Others (including Aerospace, Energy, Security) |

| By Application | Communication Systems (Optical Networking, Fiber Optic Links) Lighting Solutions (General Lighting, Automotive Lighting, Backlighting) Imaging Systems (Cameras, Medical Imaging, Machine Vision) Sensing Applications (Environmental, Industrial, Biomedical Sensing) Display Technologies (TVs, Smartphones, Wearables, AR/VR) Power Generation (Photovoltaics, Solar Cells) Others (Quantum Computing, Security Systems) |

| By Component | Active Components (LEDs, Laser Diodes, Photodetectors) Passive Components (Lenses, Mirrors, Optical Filters) Integrated Circuits (Optoelectronic ICs, Photonic ICs) Connectors & Couplers (Fiber Connectors, Optocouplers) Others (Heat Sinks, Mounting Hardware) |

| By Distribution Channel | Direct Sales Online Retail Distributors/Value-Added Resellers Retail Outlets Others |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| By Technology | Quantum Dots Organic Light Emitting Diodes (OLEDs) Inorganic Light Emitting Diodes (LEDs, MicroLEDs) Gallium Nitride (GaN) and Other Compound Semiconductors Others (Silicon Photonics, Photonic Crystals) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecommunications Optoelectronics | 100 | Network Engineers, Telecom Product Managers |

| Consumer Electronics Applications | 80 | Product Development Managers, Electronics Engineers |

| Automotive Lighting Solutions | 70 | Automotive Engineers, Supply Chain Managers |

| Industrial Sensors and Imaging | 50 | Manufacturing Engineers, Quality Control Managers |

| Medical Optoelectronic Devices | 60 | Biomedical Engineers, Regulatory Affairs Specialists |

The Global Optoelectronics Market is valued at approximately USD 156 billion, driven by the demand for energy-efficient lighting solutions, advancements in telecommunications, and the growing adoption of optoelectronic devices in consumer electronics.