Region:Global

Author(s):Geetanshi

Product Code:KRAB0010

Pages:91

Published On:August 2025

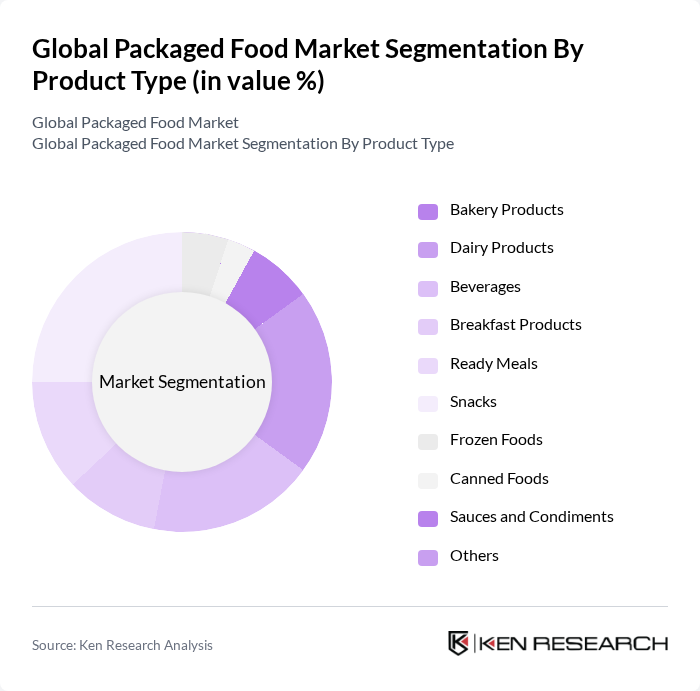

By Product Type:The product type segmentation includes various categories such as Bakery Products, Dairy Products, Beverages, Breakfast Products, Ready Meals, Snacks, Frozen Foods, Canned Foods, Sauces and Condiments, and Others. Among these, Snacks have emerged as a dominant segment due to changing consumer lifestyles and preferences for on-the-go food options. The increasing trend of snacking, particularly among younger demographics, has led to a surge in demand for innovative and healthier snack options. Additionally, the beverage segment has shown significant growth, driven by the popularity of functional and fortified drinks, as well as the expansion of ready-to-drink and plant-based beverages .

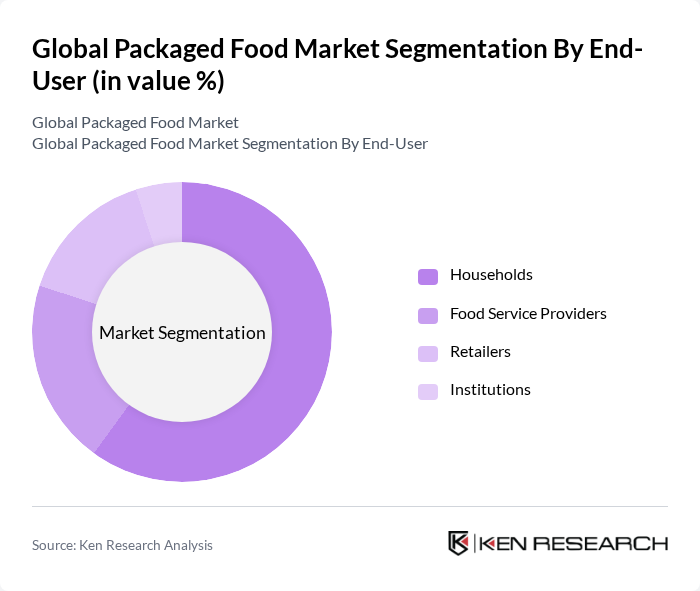

By End-User:The end-user segmentation includes Households, Food Service Providers, Retailers, and Institutions. Households represent the largest segment, driven by the increasing trend of home cooking and the demand for convenient meal solutions. The rise in dual-income families, busy lifestyles, and the growing adoption of online grocery shopping have led to a greater reliance on packaged food products, making this segment a key driver of market growth .

The Global Packaged Food Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé S.A., PepsiCo, Inc., The Kraft Heinz Company, Unilever PLC, General Mills, Inc., Mondelez International, Inc., Conagra Brands, Inc., Kellogg Company, Tyson Foods, Inc., Danone S.A., Mars, Incorporated, Associated British Foods PLC, Hormel Foods Corporation, The J.M. Smucker Company, Arla Foods amba, Campbell Soup Company, Grupo Bimbo S.A.B. de C.V., McCain Foods Limited, FrieslandCampina, Saputo Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the packaged food market appears promising, driven by evolving consumer preferences and technological advancements. As health-consciousness continues to rise, manufacturers are likely to focus on clean label products and innovative packaging solutions. Additionally, the expansion of e-commerce platforms will facilitate greater access to diverse food options. Companies that adapt to these trends and invest in sustainable practices are expected to thrive, positioning themselves favorably in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Bakery Products Dairy Products Beverages Breakfast Products Ready Meals Snacks Frozen Foods Canned Foods Sauces and Condiments Others |

| By End-User | Households Food Service Providers Retailers Institutions |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail Stores Specialty Stores Others |

| By Packaging Type | Flexible Packaging Rigid Packaging Glass Packaging Metal Packaging |

| By Price Range | Economy Mid-Range Premium |

| By Flavor Profile | Sweet Savory Spicy Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Packaged Food Sales | 100 | Category Managers, Retail Buyers |

| Consumer Packaged Goods Insights | 80 | Product Development Managers, Marketing Directors |

| Food Safety Compliance | 60 | Quality Assurance Managers, Regulatory Affairs Specialists |

| Trends in Healthy Packaged Foods | 50 | Nutritionists, Health Food Retailers |

| Impact of E-commerce on Packaged Food | 40 | E-commerce Managers, Digital Marketing Specialists |

The Global Packaged Food Market is valued at approximately USD 2.9 trillion, driven by increasing consumer demand for convenience, health-conscious products, and innovative packaging solutions. This market is expected to continue growing as consumer preferences evolve.