Region:Global

Author(s):Rebecca

Product Code:KRAA2928

Pages:85

Published On:August 2025

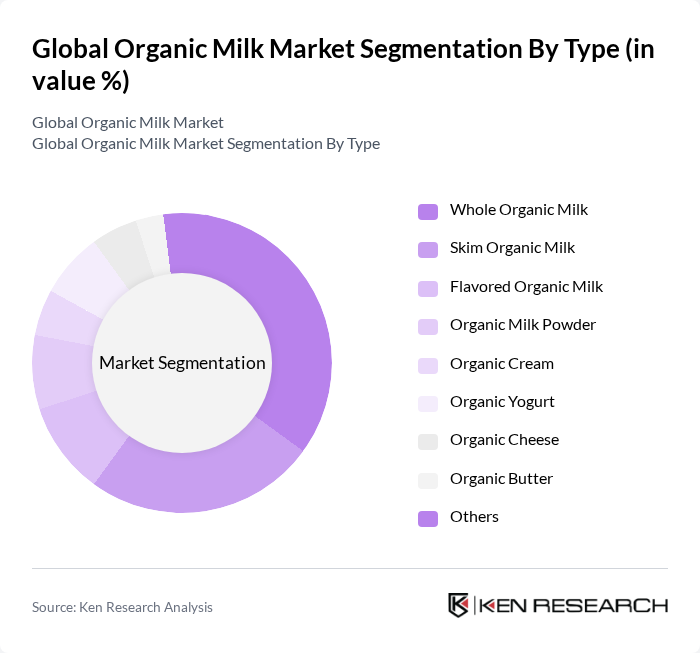

By Type:The organic milk market is segmented into various types, including Whole Organic Milk, Skim Organic Milk, Flavored Organic Milk, Organic Milk Powder, Organic Cream, Organic Yogurt, Organic Cheese, Organic Butter, and Others. Among these,Whole Organic Milkis the most popular due to its rich taste and nutritional benefits, appealing to health-conscious consumers. Skim Organic Milk is also gaining traction as more consumers seek lower-fat options without compromising on organic quality.

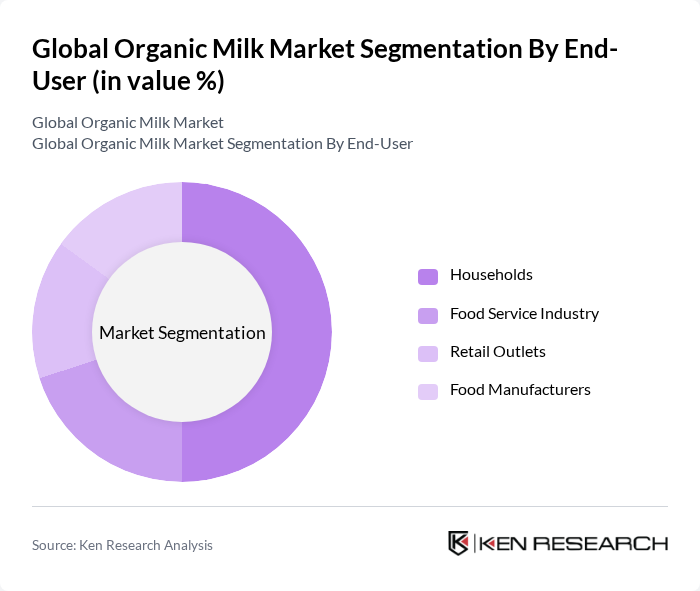

By End-User:The market is segmented by end-users, including Households, Food Service Industry, Retail Outlets, and Food Manufacturers.Householdsrepresent the largest segment, driven by the increasing trend of health-conscious eating and the growing preference for organic products among families. The Food Service Industry is also expanding as restaurants and cafes increasingly offer organic options to cater to consumer demand.

The Global Organic Milk Market is characterized by a dynamic mix of regional and international players. Leading participants such as Organic Valley (Cropp Cooperative, USA), Horizon Organic (Danone North America, USA), Stonyfield Farm (Danone North America, USA), Maple Hill Creamery (USA), Aurora Organic Dairy (USA), Clover Sonoma (USA), Arla Foods (Denmark/Global), Yeo Valley Organic (UK), China Shengmu Organic Milk Ltd. (China), The Kroger Co. (Simple Truth Organic, USA), General Mills, Inc. (USA), Saputo Inc. (Canada), Almarai (Saudi Arabia), Lactalis Group (France), Danone S.A. (France/Global) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the organic milk market appears promising, driven by increasing consumer demand for health-oriented products and sustainable practices. As more consumers prioritize organic options, the market is likely to see innovations in product offerings, including flavored and fortified organic milk. Additionally, the rise of e-commerce will facilitate broader access to organic milk, particularly in regions where traditional retail channels are limited. This trend is expected to enhance market penetration and consumer engagement significantly.

| Segment | Sub-Segments |

|---|---|

| By Type | Whole Organic Milk Skim Organic Milk Flavored Organic Milk Organic Milk Powder Organic Cream Organic Yogurt Organic Cheese Organic Butter Others |

| By End-User | Households Food Service Industry Retail Outlets Food Manufacturers |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail Specialty Stores Direct Sales |

| By Packaging Type | Cartons Bottles Pouches Tetra Packs |

| By Region | North America (United States, Canada, Mexico) Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Latin America (Brazil, Argentina, Rest of South America) Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa) |

| By Price Range | Premium Mid-Range Budget |

| By Certification Type | USDA Organic EU Organic Other Certifications |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Organic Dairy Farmers | 60 | Farm Owners, Agricultural Consultants |

| Retailers of Organic Milk | 50 | Store Managers, Category Buyers |

| Consumers of Organic Dairy Products | 100 | Health-Conscious Shoppers, Organic Product Enthusiasts |

| Distributors of Organic Milk | 40 | Logistics Managers, Sales Representatives |

| Industry Experts and Analysts | 40 | Market Analysts, Academic Researchers |

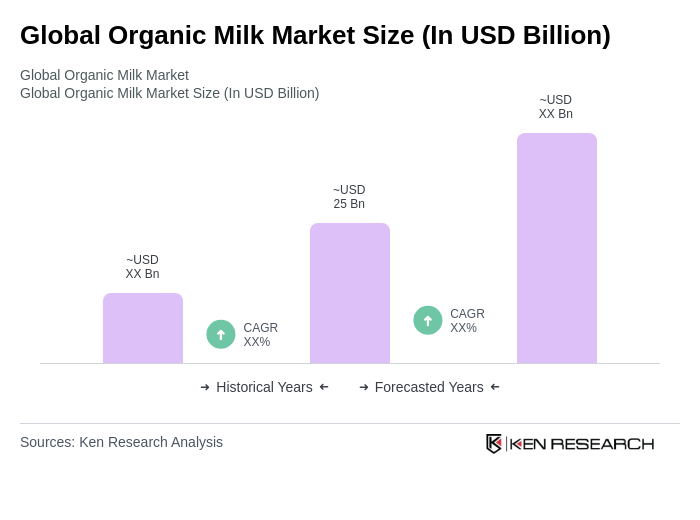

The Global Organic Milk Market is valued at approximately USD 25 billion, reflecting significant growth driven by increasing consumer awareness of health benefits, rising demand for organic products, and a shift towards sustainable farming practices.