Region:Global

Author(s):Rebecca

Product Code:KRAC0205

Pages:87

Published On:August 2025

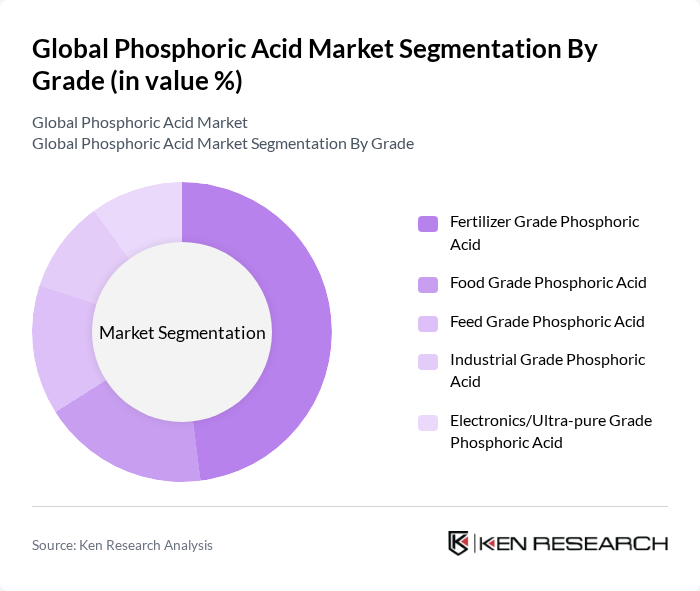

By Grade:The market is segmented into various grades of phosphoric acid, each serving distinct applications. The primary subsegments include Fertilizer Grade Phosphoric Acid, Food Grade Phosphoric Acid, Feed Grade Phosphoric Acid, Industrial Grade Phosphoric Acid, and Electronics/Ultra-pure Grade Phosphoric Acid. Fertilizer Grade Phosphoric Acid is the most dominant segment due to its extensive use in agricultural fertilizers, which are essential for enhancing crop yields and ensuring food security.

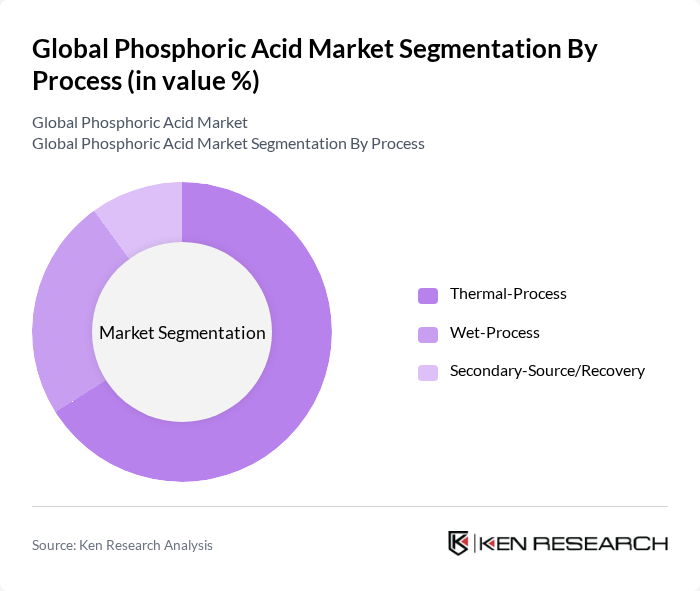

By Process:The production of phosphoric acid can be categorized into three main processes: Wet-Process, Thermal-Process, and Secondary-Source/Recovery. The Thermal-Process is the most widely used method by market share, especially for high-purity applications, while the Wet-Process remains crucial for fertilizer production due to its cost-effectiveness and efficiency in large-scale output.

The Global Phosphoric Acid Market is characterized by a dynamic mix of regional and international players. Leading participants such as The Mosaic Company, Nutrien Ltd., OCP Group, Yara International ASA, PhosAgro, ICL Group Ltd., EuroChem Group AG, K+S AG, Vale Fertilizantes S.A., CF Industries Holdings, Inc., Arianne Phosphate Inc., Innophos Holdings, Inc., J.R. Simplot Company, Sociedad Química y Minera de Chile S.A., Ma'aden Phosphate Company, Wengfu Group Co., Ltd., Prayon S.A., Jordan Phosphate Mines Company PLC, Gujarat Narmada Valley Fertilizers & Chemicals Ltd. (GNFC), and Desmet Ballestra Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the phosphoric acid market appears promising, driven by the increasing focus on sustainable agricultural practices and the rising demand for organic fertilizers. As the global population continues to grow, the need for efficient food production methods will drive innovation in phosphoric acid applications. Additionally, strategic partnerships among key industry players are likely to enhance market resilience, enabling companies to adapt to regulatory changes and supply chain challenges effectively.

| Segment | Sub-Segments |

|---|---|

| By Grade | Fertilizer Grade Phosphoric Acid Food Grade Phosphoric Acid Feed Grade Phosphoric Acid Industrial Grade Phosphoric Acid Electronics/Ultra-pure Grade Phosphoric Acid |

| By Process | Wet-Process Thermal-Process Secondary-Source/Recovery |

| By Application | Fertilizers (DAP, MAP, TSP) Food Additives Detergents & Cleaning Agents Water Treatment Metal Treatment Pharmaceuticals Others |

| By End-User Industry | Agriculture Food and Beverage Chemicals Medicine Metallurgy Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Fertilizer Producers | 100 | Procurement Managers, Agronomists |

| Food Processing Companies | 60 | Quality Control Managers, Production Supervisors |

| Industrial Chemical Manufacturers | 50 | Operations Managers, R&D Directors |

| Environmental Regulatory Bodies | 40 | Policy Analysts, Environmental Scientists |

| Research Institutions and Universities | 40 | Research Fellows, Professors in Chemical Engineering |

The Global Phosphoric Acid Market is valued at approximately USD 48 billion, driven by increasing demand for fertilizers, food security needs, and growth in various industries such as food and beverage, water treatment, and metal treatment.