Region:Middle East

Author(s):Rebecca

Product Code:KRAC8405

Pages:81

Published On:November 2025

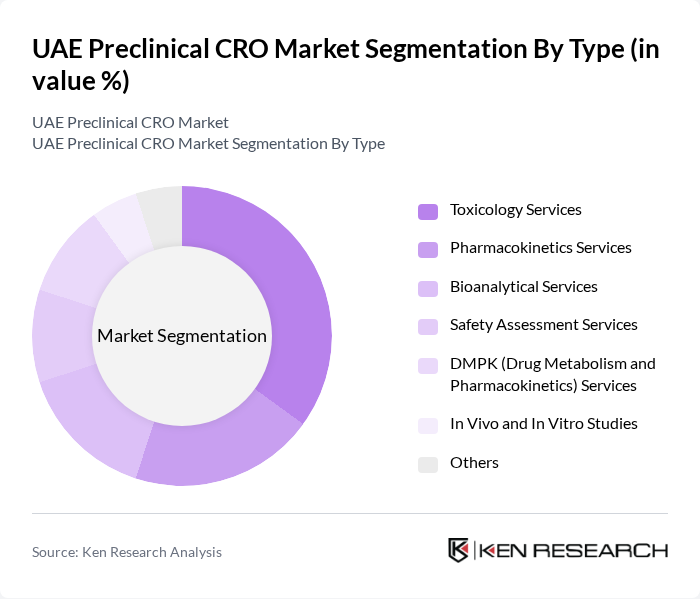

By Type:The market is segmented into various types of services that cater to the needs of pharmaceutical and biotechnology companies. The primary subsegments include Toxicology Services, Pharmacokinetics Services, Bioanalytical Services, Safety Assessment Services, DMPK (Drug Metabolism and Pharmacokinetics) Services, In Vivo and In Vitro Studies, and Others. Among these, Toxicology Services are currently leading the market due to the increasing emphasis on safety assessments in drug development. The demand for comprehensive toxicological evaluations has surged as regulatory bodies enforce stricter guidelines for drug approval. This trend is reinforced by the UAE’s alignment with international standards for preclinical safety and efficacy testing .

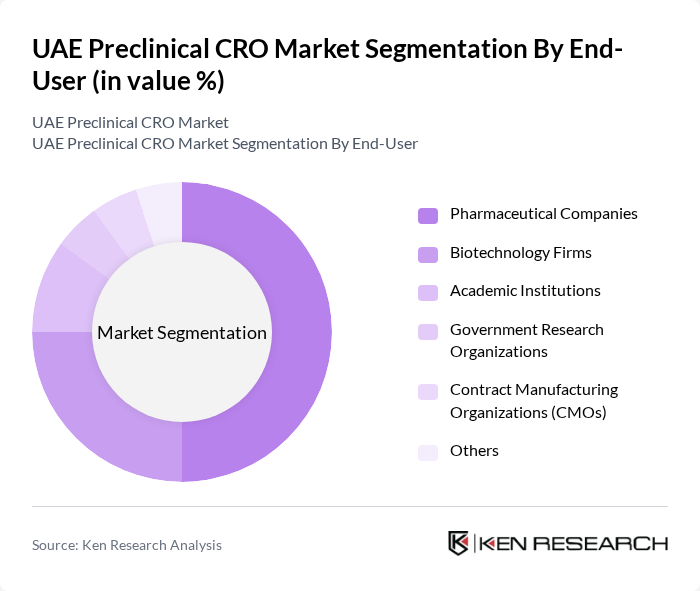

By End-User:The end-user segmentation includes Pharmaceutical Companies, Biotechnology Firms, Academic Institutions, Government Research Organizations, Contract Manufacturing Organizations (CMOs), and Others. Pharmaceutical Companies dominate this segment, driven by their need for extensive preclinical testing to ensure drug safety and efficacy. The increasing number of drug candidates entering the pipeline has led to a higher demand for preclinical services, particularly from large pharmaceutical firms that require comprehensive testing solutions. The dominance of pharmaceutical and biotechnology companies as end-users is consistent with global and regional trends .

The UAE Preclinical CRO Market is characterized by a dynamic mix of regional and international players. Leading participants such as Charles River Laboratories, Labcorp Drug Development (formerly Covance), WuXi AppTec, Eurofins Scientific, Medpace, PPD (part of Thermo Fisher Scientific), Syneos Health, ICON plc, BioClinica (now part of ERT), KCR, Premier Research, Celerion, IROS (International Research Organization for Health Sciences), Fortrea, Novotech CRO contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE preclinical CRO market appears promising, driven by ongoing advancements in technology and a growing emphasis on personalized medicine. As biopharmaceutical companies expand their operations, the demand for specialized preclinical services is expected to rise. Additionally, collaborations between CROs and academic institutions are likely to foster innovation and enhance research capabilities, positioning the UAE as a key player in the global pharmaceutical landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Toxicology Services Pharmacokinetics Services Bioanalytical Services Safety Assessment Services DMPK (Drug Metabolism and Pharmacokinetics) Services In Vivo and In Vitro Studies Others |

| By End-User | Pharmaceutical Companies Biotechnology Firms Academic Institutions Government Research Organizations Contract Manufacturing Organizations (CMOs) Others |

| By Therapeutic Area | Oncology Cardiovascular Neurology Infectious Diseases Metabolic Disorders Rare Diseases Others |

| By Service Model | Full-Service CROs Functional Service Providers (FSPs) Hybrid Models Niche/Specialty CROs Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah Umm Al Quwain Others |

| By Client Type | Large Enterprises SMEs Startups Academic/Government Clients Others |

| By Project Phase | Preclinical Phase IND-Enabling Studies Clinical Phase Post-Approval Phase Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Preclinical Studies | 80 | Clinical Research Directors, Project Managers |

| Biotechnology Research Initiatives | 60 | Research Scientists, Lab Managers |

| Regulatory Compliance in Preclinical Trials | 50 | Regulatory Affairs Specialists, Quality Assurance Managers |

| Contract Research Services Utilization | 55 | Procurement Officers, Business Development Managers |

| Emerging Therapeutic Areas | 40 | Therapeutic Area Leads, Medical Affairs Directors |

The UAE Preclinical CRO Market is valued at approximately USD 8 million, reflecting a five-year historical analysis. This growth is driven by increasing demand for drug development services and advancements in biotechnology.