Region:North America

Author(s):Geetanshi

Product Code:KRAD1149

Pages:96

Published On:November 2025

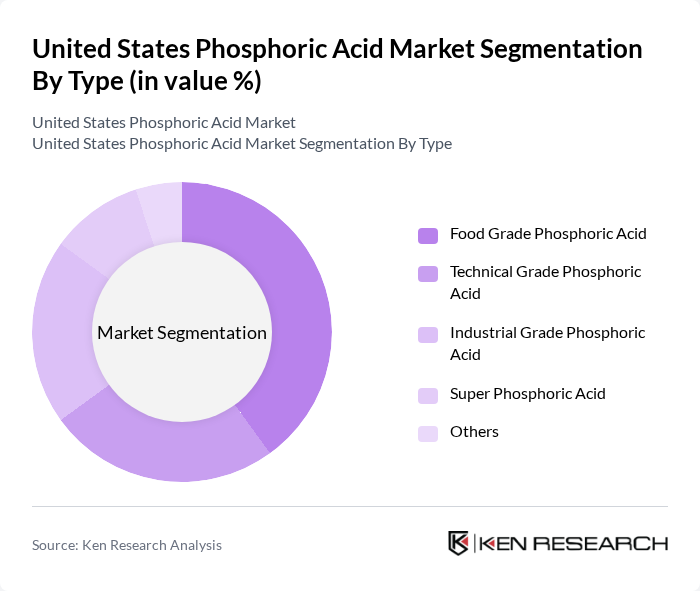

By Type:

The phosphoric acid market is segmented into various types, including Food Grade Phosphoric Acid, Technical Grade Phosphoric Acid, Industrial Grade Phosphoric Acid, Super Phosphoric Acid, and Others. Among these, the Food Grade Phosphoric Acid sub-segment is currently leading the market due to its extensive use in food and beverage applications, where it serves as an acidity regulator and flavoring agent. The increasing consumer preference for processed foods and beverages has significantly boosted the demand for food-grade phosphoric acid, making it a dominant player in the market.

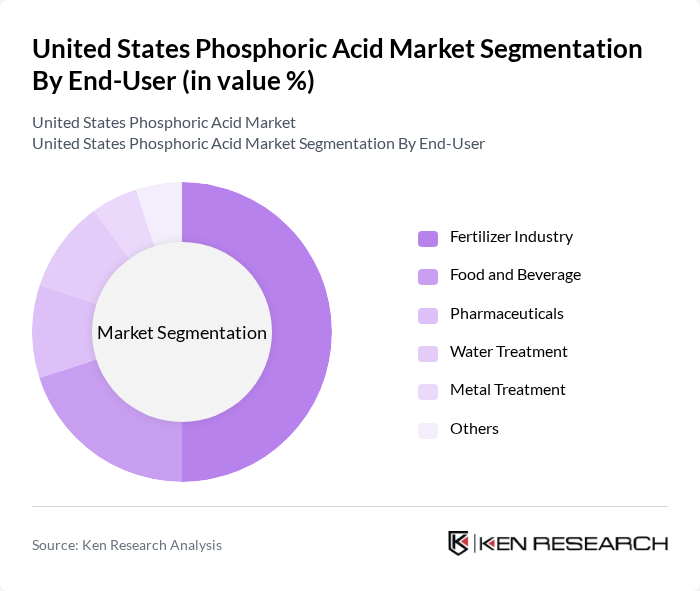

By End-User:

The end-user segmentation of the phosphoric acid market includes the Fertilizer Industry, Food and Beverage, Pharmaceuticals, Water Treatment, Metal Treatment, and Others. The Fertilizer Industry is the leading segment, driven by the increasing global population and the consequent demand for food production. Phosphoric acid is a key ingredient in the production of fertilizers, particularly in the manufacturing of diammonium phosphate (DAP) and monoammonium phosphate (MAP), which are essential for enhancing crop yields.

The United States Phosphoric Acid Market is characterized by a dynamic mix of regional and international players. Leading participants such as The Mosaic Company, Nutrien Ltd., Prayon Inc., Yara International ASA, ICL Group Ltd., CF Industries Holdings, Inc., J.R. Simplot Company, Innophos Holdings, Inc., OCP North America, Inc., Aditya Birla Chemicals (USA) Inc., EuroChem Group AG, PhosAgro Americas, Inc., Yuntianhua Group Co., Ltd., Acron Group, SQM North America Corp. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. phosphoric acid market appears promising, driven by increasing agricultural demands and technological advancements. As the industry adapts to environmental regulations, companies are likely to invest in sustainable practices and eco-friendly production methods. Additionally, the growing trend towards bio-based products and digital transformation in supply chain management will enhance operational efficiencies. These factors will collectively shape a resilient market landscape, fostering innovation and sustainability in the phosphoric acid sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Food Grade Phosphoric Acid Technical Grade Phosphoric Acid Industrial Grade Phosphoric Acid Super Phosphoric Acid Others |

| By End-User | Fertilizer Industry Food and Beverage Pharmaceuticals Water Treatment Metal Treatment Others |

| By Application | Diammonium Hydrogenphosphate (DAP) Monoammonium Dihydrogenphosphate (MAP) Triple Superphosphate (TSP) Feed & Food Additives Detergents Water Treatment Chemicals Metal Treatment Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Geography | Northeast Midwest South West |

| By Production Method | Wet Process Thermal Process Others |

| By Packaging Type | Bulk Packaging Drums Bags Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Fertilizer Producers | 80 | Procurement Managers, Agronomists |

| Food Processing Companies | 60 | Quality Control Managers, Production Supervisors |

| Industrial Chemical Manufacturers | 50 | Operations Managers, Chemical Engineers |

| Research Institutions and Universities | 40 | Research Scientists, Academic Professors |

| Environmental Regulatory Bodies | 40 | Policy Analysts, Environmental Scientists |

The United States Phosphoric Acid Market is valued at approximately USD 4.2 billion, driven by increasing demand in the fertilizer and food and beverage sectors, along with advancements in production technologies and high-purity applications.