Region:Global

Author(s):Geetanshi

Product Code:KRAA2352

Pages:99

Published On:August 2025

Equipment Market.png)

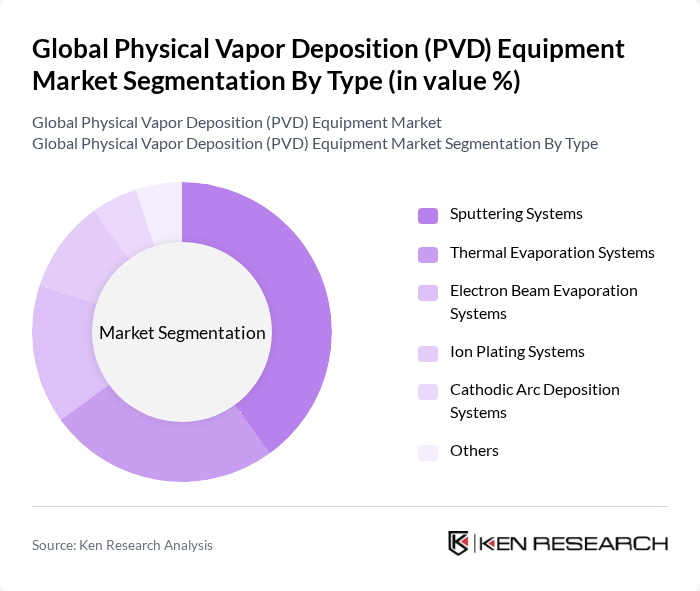

By Type:The PVD equipment market is segmented into Sputtering Systems, Thermal Evaporation Systems, Electron Beam Evaporation Systems, Ion Plating Systems, Cathodic Arc Deposition Systems, and Others.Sputtering Systemsremain the dominant segment, attributed to their versatility, high deposition rates, and suitability for microelectronics and advanced coatings in automotive and aerospace industries. The growing need for thin films in semiconductor fabrication and high-performance coatings continues to drive demand for sputtering technology .

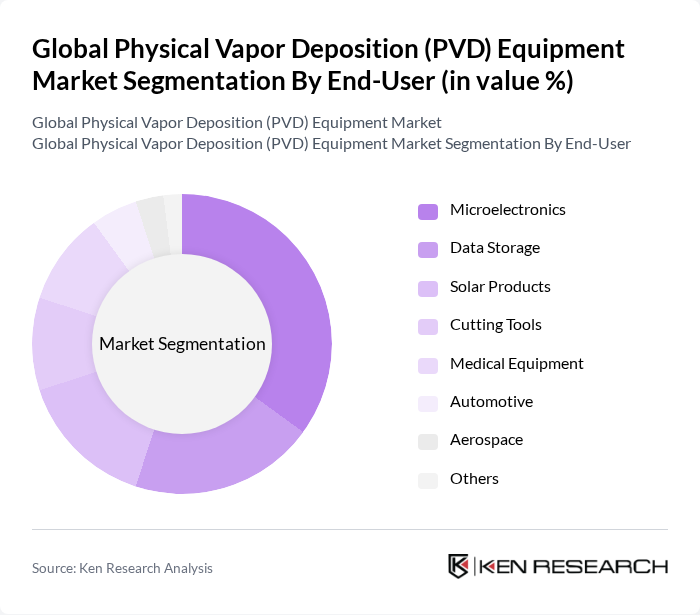

By End-User:The end-user segmentation includes Microelectronics, Data Storage, Solar Products, Cutting Tools, Medical Equipment, Automotive, Aerospace, and Others.Microelectronicsis the largest segment, propelled by the rapid growth of semiconductor and consumer electronics industries. The increasing demand for miniaturized, high-performance devices and the need for advanced coatings in electronic components underpin the strong market potential for PVD equipment in this segment .

The Global Physical Vapor Deposition (PVD) Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Applied Materials, Inc., Veeco Instruments Inc., Oerlikon Balzers Coating AG, ULVAC, Inc., Sputter Tech, Inc., CemeCon AG, IHI Corporation, KLA Corporation, Tokyo Electron Limited, Denton Vacuum, LLC, AJA International, Inc., Plasma-Therm, LLC, SENTECH Instruments GmbH, MKS Instruments, Inc., CHA Industries, Inc., Lam Research Corporation, Buhler AG, Singulus Technologies AG, Semicore Equipment, Inc., Silfex, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the PVD equipment market appears promising, driven by ongoing technological advancements and increasing demand for high-performance coatings. As industries prioritize sustainability, the development of eco-friendly PVD solutions is expected to gain traction, aligning with global environmental goals. Furthermore, the integration of IoT technologies into PVD systems will enhance process monitoring and control, leading to improved efficiency and reduced waste. These trends indicate a robust growth trajectory for the PVD equipment market in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Sputtering Systems Thermal Evaporation Systems Electron Beam Evaporation Systems Ion Plating Systems Cathodic Arc Deposition Systems Others |

| By End-User | Microelectronics Data Storage Solar Products Cutting Tools Medical Equipment Automotive Aerospace Others |

| By Application | Decorative Coatings Functional Coatings Optical Coatings Hard Coatings Others |

| By Component | Vacuum Chambers Power Supplies Control Systems Substrates Target Materials Others |

| By Sales Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America Latin America Europe East Asia South Asia & Oceania Middle East & Africa (MEA) |

| By Price Range | Low Price Range Mid Price Range High Price Range Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Semiconductor Manufacturing | 100 | Process Engineers, Production Managers |

| Aerospace Coatings | 60 | Quality Assurance Managers, Coating Technologists |

| Optical Coating Applications | 50 | Optical Engineers, Product Development Managers |

| Automotive Component Coatings | 40 | Supply Chain Managers, R&D Directors |

| Research Institutions and Academia | 40 | Research Scientists, Professors in Materials Science |

The Global Physical Vapor Deposition (PVD) Equipment Market is valued at approximately USD 25 billion, driven by increasing demand for advanced materials in sectors such as electronics, automotive, aerospace, and medical industries.