Region:Global

Author(s):Dev

Product Code:KRAA2526

Pages:97

Published On:August 2025

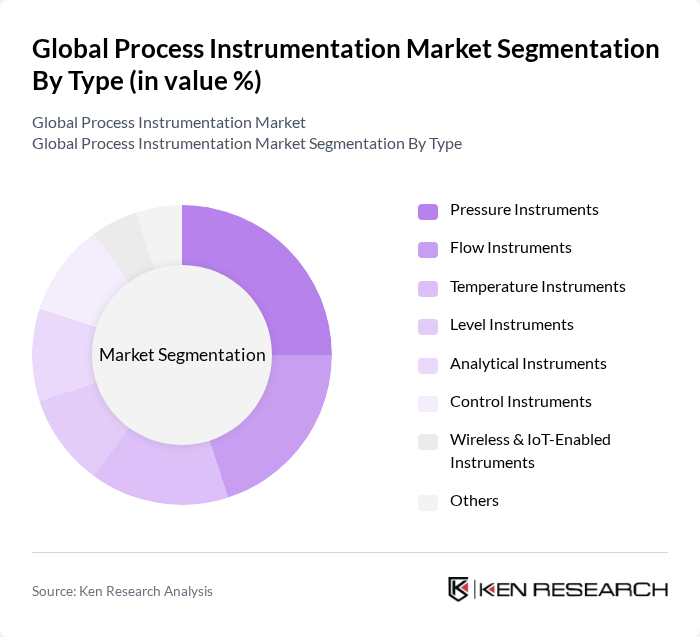

By Type:The market is segmented into Pressure Instruments, Flow Instruments, Temperature Instruments, Level Instruments, Analytical Instruments, Control Instruments, Wireless & IoT-Enabled Instruments, and Others. Each type addresses specific industrial needs: Pressure and Flow Instruments are critical in oil & gas and chemical processing for monitoring and control; Temperature and Level Instruments are essential in food, beverage, and pharmaceuticals for quality assurance; Analytical Instruments support compliance and process optimization; Control Instruments underpin automation and safety; Wireless & IoT-Enabled Instruments enable remote monitoring, predictive maintenance, and integration with digital manufacturing platforms.

By End-User:The end-user segmentation covers Oil & Gas, Chemical, Water & Wastewater, Food & Beverage, Pharmaceuticals, Power Generation, Automotive, Metals & Mining, Pulp & Paper, and Others. Oil & Gas and Chemical sectors are the largest consumers, driven by stringent safety and environmental regulations and the need for precise measurement and control. Water & Wastewater utilities rely on instrumentation for compliance and efficiency. Food & Beverage and Pharmaceuticals require high-precision monitoring for quality and safety. Power Generation, Automotive, and Metals & Mining sectors utilize process instrumentation for operational optimization and risk reduction.

The Global Process Instrumentation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emerson Electric Co., Siemens AG, Honeywell International Inc., Endress+Hauser AG, Yokogawa Electric Corporation, ABB Ltd., Schneider Electric SE, KROHNE Group, Azbil Corporation, Rockwell Automation, Inc., Vega Grieshaber KG, National Instruments Corporation, AMETEK, Inc., Badger Meter, Inc., Fluke Corporation, Omron Corporation, Brooks Instrument (a division of ITW), Bürkert Fluid Control Systems, Mettler-Toledo International Inc., SICK AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the process instrumentation market appears promising, driven by technological advancements and increasing demand for efficiency. As industries continue to embrace digital transformation, the integration of IoT and AI technologies will enhance data collection and analysis capabilities. Furthermore, the focus on sustainability will push companies to adopt greener practices, leading to innovations in instrumentation. These trends indicate a robust growth trajectory, with significant investments expected in smart manufacturing and renewable energy sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Pressure Instruments Flow Instruments Temperature Instruments Level Instruments Analytical Instruments Control Instruments Wireless & IoT-Enabled Instruments Others |

| By End-User | Oil & Gas Chemical Water & Wastewater Food & Beverage Pharmaceuticals Power Generation Automotive Metals & Mining Pulp & Paper Others |

| By Application | Process Control Quality Control Environmental Monitoring Safety Management Asset Management Predictive Maintenance Others |

| By Component | Sensors Transmitters Controllers Software & Analytics Actuators Others |

| By Sales Channel | Direct Sales Distributors Online Sales System Integrators Others |

| By Distribution Mode | Wholesale Retail E-commerce Others |

| By Price Range | Low Range Mid Range High Range Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector Instrumentation | 120 | Process Engineers, Production Managers |

| Oil & Gas Measurement Solutions | 90 | Field Engineers, Operations Supervisors |

| Pharmaceutical Process Control | 60 | Quality Assurance Managers, R&D Directors |

| Food & Beverage Quality Monitoring | 50 | Quality Control Analysts, Production Supervisors |

| Water & Wastewater Treatment Instrumentation | 40 | Environmental Engineers, Plant Managers |

The Global Process Instrumentation Market is valued at approximately USD 18.7 billion. This valuation reflects the increasing demand for automation, operational efficiency, and safety compliance across various manufacturing sectors.