Region:Global

Author(s):Dev

Product Code:KRAA3086

Pages:100

Published On:August 2025

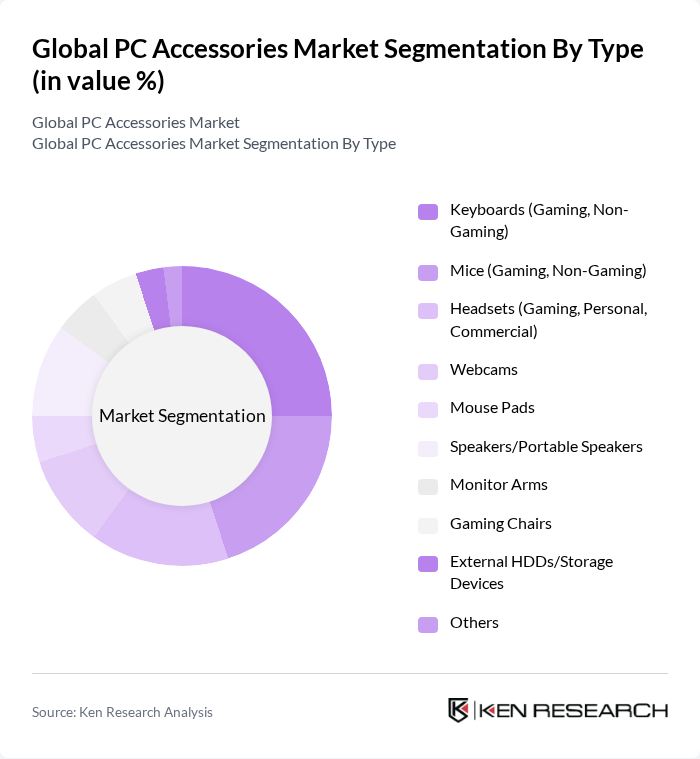

By Type:The market is segmented into various types of accessories, including keyboards, mice, headsets, webcams, mouse pads, speakers, monitor arms, gaming chairs, external storage devices, and others. Among these, gaming peripherals—particularly gaming keyboards and mice—have gained significant traction due to the rising popularity of e-sports and gaming culture. The demand for high-performance accessories that enhance gaming experiences is driving growth in this segment. Technological advancements such as customizable RGB lighting, wireless connectivity, and ergonomic designs are further supporting this trend .

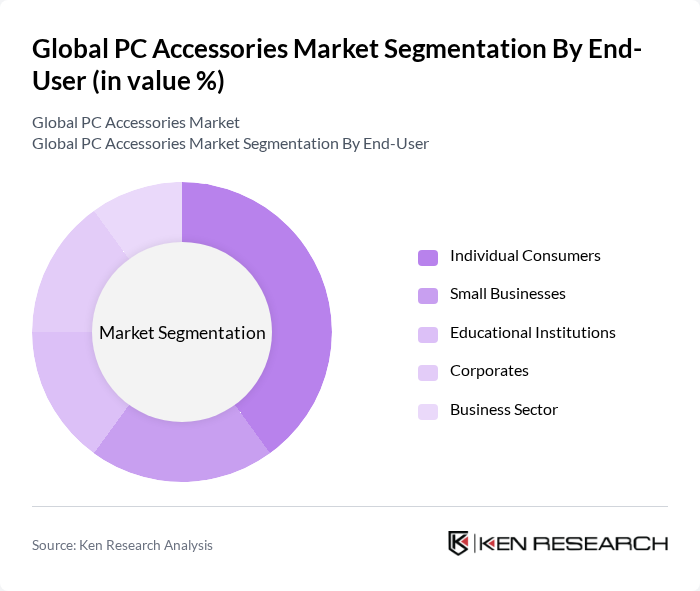

By End-User:The end-user segmentation includes individual consumers, small businesses, educational institutions, corporates, and the broader business sector. Individual consumers dominate the market, driven by the increasing trend of gaming and remote work. The demand for personalized and high-quality accessories is particularly strong among gamers and professionals who seek to enhance their computing experience. The growth of home office setups and e-learning has also contributed to increased demand from small businesses and educational institutions .

The Global PC Accessories Market is characterized by a dynamic mix of regional and international players. Leading participants such as Logitech International S.A., Razer Inc., Corsair Gaming, Inc., SteelSeries ApS, HyperX (Kingston Technology Company, Inc.), Dell Technologies Inc., HP Inc., Microsoft Corporation, ASUS Tek Computer Inc., AOC International (Taiwan) Co., Ltd., BenQ Corporation, Cooler Master Technology Inc., ZOTAC Technology Limited, MSI (Micro-Star International Co., Ltd.), Targus Group International, Inc., Lenovo Group Limited, Seagate Technology Holdings plc, Western Digital Corporation, Toshiba Corporation, Seiko Epson Corporation, Lexmark International, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the PC accessories market in None appears promising, driven by the increasing integration of smart technology and the growing trend of remote work. As consumers seek more versatile and multifunctional devices, manufacturers are likely to focus on innovation and sustainability. Additionally, the expansion into emerging markets presents significant growth potential, allowing companies to tap into new customer bases and diversify their product offerings, ultimately enhancing market resilience.

| Segment | Sub-Segments |

|---|---|

| By Type | Keyboards (Gaming, Non-Gaming) Mice (Gaming, Non-Gaming) Headsets (Gaming, Personal, Commercial) Webcams Mouse Pads Speakers/Portable Speakers Monitor Arms Gaming Chairs External HDDs/Storage Devices Others |

| By End-User | Individual Consumers Small Businesses Educational Institutions Corporates Business Sector |

| By Sales Channel | Online Retail Offline Retail Direct Sales Distributors |

| By Price Range | Budget Mid-Range Premium |

| By Brand | Established Brands Emerging Brands Private Labels |

| By Material | Plastic Metal Fabric |

| By Functionality | Wired Accessories Wireless Accessories Multi-functional Accessories |

| By Geography | North America (United States, Canada) Europe (Germany, United Kingdom, France, Italy, Russia, Switzerland, Rest of Europe) Asia-Pacific (China, Japan, South Korea, Australia & New Zealand, Rest of Asia-Pacific) Latin America (Brazil, Mexico, Rest of Latin America) Middle East and Africa (United Arab Emirates, Saudi Arabia, South Africa, Rest of Middle East and Africa) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Gaming Accessories Market | 100 | Gamers, Retail Managers, Product Developers |

| Office Productivity Tools | 90 | Office Managers, IT Administrators, Procurement Officers |

| Ergonomic Accessories Segment | 60 | Health and Safety Officers, Ergonomics Consultants |

| Audio Accessories Market | 80 | Audio Engineers, Marketing Managers, End-Users |

| Mobile Accessories for PCs | 50 | Mobile Device Managers, Retail Buyers, Tech Enthusiasts |

The Global PC Accessories Market is valued at approximately USD 48 billion, driven by increasing consumer demand for gaming peripherals, remote work setups, and e-sports. This valuation is based on a comprehensive five-year historical analysis.