Region:Middle East

Author(s):Geetanshi

Product Code:KRAA0533

Pages:85

Published On:December 2025

By Type:The digital health market is segmented into various types, including Mobile Health Applications, Telehealth Platforms, Electronic Health Records (EHR), Health Analytics Solutions, Remote Patient Monitoring Devices, Digital Therapeutics, and Others. Among these, Mobile Health Applications are gaining significant traction due to the increasing smartphone penetration and the growing demand for health management solutions. Telehealth Platforms are also witnessing rapid adoption as they provide convenient access to healthcare services, especially in remote areas.

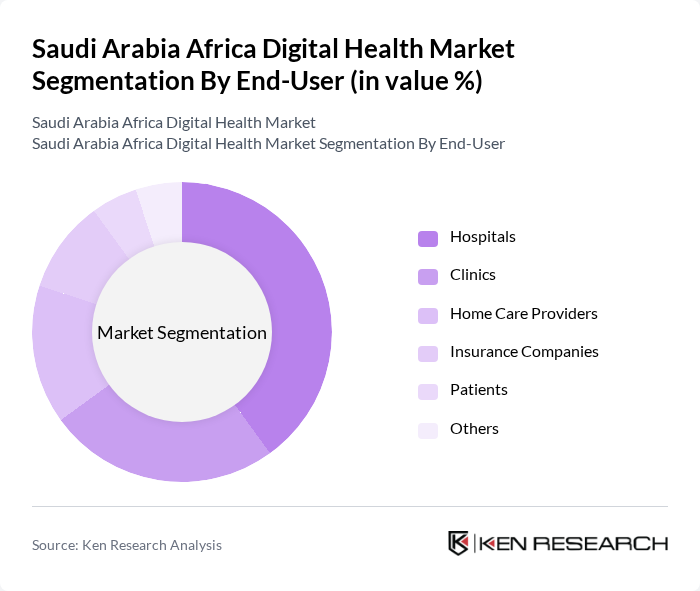

By End-User:The end-user segmentation includes Hospitals, Clinics, Home Care Providers, Insurance Companies, Patients, and Others. Hospitals are the leading end-users of digital health solutions, driven by the need for efficient patient management systems and improved healthcare delivery. Clinics are also increasingly adopting digital health technologies to enhance patient engagement and streamline operations.

The Saudi Arabia Africa Digital Health Market is characterized by a dynamic mix of regional and international players. Leading participants such as Healthigo, Vezeeta, DabaDoc, Altibbi, Okadoc, Mawid, Meddy, Careem Health, Seha, Tibbiyah, Qaree, HealthTech, Medgulf, Aster DM Healthcare, and Saudi Health Council contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia Africa digital health market appears promising, driven by ongoing investments in digital infrastructure and government support for health technology initiatives. With the anticipated expansion of internet access and the integration of AI in healthcare, the market is poised for significant growth. Additionally, the increasing prevalence of chronic diseases will further fuel demand for innovative digital health solutions, enhancing patient care and management across the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Health Applications Telehealth Platforms Electronic Health Records (EHR) Health Analytics Solutions Remote Patient Monitoring Devices Digital Therapeutics Others |

| By End-User | Hospitals Clinics Home Care Providers Insurance Companies Patients Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Technology | Cloud Computing Artificial Intelligence Internet of Things (IoT) Big Data Analytics Blockchain Technology Others |

| By Application | Chronic Disease Management Fitness and Wellness Mental Health Preventive Healthcare Others |

| By Investment Source | Private Investments Government Funding Venture Capital Public-Private Partnerships Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telemedicine Adoption in Saudi Arabia | 100 | Healthcare Administrators, Telehealth Coordinators |

| mHealth Application Usage in Africa | 80 | Mobile Health Developers, User Experience Researchers |

| eHealth Policy Impact Assessment | 70 | Health Policy Analysts, Government Officials |

| Patient Engagement Strategies | 90 | Patient Advocates, Healthcare Marketers |

| Digital Health Investment Trends | 60 | Venture Capitalists, Health Tech Investors |

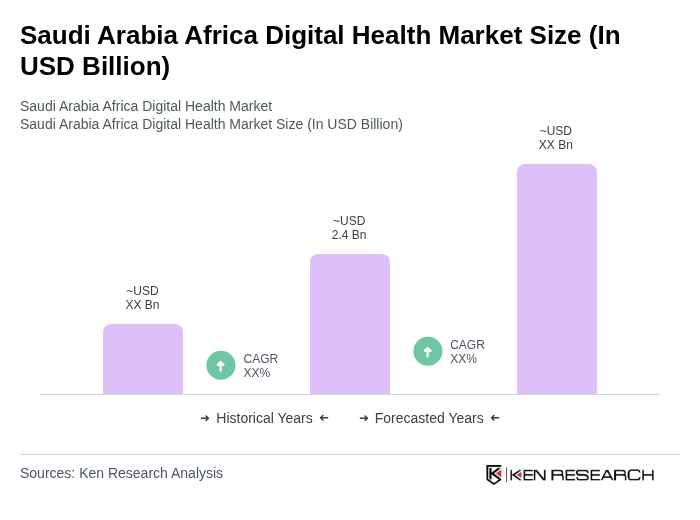

The Saudi Arabia Africa Digital Health Market is valued at approximately USD 2.4 billion, reflecting significant growth driven by government investments, a tech-savvy population, and increasing demand for remote healthcare solutions.