Region:Middle East

Author(s):Shubham

Product Code:KRAD1848

Pages:86

Published On:December 2025

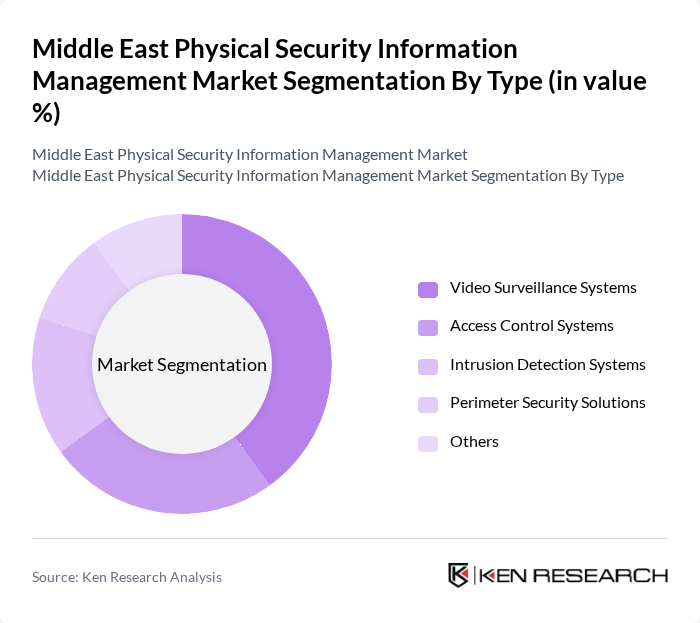

By Type:The market is segmented into various types of physical security information management solutions, including video surveillance systems, access control systems, intrusion detection systems, perimeter security solutions, and others. Among these, video surveillance systems are the most dominant, driven by the increasing need for real-time monitoring and incident response capabilities. The growing integration of AI and analytics into these systems enhances their effectiveness, making them a preferred choice for many organizations.

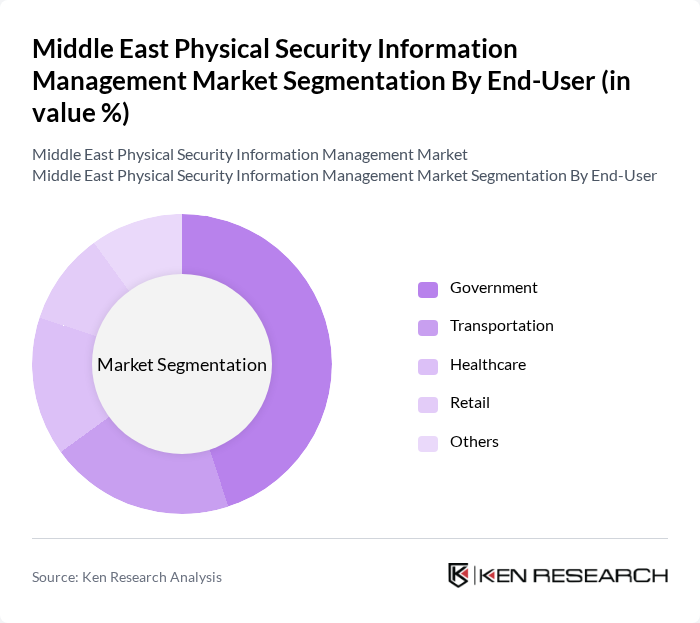

By End-User:The end-user segmentation includes government, transportation, healthcare, retail, and others. The government sector is the leading end-user, primarily due to the increasing investments in public safety and national security initiatives. Governments are adopting advanced PSIM solutions to enhance surveillance capabilities and ensure the safety of citizens, which drives the demand in this segment.

The Middle East Physical Security Information Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hikvision, Dahua Technology, Axis Communications, Bosch Security Systems, Honeywell Security, Tyco Integrated Security, Genetec, Avigilon, FLIR Systems, Johnson Controls, Milestone Systems, Panasonic Security, Samsung Techwin, SecureTech, Verint Systems contribute to innovation, geographic expansion, and service delivery in this space.

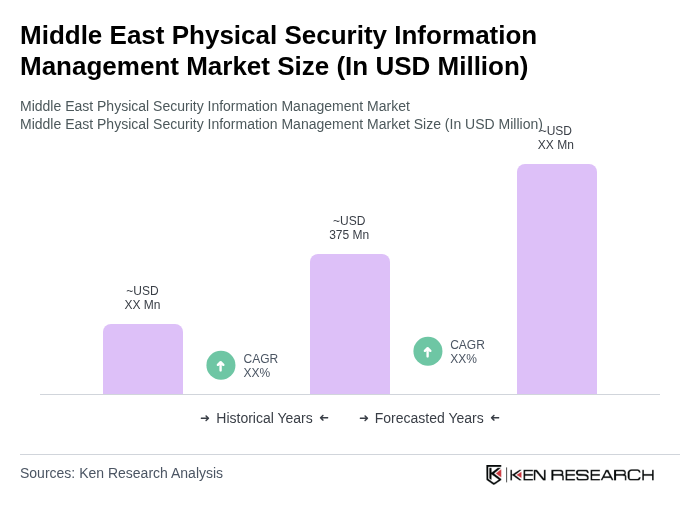

The future of the Middle East Physical Security Information Management market appears promising, driven by increasing security demands across various sectors. With a projected revenue of USD 372.7 million in future, the market is expected to triple by future, reflecting a growing emphasis on safety and security. Investments in digital infrastructure and smart city initiatives will further enhance the adoption of integrated security solutions, positioning the region for significant advancements in physical security technologies.

| Segment | Sub-Segments |

|---|---|

| By Type | Video Surveillance Systems Access Control Systems Intrusion Detection Systems Perimeter Security Solutions Others |

| By End-User | Government Transportation Healthcare Retail Others |

| By Application | Commercial Security Residential Security Industrial Security Critical Infrastructure Protection Others |

| By Region | GCC Countries Levant Region North Africa Others |

| By Technology | Analog Systems IP-based Systems Wireless Systems Hybrid Systems Others |

| By Investment Source | Private Investments Government Funding Public-Private Partnerships Others |

| By Policy Support | Government Incentives Tax Benefits Grants for Security Projects Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Government Security Agencies | 100 | Security Directors, Policy Makers |

| Commercial Sector Security Solutions | 80 | Facility Managers, Security Officers |

| Residential Security Systems | 70 | Homeowners, Property Managers |

| Event Security Management | 60 | Event Coordinators, Security Consultants |

| Healthcare Facility Security | 50 | Healthcare Administrators, Safety Officers |

The Middle East Physical Security Information Management Market is valued at approximately USD 375 million, driven by increasing security concerns, urban development, and smart city initiatives across the region.