Region:Middle East

Author(s):Dev

Product Code:KRAE0110

Pages:96

Published On:December 2025

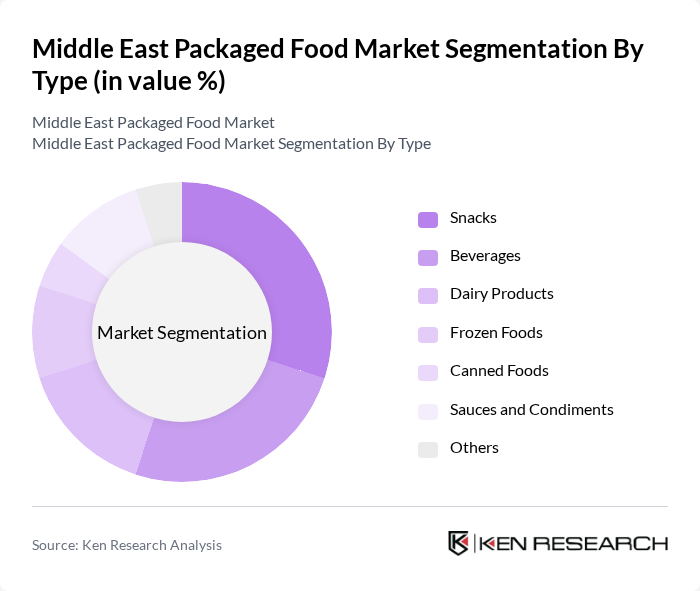

By Type:The packaged food market is segmented into various types, including snacks, beverages, dairy products, frozen foods, canned foods, sauces and condiments, and others. Among these, snacks and beverages are the leading segments, driven by changing consumer lifestyles and preferences for convenience and on-the-go options. The demand for healthy snacks and functional beverages is particularly high, reflecting a shift towards healthier eating habits.

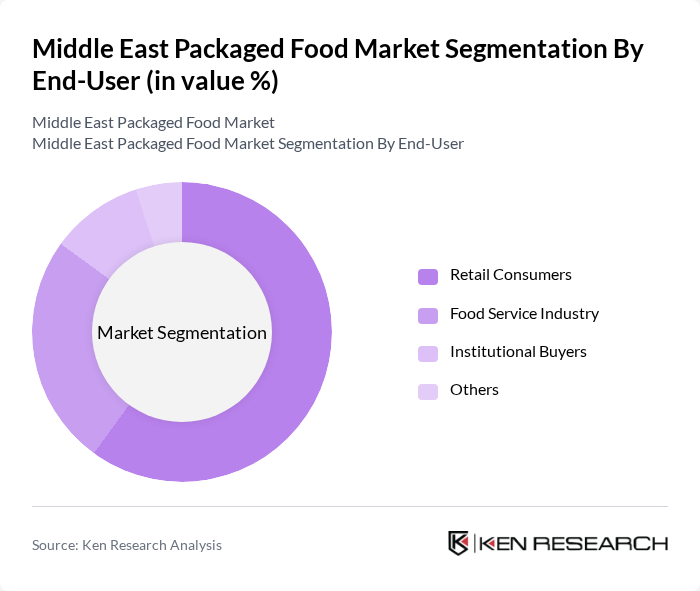

By End-User:The end-user segmentation includes retail consumers, the food service industry, institutional buyers, and others. Retail consumers dominate the market, driven by the increasing trend of home cooking and the demand for convenience foods. The food service industry is also significant, as restaurants and cafes seek to offer packaged food options to meet consumer preferences for quick and easy meals.

The Middle East Packaged Food Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé Middle East, Unilever Gulf, Almarai Company, Americana Group, Danone Middle East, Mondel?z International, PepsiCo Middle East, Kraft Heinz Company, General Mills Middle East, Al Ain Food & Beverages, Al-Fakher Tobacco, Bisco Misr, Al-Hokair Group, Al-Safi Danone, Al-Watania Poultry contribute to innovation, geographic expansion, and service delivery in this space.

The Middle East packaged food market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As health-conscious consumers increasingly seek nutritious options, manufacturers are likely to innovate with healthier product lines. Additionally, the expansion of e-commerce platforms will facilitate greater access to a diverse range of packaged foods, enhancing consumer convenience. The focus on sustainability will also shape product development, as companies adopt eco-friendly practices to meet growing environmental concerns among consumers.

| Segment | Sub-Segments |

|---|---|

| By Type | Snacks Beverages Dairy Products Frozen Foods Canned Foods Sauces and Condiments Others |

| By End-User | Retail Consumers Food Service Industry Institutional Buyers Others |

| By Distribution Channel | Supermarkets and Hypermarkets Convenience Stores Online Retail Specialty Stores Others |

| By Packaging Type | Flexible Packaging Rigid Packaging Semi-Rigid Packaging Others |

| By Price Range | Economy Mid-Range Premium Others |

| By Consumer Demographics | Age Group Income Level Lifestyle Preferences Others |

| By Region | GCC Countries Levant Region North Africa Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Packaged Food Preferences | 150 | Household Decision Makers, Grocery Shoppers |

| Retail Distribution Insights | 100 | Retail Managers, Category Buyers |

| Food Safety and Quality Perceptions | 80 | Food Safety Inspectors, Quality Assurance Managers |

| Trends in Healthy Eating | 70 | Nutritionists, Health Coaches |

| Impact of E-commerce on Food Purchases | 90 | eCommerce Managers, Online Grocery Shoppers |

The Middle East Packaged Food Market is valued at approximately USD 182 billion, reflecting a robust growth trajectory driven by urbanization, rising disposable incomes, and evolving consumer preferences for health-oriented products.