Region:Global

Author(s):Shubham

Product Code:KRAA2721

Pages:95

Published On:August 2025

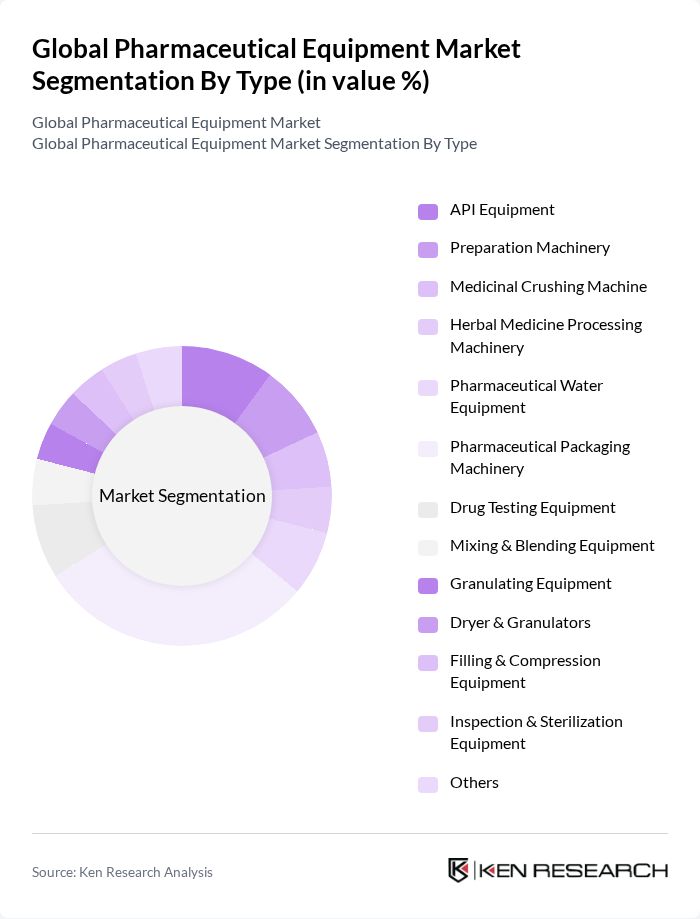

By Type:The market is segmented into various types of equipment essential for pharmaceutical manufacturing. The subsegments include API Equipment, Preparation Machinery, Medicinal Crushing Machine, Herbal Medicine Processing Machinery, Pharmaceutical Water Equipment, Pharmaceutical Packaging Machinery, Drug Testing Equipment, Mixing & Blending Equipment, Granulating Equipment, Dryer & Granulators, Filling & Compression Equipment, Inspection & Sterilization Equipment, and Others. Among these, Pharmaceutical Packaging Machinery is currently dominating the market due to the increasing need for efficient and safe packaging solutions, the rise in generic and biopharmaceutical products, and the adoption of automation to ensure product integrity and regulatory compliance in the pharmaceutical industry .

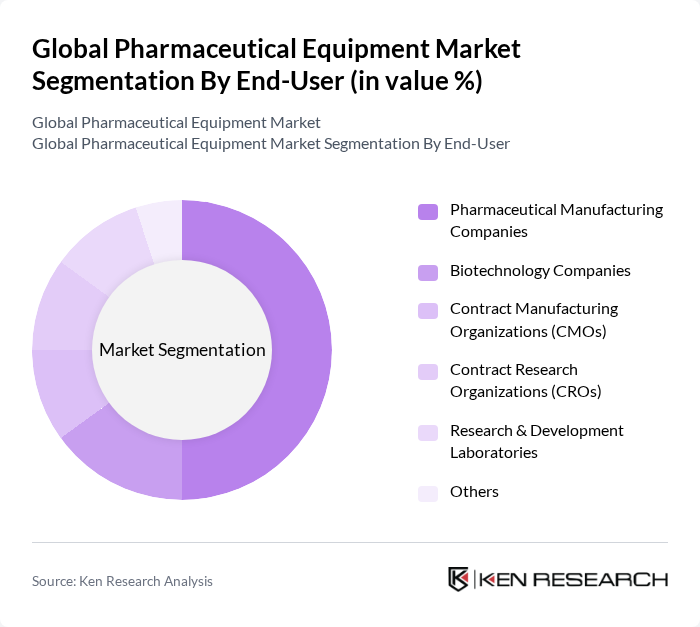

By End-User:The end-user segmentation includes Pharmaceutical Manufacturing Companies, Biotechnology Companies, Contract Manufacturing Organizations (CMOs), Contract Research Organizations (CROs), Research & Development Laboratories, and Others. Pharmaceutical Manufacturing Companies are the leading end-users, driven by the increasing demand for innovative drugs, the need for efficient production processes, and the expansion of biopharmaceutical and generic drug manufacturing. Biotechnology companies and CMOs are also significant contributors due to the rising trend of outsourcing and the development of advanced therapies .

The Global Pharmaceutical Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, Thermo Fisher Scientific Inc., GE HealthCare Technologies Inc., Syntegon Technology GmbH (formerly Bosch Packaging Technology), IMA S.p.A., GEA Group AG, SMC Corporation, Krones AG, OPTEL Group, ACG Worldwide, Uhlmann Pac-Systeme GmbH & Co. KG, SCHOTT AG, groninger & co. gmbh, Romaco Pharmatechnik GmbH, MULTIVAC Sepp Haggenmüller SE & Co. KG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the pharmaceutical equipment market is poised for significant transformation, driven by technological advancements and evolving industry needs. As manufacturers increasingly adopt automation and AI technologies, production efficiency is expected to improve, reducing costs and enhancing product quality. Additionally, the growing focus on sustainable practices will likely lead to innovations in eco-friendly manufacturing processes. These trends will shape the market landscape, fostering a competitive environment that prioritizes quality, compliance, and operational excellence.

| Segment | Sub-Segments |

|---|---|

| By Type | API Equipment Preparation Machinery Medicinal Crushing Machine Herbal Medicine Processing Machinery Pharmaceutical Water Equipment Pharmaceutical Packaging Machinery Drug Testing Equipment Mixing & Blending Equipment Granulating Equipment Dryer & Granulators Filling & Compression Equipment Inspection & Sterilization Equipment Others |

| By End-User | Pharmaceutical Manufacturing Companies Biotechnology Companies Contract Manufacturing Organizations (CMOs) Contract Research Organizations (CROs) Research & Development Laboratories Others |

| By Application | Drug Development Quality Control Production/Manufacturing Packaging Mixing & Blending Granulation Drying Tablet Compression Capsule Filling Others |

| By Component | Hardware Software Services |

| By Sales Channel | Direct Sales Distributors Online Sales Others |

| By Distribution Mode | Offline Distribution Online Distribution |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Manufacturing Equipment | 120 | Production Managers, Equipment Engineers |

| Laboratory Equipment for Drug Development | 90 | Lab Managers, Research Scientists |

| Packaging Solutions in Pharmaceuticals | 60 | Packaging Engineers, Quality Control Managers |

| Pharmaceutical Supply Chain Management | 70 | Supply Chain Directors, Logistics Coordinators |

| Regulatory Compliance Equipment | 50 | Compliance Officers, Regulatory Affairs Managers |

The Global Pharmaceutical Equipment Market is valued at approximately USD 24 billion, driven by advancements in pharmaceutical manufacturing technologies, increasing chronic disease prevalence, and a focus on research and development within the pharmaceutical sector.