Region:Global

Author(s):Rebecca

Product Code:KRAA2930

Pages:87

Published On:August 2025

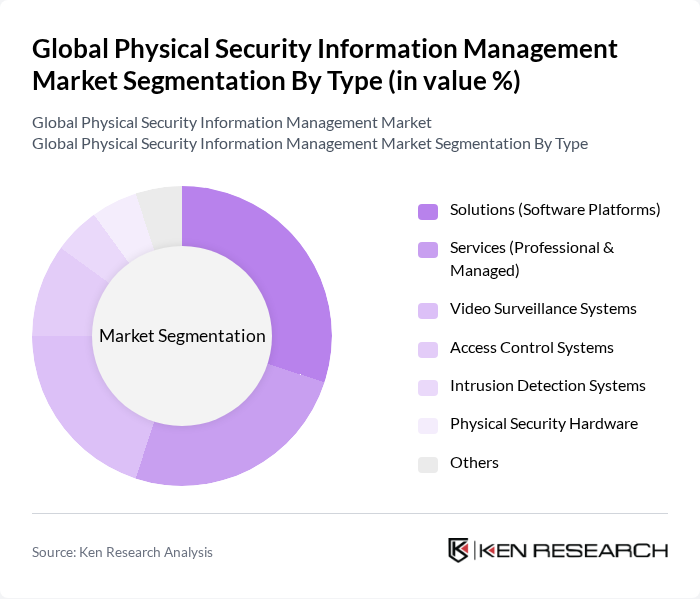

By Type:The market is segmented into various types, including Solutions (Software Platforms), Services (Professional & Managed), Video Surveillance Systems, Access Control Systems, Intrusion Detection Systems, Physical Security Hardware, and Others. Each of these segments plays a crucial role in the overall market dynamics as organizations increasingly seek unified command platforms that integrate multiple security functions for enhanced situational awareness and operational efficiency .

TheSolutions (Software Platforms)segment is currently dominating the market due to the increasing demand for integrated security management systems that provide real-time monitoring, analytics, and centralized control. Organizations are adopting software platforms that consolidate video surveillance, access control, and alarm monitoring into unified interfaces, enhancing operational efficiency and incident response. The trend toward digital transformation and the adoption of AI-enabled analytics further propel this segment’s growth, as businesses seek scalable, flexible, and data-driven security management .

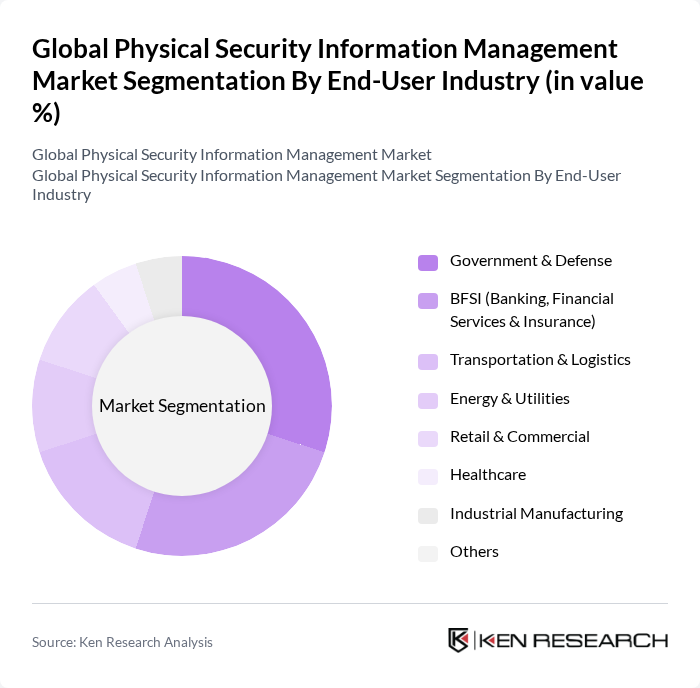

By End-User Industry:The market is segmented into Government & Defense, BFSI (Banking, Financial Services & Insurance), Transportation & Logistics, Energy & Utilities, Retail & Commercial, Healthcare, Industrial Manufacturing, and Others. Each segment has unique security requirements that drive demand for physical security solutions, with government and defense leading due to stringent compliance needs and high-value asset protection .

TheGovernment & Defensesector is the leading end-user industry, driven by the need for stringent security measures to protect sensitive information and critical infrastructure. This sector’s high budget allocation for security technologies and the increasing frequency of security threats have led to robust demand for advanced physical security solutions. The BFSI sector follows closely, as financial institutions prioritize safeguarding assets and customer data against evolving threats, while transportation, energy, and healthcare sectors are also rapidly adopting PSIM to address sector-specific risks and regulatory requirements .

The Global Physical Security Information Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Johnson Controls International plc, Honeywell International Inc., Bosch Security Systems (Robert Bosch GmbH), Axis Communications AB, Genetec Inc., Tyco International plc, Hikvision Digital Technology Co., Ltd., Dahua Technology Co., Ltd., Avigilon Corporation (Motorola Solutions), Milestone Systems A/S, FLIR Systems, Inc. (Teledyne FLIR), Panasonic Corporation, Hanwha Vision Co., Ltd. (formerly Samsung Techwin), Verint Systems Inc., AxxonSoft, Advancis Software & Services GmbH, Everbridge Inc., NICE Ltd., Hexagon AB, Carrier Global Corporation, Siemens AG, Canon Inc., Kentima AB, Cisco Systems, Inc., SecureTech Solutions contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Physical Security Information Management market is poised for significant transformation, driven by the increasing adoption of integrated security solutions and advancements in artificial intelligence. As organizations prioritize cybersecurity alongside physical security, the demand for comprehensive PSIM systems will likely grow. Furthermore, the rise of smart city initiatives will create new opportunities for innovative security applications, enhancing public safety and operational efficiency across urban environments.

| Segment | Sub-Segments |

|---|---|

| By Type | Solutions (Software Platforms) Services (Professional & Managed) Video Surveillance Systems Access Control Systems Intrusion Detection Systems Physical Security Hardware Others |

| By End-User Industry | Government & Defense BFSI (Banking, Financial Services & Insurance) Transportation & Logistics Energy & Utilities Retail & Commercial Healthcare Industrial Manufacturing Others |

| By Application | Critical Infrastructure Protection Event Security Facility Management Perimeter Security Cyber-Physical Security Integration Emergency Response Management Others |

| By Component | Hardware Software Services Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid Others |

| By Region | North America Europe Asia Pacific Middle East & Africa Latin America |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Security Management | 100 | Security Managers, Risk Assessment Officers |

| Healthcare Facility Security | 60 | Facility Managers, Compliance Officers |

| Retail Security Solutions | 50 | Loss Prevention Managers, Store Operations Directors |

| Government Security Programs | 40 | Public Safety Officials, Security Policy Advisors |

| Critical Infrastructure Protection | 45 | Infrastructure Security Directors, Emergency Management Coordinators |

The Global Physical Security Information Management Market is valued at approximately USD 4.3 billion, driven by the increasing demand for integrated security solutions and advancements in technology such as IoT and artificial intelligence.