Region:Global

Author(s):Geetanshi

Product Code:KRAA2318

Pages:88

Published On:August 2025

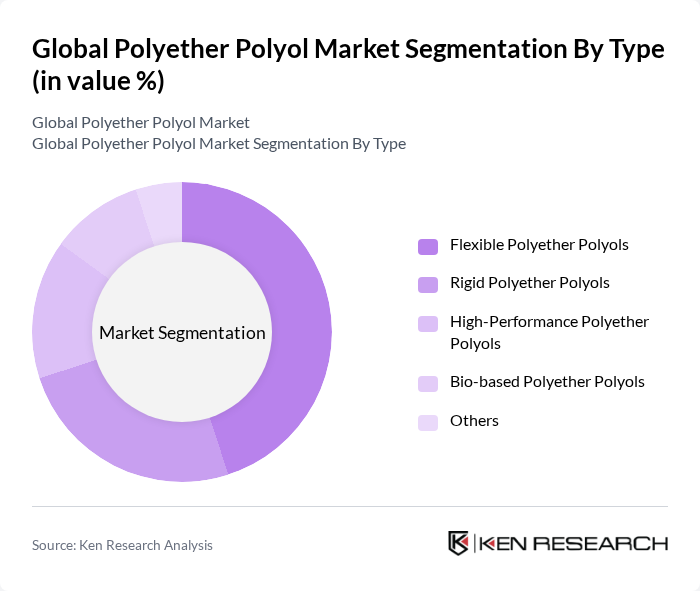

By Type:The market is segmented into Flexible Polyether Polyols, Rigid Polyether Polyols, High-Performance Polyether Polyols, Bio-based Polyether Polyols, and Others. Flexible Polyether Polyols account for the largest share, primarily due to their extensive use in manufacturing flexible foams for furniture, automotive seating, and bedding. The demand for comfort, durability, and energy efficiency in these applications continues to drive this segment’s dominance .

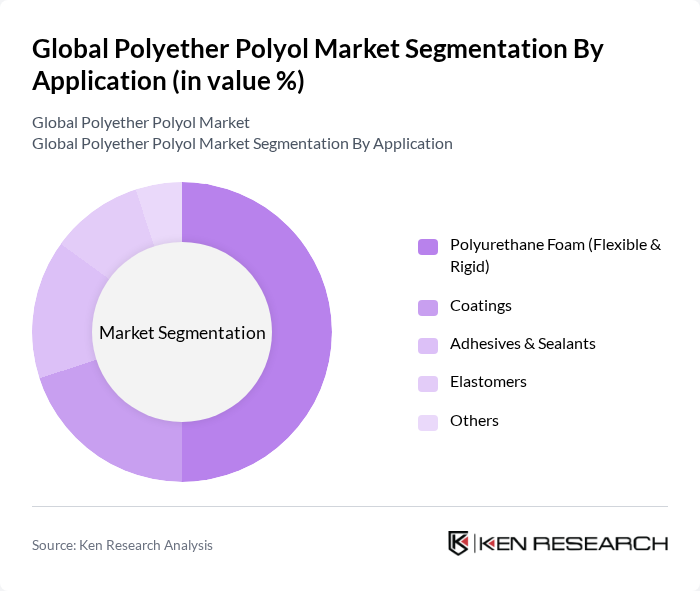

By Application:Polyether polyols are used in Polyurethane Foam (Flexible & Rigid), Coatings, Adhesives & Sealants, Elastomers, and Others. The Polyurethane Foam segment, especially flexible foams, holds the largest share due to their widespread use in automotive interiors, construction insulation, and furniture. The push for lightweight, energy-efficient, and sustainable materials in these sectors continues to drive demand for polyurethane foams, reinforcing this application as the market leader .

The Global Polyether Polyol Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Dow Inc., Huntsman Corporation, Covestro AG, Repsol S.A., Shell Chemicals, INEOS Group, Mitsubishi Chemical Corporation, LG Chem Ltd., Cargill, Incorporated, Tosoh Corporation, KURARAY Co., Ltd., Wanhua Chemical Group Co., Ltd., DIC Corporation, Solvay S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the polyether polyol market appears promising, driven by technological advancements and a growing emphasis on sustainability. Innovations in production processes are expected to enhance efficiency and reduce environmental impact, while the increasing focus on bio-based materials will likely reshape product offerings. Additionally, the expansion into emerging markets, particularly in Asia-Pacific and Latin America, presents significant growth potential, as these regions experience rapid industrialization and urbanization.

| Segment | Sub-Segments |

|---|---|

| By Type | Flexible Polyether Polyols Rigid Polyether Polyols High-Performance Polyether Polyols Bio-based Polyether Polyols Others |

| By Application | Polyurethane Foam (Flexible & Rigid) Coatings Adhesives & Sealants Elastomers Others |

| By End-User | Automotive Construction Furniture and Bedding Packaging Electrical & Electronics Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America (United States, Canada, Mexico) Europe (Germany, UK, France, Italy, Spain, BeNeLux, Russia, Rest of Europe) Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, Malaysia, Vietnam, Rest of APAC) Middle East & Africa (Saudi Arabia, South Africa, Iran, UAE, Egypt, Rest of MEA) South & Central America (Brazil, Argentina, Chile, Peru, Rest of SCA) |

| By Price Range | Low Price Mid Price High Price |

| By Product Form | Liquid Polyether Polyols Solid Polyether Polyols Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Flexible Foam Applications | 120 | Product Managers, R&D Specialists |

| Rigid Foam Applications | 90 | Manufacturing Engineers, Quality Control Managers |

| Coatings and Adhesives | 60 | Formulators, Technical Sales Representatives |

| Automotive Interior Components | 50 | Design Engineers, Procurement Managers |

| Construction and Insulation Materials | 70 | Construction Managers, Architects |

The Global Polyether Polyol Market is valued at approximately USD 16.5 billion, driven by increasing demand for polyurethane products in various sectors such as automotive, construction, furniture, and packaging.