Region:Global

Author(s):Geetanshi

Product Code:KRAA2829

Pages:85

Published On:August 2025

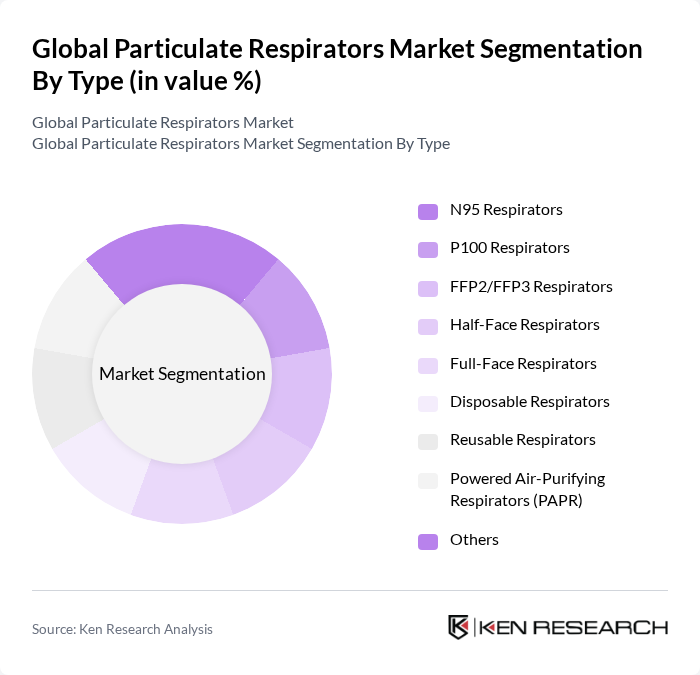

By Type:The market is segmented into N95 Respirators, P100 Respirators, FFP2/FFP3 Respirators, Half-Face Respirators, Full-Face Respirators, Disposable Respirators, Reusable Respirators, Powered Air-Purifying Respirators (PAPR), and Others. N95 Respirators are the most widely used, owing to their proven efficiency in filtering at least 95% of airborne particles. Their adoption is particularly prominent in healthcare and industrial sectors, where regulatory standards and infection control protocols drive demand .

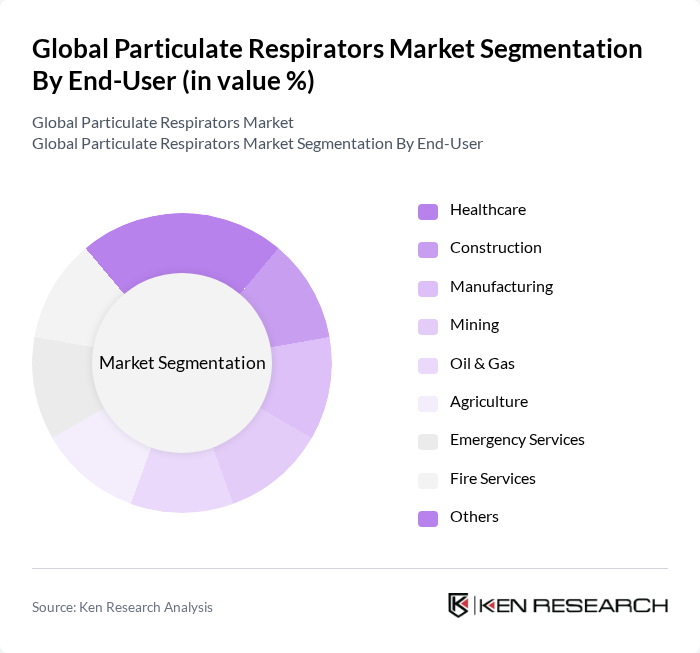

By End-User:End-user segments include Healthcare, Construction, Manufacturing, Mining, Oil & Gas, Agriculture, Emergency Services, Fire Services, and Others. The healthcare sector remains the largest end-user, attributed to the critical need for respiratory protection in hospitals, clinics, and emergency response. Construction and manufacturing sectors also represent significant demand due to regulatory requirements and occupational exposure risks .

The Global Particulate Respirators Market is characterized by a dynamic mix of regional and international players. Leading participants such as 3M Company, Honeywell International Inc., DuPont de Nemours, Inc., Kimberly-Clark Corporation, MSA Safety Incorporated, Ansell Limited, Alpha Pro Tech, Ltd., Moldex-Metric, Inc., RPB Safety LLC, Delta Plus Group, Lakeland Industries, Inc., Bullard, JSP Ltd., Uvex Safety Group GmbH & Co. KG, Radians, Inc., Draegerwerk AG & Co. KGaA, CleanSpace Technology Pty Ltd, Shigematsu Works Co., Ltd., Shanghai Dasheng Health Products Manufacturing Co., Ltd., Makrite Industries Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the particulate respirators market appears promising, driven by increasing regulatory pressures and technological advancements. As governments worldwide implement stricter air quality regulations, the demand for effective respiratory protection will likely rise. Additionally, innovations in filtration technology and the integration of smart features into respirators are expected to enhance product appeal. Companies that adapt to these trends and focus on sustainability will be well-positioned to capture market share in the evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | N95 Respirators P100 Respirators FFP2/FFP3 Respirators Half-Face Respirators Full-Face Respirators Disposable Respirators Reusable Respirators Powered Air-Purifying Respirators (PAPR) Others |

| By End-User | Healthcare Construction Manufacturing Mining Oil & Gas Agriculture Emergency Services Fire Services Others |

| By Application | Industrial Use Medical Use Personal Use Military Use Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Distributors Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Price Range | Low Price Mid Price High Price Others |

| By Brand | Established Brands Emerging Brands Private Labels Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Sector Respirator Usage | 100 | Healthcare Administrators, Infection Control Specialists |

| Construction Industry Safety Practices | 80 | Site Safety Managers, Project Supervisors |

| Manufacturing Sector Compliance | 60 | Safety Officers, Production Managers |

| Consumer Market Insights | 50 | Retail Buyers, Consumer Safety Advocates |

| Environmental Health Perspectives | 40 | Environmental Scientists, Public Health Officials |

The Global Particulate Respirators Market is valued at approximately USD 12 billion, driven by increased awareness of respiratory health, air pollution, and the demand for personal protective equipment across various sectors, including healthcare and construction.