Region:Global

Author(s):Dev

Product Code:KRAC0533

Pages:82

Published On:August 2025

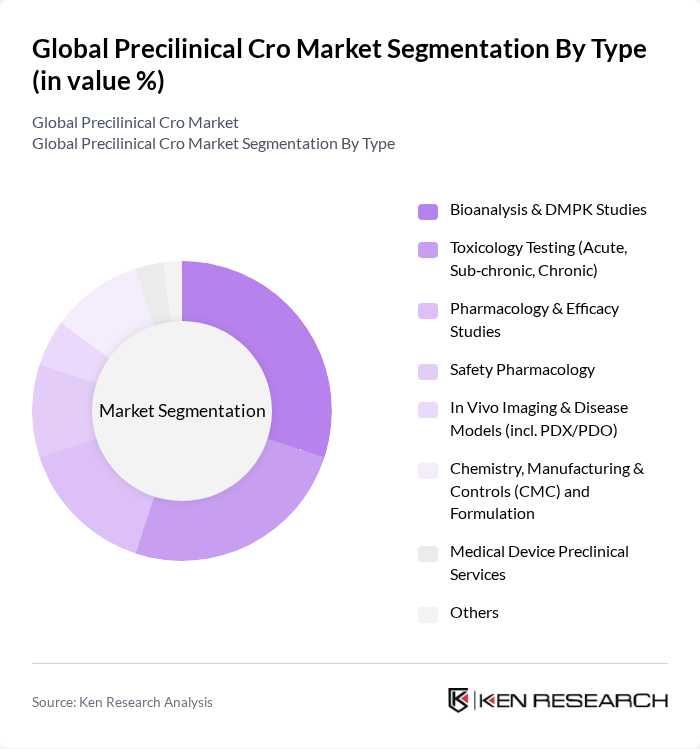

By Type:The market is segmented into various types of preclinical services, including Bioanalysis & DMPK Studies, Toxicology Testing (Acute, Sub?chronic, Chronic), Pharmacology & Efficacy Studies, Safety Pharmacology, In Vivo Imaging & Disease Models (incl. PDX/PDO), Chemistry, Manufacturing & Controls (CMC) and Formulation, Medical Device Preclinical Services, and Others. Among these, Bioanalysis & DMPK Studies are currently a leading service category due to intensified focus on absorption, distribution, metabolism, and excretion characterization to inform dose selection, exposure–response, and IND?enabling packages; demand is reinforced by regulatory expectations for high?quality quantitative bioanalysis and PK/PD integration to de?risk first?in?human transitions .

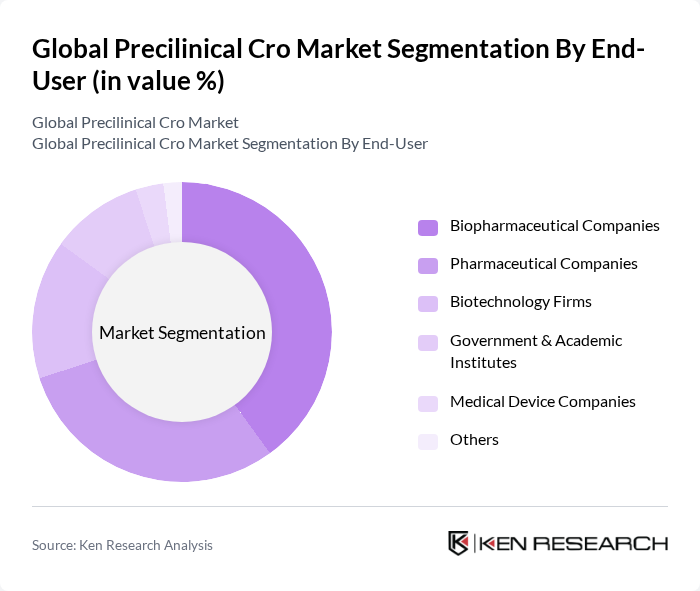

By End-User:The end-user segmentation includes Biopharmaceutical Companies, Pharmaceutical Companies, Biotechnology Firms, Government & Academic Institutes, Medical Device Companies, and Others. Biopharmaceutical Companies are the dominant end?users, as complex modalities such as monoclonal antibodies, cell and gene therapies, and next?generation biologics require extensive GLP toxicology, biodistribution, and DMPK packages that are frequently outsourced to specialized CROs .

The Global Preclinical CRO Market is characterized by a dynamic mix of regional and international players. Leading participants such as Charles River Laboratories, Labcorp Drug Development (formerly Covance), WuXi AppTec, ICON plc, Medpace Holdings, Inc., PPD, Inc. (part of Thermo Fisher Scientific), Eurofins Scientific, Syneos Health, PRA Health Sciences (now part of ICON plc), BioAgilytix Labs, KCR S.A., Pharmaron, Evotec SE, CR Medicon, Toxikon Corporation (now part of Labcorp) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the preclinical CRO market appears promising, driven by ongoing advancements in technology and a growing emphasis on personalized medicine. As pharmaceutical companies increasingly adopt AI and machine learning for drug discovery, the efficiency of preclinical testing is expected to improve significantly. Additionally, the shift towards in vitro testing methods will likely reduce reliance on animal models, aligning with ethical standards and regulatory expectations, thus fostering innovation and growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Bioanalysis & DMPK Studies Toxicology Testing (Acute, Sub?chronic, Chronic) Pharmacology & Efficacy Studies Safety Pharmacology In Vivo Imaging & Disease Models (incl. PDX/PDO) Chemistry, Manufacturing & Controls (CMC) and Formulation Medical Device Preclinical Services Others |

| By End-User | Biopharmaceutical Companies Pharmaceutical Companies Biotechnology Firms Government & Academic Institutes Medical Device Companies Others |

| By Application | Oncology Cardiovascular Neurology Infectious Diseases Metabolic Disorders Immunology & Inflammation Others |

| By Service Type | In Vivo Services In Vitro Services Bioanalytical Services Toxicology Services DMPK/ADME Safety Pharmacology Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Client Type | Large Enterprises Small and Medium Enterprises Startups |

| By Pricing Model | Fixed Pricing Unit-Based/Per-Study Pricing FTE (Full-Time Equivalent) Pricing Milestone/Performance-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical R&D Departments | 120 | R&D Directors, Project Managers |

| Biotechnology Firms | 100 | Chief Scientific Officers, Regulatory Affairs Managers |

| Academic Research Institutions | 80 | Principal Investigators, Lab Managers |

| Preclinical CRO Service Providers | 70 | Business Development Managers, Operations Directors |

| Investors in Biopharma | 60 | Venture Capitalists, Investment Analysts |

The Global Preclinical CRO Market is valued at approximately USD 5.9 billion, reflecting a consolidation of industry estimates that range between USD 5.8 billion and USD 6.0 billion, driven by outsourcing intensity and advancements in biologics and therapy pipelines.