Region:Asia

Author(s):Geetanshi

Product Code:KRAD1179

Pages:92

Published On:November 2025

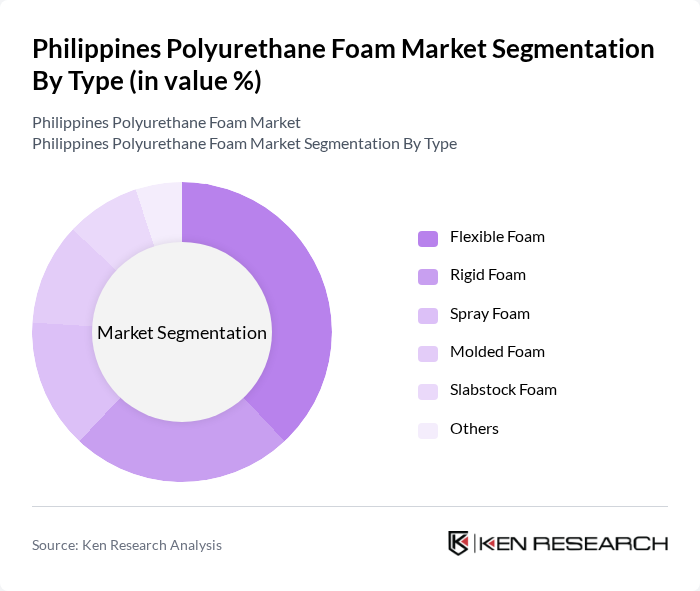

By Type:The market is segmented into various types of polyurethane foam, each serving distinct applications and industries. The primary types include Flexible Foam, Rigid Foam, Spray Foam, Molded Foam, Slabstock Foam, and Others. Flexible foam is widely used in furniture and bedding, while rigid foam is essential for insulation in construction. Spray foam is gaining traction for its versatility in various applications, including building insulation and packaging.

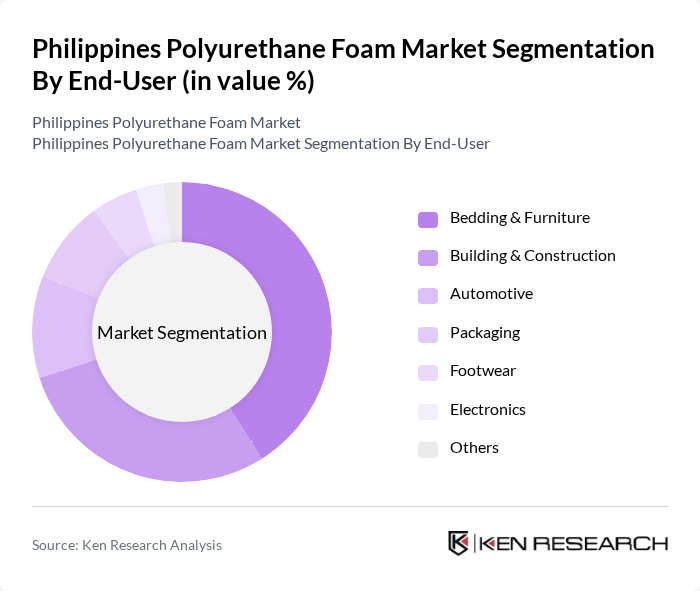

By End-User:The end-user segmentation includes various industries such as Bedding & Furniture, Building & Construction, Automotive, Packaging, Footwear, Electronics, and Others. The Bedding & Furniture segment is the largest consumer of polyurethane foam, driven by the growing demand for comfortable and durable products. The Building & Construction sector follows closely, utilizing foam for insulation and structural applications. The automotive and electronics sectors are also emerging as important end-users, supported by the shift towards lightweight and energy-efficient materials.

The Philippines Polyurethane Foam Market is characterized by a dynamic mix of regional and international players. Leading participants such as Uratex (RGC Foam Group), BASF Philippines, Inc., Huntsman Corporation, Dow Chemical Company, Recticel, Armacell International S.A., Urethane Technologies, Inc., Foamtech, Sika Philippines, Inc., Covestro AG, RAMPF Group, INOAC Corporation, Sealed Air Corporation, Kingspan Group, Vitafoam Philippines, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the polyurethane foam market in the Philippines appears promising, driven by increasing demand for sustainable materials and innovative applications. As consumers prioritize eco-friendly products, manufacturers are likely to invest in research and development to create biodegradable foams. Additionally, the expansion of e-commerce platforms will facilitate greater access to polyurethane foam products, enhancing market reach. Overall, the industry is expected to adapt to changing consumer preferences and regulatory landscapes, fostering growth and innovation.

| Segment | Sub-Segments |

|---|---|

| By Type | Flexible Foam Rigid Foam Spray Foam Molded Foam Slabstock Foam Others |

| By End-User | Bedding & Furniture Building & Construction Automotive Packaging Footwear Electronics Others |

| By Application | Insulation Cushioning Packaging Automotive Components Furniture & Bedding Footwear Others |

| By Density Composition | Low-Density Composition Medium-Density Composition High-Density Composition |

| By Category | Open Cell Closed Cell |

| By Process | Molded Foam Slabstock Foam Lamination Spraying |

| By Region | Luzon Visayas Mindanao |

| By Product Form | Sheets Blocks Rolls Others |

| By Distribution Channel | Direct Sales Retail Online Sales Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Applications | 60 | Project Managers, Architects, Contractors |

| Automotive Sector Utilization | 50 | Product Engineers, Quality Assurance Managers |

| Furniture Manufacturing Insights | 40 | Designers, Production Supervisors, Sales Managers |

| Insulation Market Trends | 40 | Building Inspectors, Energy Efficiency Consultants |

| Consumer Preferences in Home Products | 50 | Homeowners, Interior Designers, Retail Buyers |

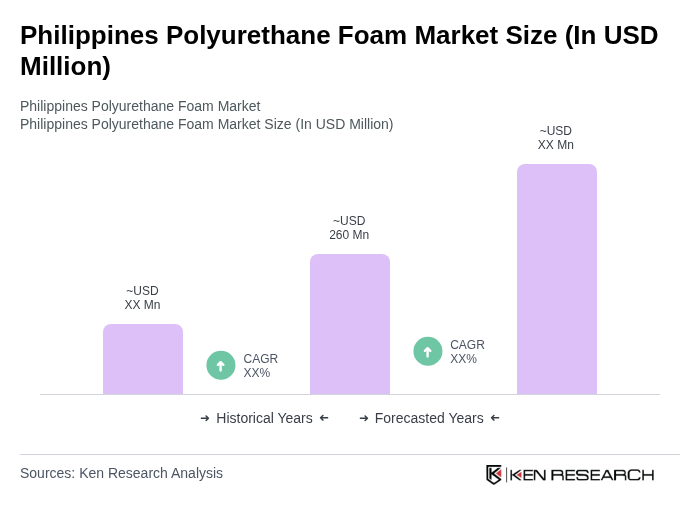

The Philippines Polyurethane Foam Market is valued at approximately USD 260 million, driven by demand from sectors such as automotive, construction, and furniture, alongside consumer preferences for durable materials.