Region:Global

Author(s):Geetanshi

Product Code:KRAD3882

Pages:93

Published On:November 2025

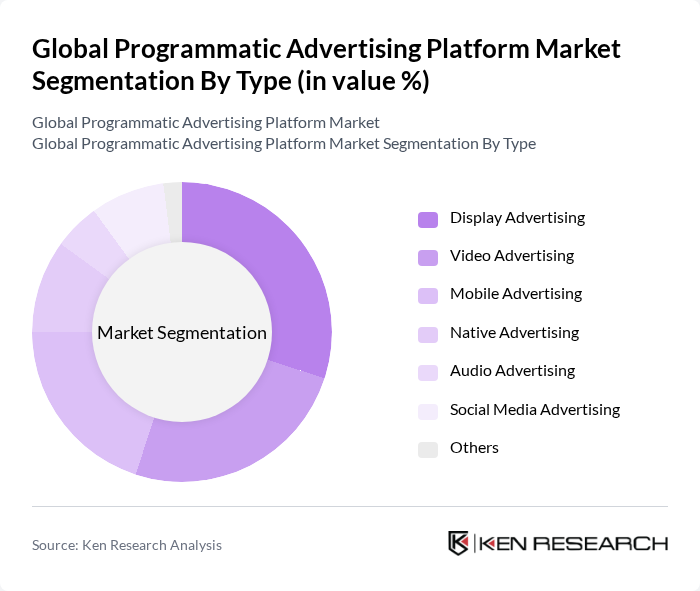

By Type:The programmatic advertising market can be segmented into various types, including Display Advertising, Video Advertising, Mobile Advertising, Native Advertising, Audio Advertising, Social Media Advertising, and Others. Each of these sub-segments plays a crucial role in the overall market dynamics, with specific trends and consumer preferences influencing their growth.

The Display Advertising segment is currently dominating the market due to its widespread use across various digital platforms. Advertisers favor display ads for their visual appeal and ability to capture user attention effectively. The increasing integration of programmatic technology in display advertising has also enhanced targeting capabilities, making it a preferred choice for brands looking to maximize their reach and engagement. Video Advertising follows closely, driven by the growing consumption of video content on platforms like YouTube and social media, which has led to higher demand for programmatic video ad placements.

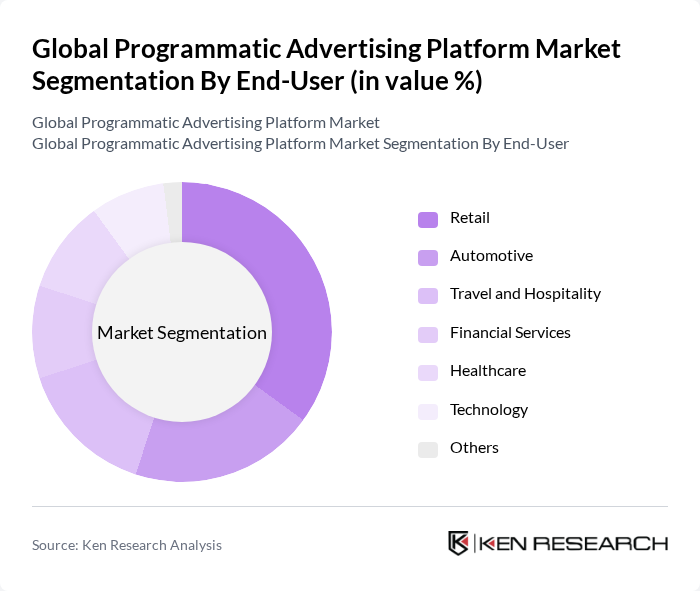

By End-User:The programmatic advertising market is segmented by end-users, including Retail, Automotive, Travel and Hospitality, Financial Services, Healthcare, Technology, and Others. Each end-user category has unique advertising needs and strategies, influencing the overall market landscape.

The Retail sector is the leading end-user in the programmatic advertising market, driven by the need for targeted advertising to attract consumers in a highly competitive environment. Retailers leverage programmatic advertising to optimize their ad spend and reach potential customers effectively. The Automotive and Travel sectors also show significant engagement in programmatic advertising, utilizing data-driven strategies to enhance customer acquisition and retention.

The Global Programmatic Advertising Platform Market is characterized by a dynamic mix of regional and international players. Leading participants such as Google, Adobe, The Trade Desk, Xandr (formerly AppNexus), PubMatic, Magnite (formerly Rubicon Project), Criteo, SpotX (acquired by Magnite), InMobi, Adform, MediaMath, OpenX, Sizmek (acquired by Amazon), SmartyAds, AdRoll contribute to innovation, geographic expansion, and service delivery in this space.

The future of programmatic advertising is poised for transformative growth, driven by technological advancements and evolving consumer behaviors. As advertisers increasingly prioritize data-driven strategies, the integration of artificial intelligence and machine learning will enhance targeting and personalization. Additionally, the rise of connected devices and the Internet of Things (IoT) will create new avenues for programmatic advertising, allowing brands to engage consumers in innovative ways. This evolution will likely redefine advertising strategies, making them more efficient and effective.

| Segment | Sub-Segments |

|---|---|

| By Type | Display Advertising Video Advertising Mobile Advertising Native Advertising Audio Advertising Social Media Advertising Others |

| By End-User | Retail Automotive Travel and Hospitality Financial Services Healthcare Technology Others |

| By Industry | E-commerce Entertainment Education Real Estate Telecommunications Others |

| By Advertising Format | Programmatic Direct Real-Time Bidding (RTB) Private Marketplaces (PMP) Others |

| By Geographic Focus | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Technology Used | Artificial Intelligence Machine Learning Big Data Analytics Cloud Computing Others |

| By Payment Model | Cost Per Click (CPC) Cost Per Mille (CPM) Cost Per Acquisition (CPA) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Programmatic Advertising Platforms | 80 | Product Managers, Marketing Directors |

| Digital Marketing Agencies | 70 | Media Buyers, Campaign Managers |

| Brand Advertisers | 60 | Brand Managers, Digital Strategy Leads |

| Data Management Platforms | 50 | Data Analysts, Technology Officers |

| Ad Tech Startups | 40 | Founders, Business Development Managers |

The Global Programmatic Advertising Platform Market is valued at approximately USD 12 billion, reflecting significant growth driven by the increasing adoption of digital advertising and advancements in technologies like artificial intelligence and machine learning.