Region:Global

Author(s):Rebecca

Product Code:KRAA2939

Pages:81

Published On:August 2025

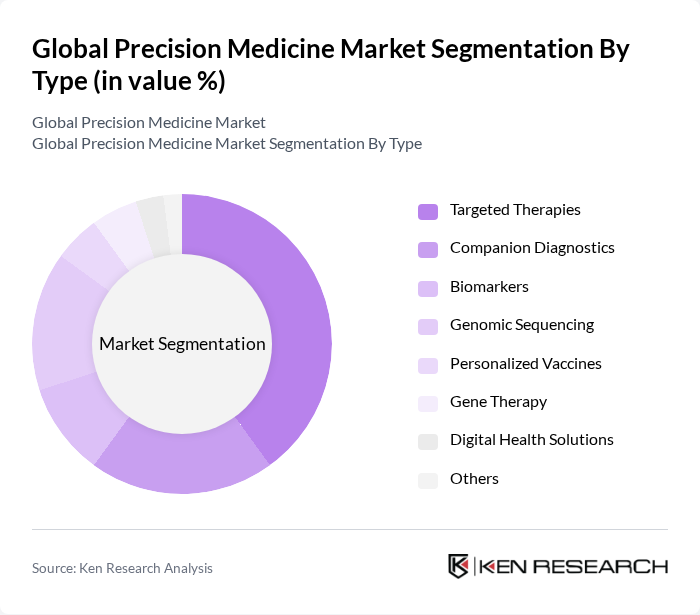

By Type:The precision medicine market is segmented into targeted therapies, companion diagnostics, biomarkers, genomic sequencing, personalized vaccines, gene therapy, digital health solutions, and others. Among these, targeted therapies are leading the market due to their effectiveness in treating specific diseases based on genetic information. The increasing adoption of companion diagnostics is also notable, as it helps in identifying the right patients for targeted therapies, thus enhancing treatment outcomes. The growth of genomic sequencing and digital health solutions is further supported by technological advancements and decreasing costs of sequencing technologies .

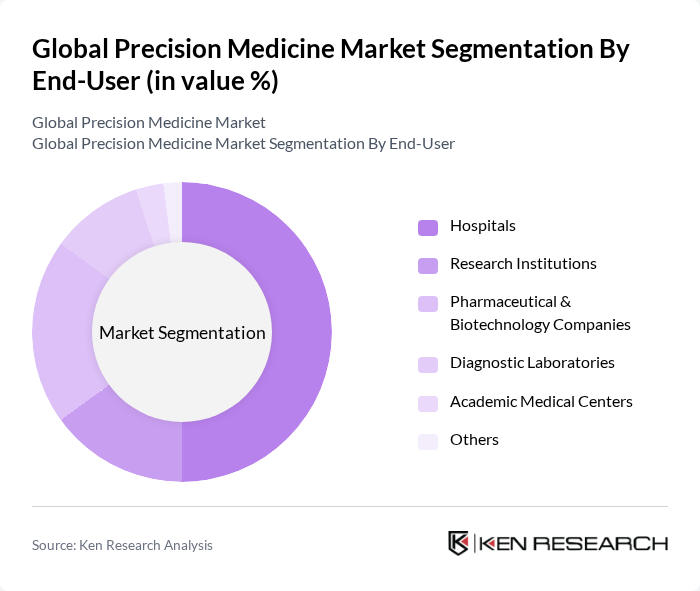

By End-User:The end-user segmentation includes hospitals, research institutions, pharmaceutical and biotechnology companies, diagnostic laboratories, academic medical centers, and others. Hospitals are the dominant end-user segment, driven by the increasing demand for personalized treatment options and the integration of precision medicine into clinical practice. Pharmaceutical and biotechnology companies are also significant players, focusing on developing targeted therapies and companion diagnostics. Research institutions and diagnostic laboratories are expanding their roles through clinical trials and advanced biomarker testing .

The Global Precision Medicine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Illumina, Inc., Thermo Fisher Scientific Inc., Roche Holding AG, Novartis AG, Pfizer Inc., GSK plc, Merck & Co., Inc., Amgen Inc., AstraZeneca PLC, Genentech, Inc., Bayer AG, Sanofi S.A., AbbVie Inc., Siemens Healthineers AG, Bio-Rad Laboratories, Inc., Agilent Technologies, Inc., Guardant Health, Inc., Foundation Medicine, Inc., Invitae Corporation, Exact Sciences Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the precision medicine market appears promising, driven by technological advancements and increasing healthcare investments. As artificial intelligence continues to integrate into healthcare, it will enhance data analysis capabilities, leading to more effective personalized treatments. Furthermore, the expansion of telemedicine will facilitate access to precision medicine, particularly in underserved areas, ensuring that more patients benefit from tailored healthcare solutions. This evolving landscape is expected to foster innovation and collaboration across the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Targeted Therapies Companion Diagnostics Biomarkers Genomic Sequencing Personalized Vaccines Gene Therapy Digital Health Solutions Others |

| By End-User | Hospitals Research Institutions Pharmaceutical & Biotechnology Companies Diagnostic Laboratories Academic Medical Centers Others |

| By Application | Oncology Cardiovascular Diseases Neurological Disorders Infectious Diseases Rare Diseases Autoimmune Diseases Others |

| By Distribution Channel | Direct Sales Online Sales Distributors Retail Pharmacies Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Technology | Next-Generation Sequencing (NGS) CRISPR & Gene Editing Bioinformatics & Big Data Analytics Molecular Imaging Technologies Liquid Biopsy Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oncology Precision Medicine | 100 | Oncologists, Clinical Researchers |

| Cardiovascular Genomics | 60 | Cardiologists, Genetic Counselors |

| Rare Disease Treatments | 40 | Healthcare Providers, Patient Advocacy Groups |

| Pharmacogenomics Applications | 50 | Pharmacists, Clinical Pharmacologists |

| Consumer Genomic Testing | 45 | Genetic Testing Companies, Marketing Managers |

The Global Precision Medicine Market is valued at approximately USD 102 billion, driven by advancements in genomics, the rising prevalence of chronic diseases, and a focus on personalized healthcare solutions.