Region:Global

Author(s):Shubham

Product Code:KRAA2636

Pages:87

Published On:August 2025

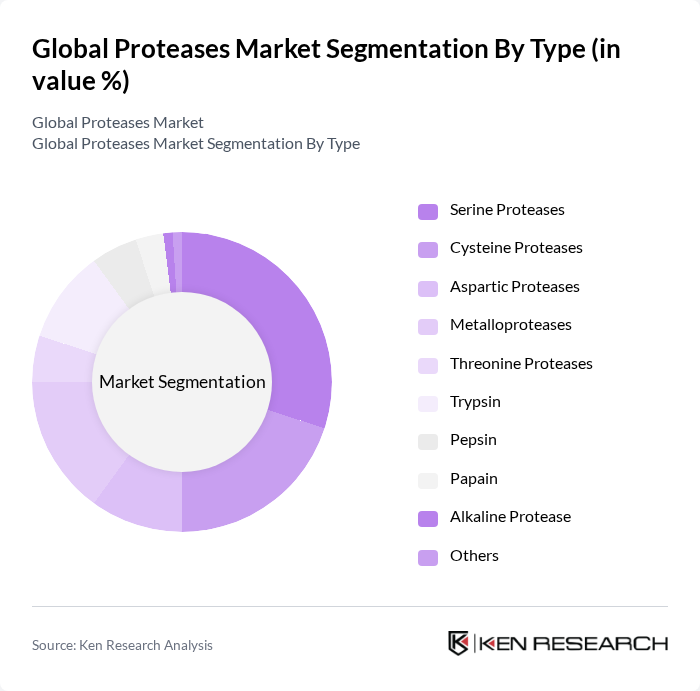

By Type:The proteases market is segmented into various types, including serine proteases, cysteine proteases, aspartic proteases, metalloproteases, threonine proteases, trypsin, pepsin, papain, alkaline protease, and others. Among these,serine proteasesare currently dominating the market due to their extensive use in the food and beverage industry, particularly in meat processing and dairy applications. The versatility and efficiency of serine proteases in breaking down proteins make them highly sought after, leading to increased adoption across various sectors. The growing demand for high-quality processed foods and advancements in enzyme technology are further reinforcing the dominance of serine proteases .

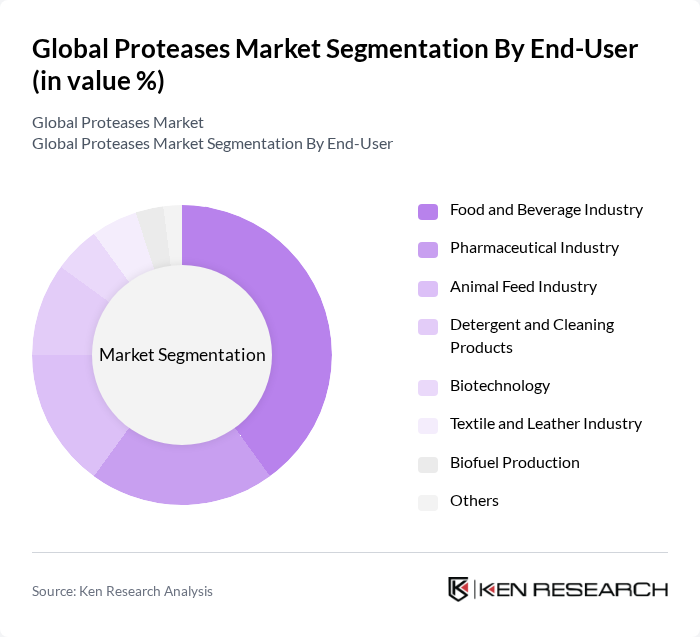

By End-User:The proteases market is also segmented by end-user industries, including food and beverage, pharmaceuticals, animal feed, detergent and cleaning products, biotechnology, textile and leather, biofuel production, and others. Thefood and beverage industryis the leading segment, driven by the increasing demand for processed foods and the need for improved food quality and safety. The growing trend of health-conscious consumers is further propelling the use of proteases in food applications, making this segment a significant contributor to market growth. Additionally, the pharmaceutical and animal feed industries are experiencing rising adoption of proteases due to their roles in drug formulation and enhancing nutrient absorption in livestock .

The Global Proteases Market is characterized by a dynamic mix of regional and international players. Leading participants such as Novozymes A/S, BASF SE, DuPont de Nemours, Inc., DSM-Firmenich AG, AB Enzymes GmbH, Amano Enzyme Inc., Enzyme Development Corporation, Chr. Hansen Holding A/S, Rousselot, Specialty Enzymes & Biotechnologies Co., Biocatalysts Ltd., Enzymatic Solutions Inc., Advanced Enzyme Technologies Ltd., Jiangsu Boli Bioproducts Co., Ltd., Kemin Industries, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the proteases market appears promising, driven by increasing demand for sustainable and natural ingredients across various industries. Innovations in enzyme technology, including the development of more efficient and cost-effective production methods, are expected to enhance market competitiveness. Additionally, the integration of artificial intelligence in enzyme development is likely to streamline research and improve product customization, catering to specific industry needs and consumer preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | Serine Proteases Cysteine Proteases Aspartic Proteases Metalloproteases Threonine Proteases Trypsin Pepsin Papain Alkaline Protease Others |

| By End-User | Food and Beverage Industry Pharmaceutical Industry Animal Feed Industry Detergent and Cleaning Products Biotechnology Textile and Leather Industry Biofuel Production Others |

| By Application | Food Processing Dairy Processing Meat Tenderization Brewing and Alcoholic Beverages Textile Industry Leather Processing Detergents Biofuel Production Waste Management Pharmaceuticals Others |

| By Source | Animal-Based Proteases Plant-Based Proteases Microbial Proteases Others |

| By Formulation | Liquid Formulations Powder Formulations Granular Formulations Lyophilized Powder Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Processing Industry | 120 | Production Managers, Quality Control Specialists |

| Pharmaceutical Applications | 90 | Clinical Researchers, Regulatory Affairs Managers |

| Detergent Manufacturing | 60 | Product Development Managers, Supply Chain Analysts |

| Animal Feed Sector | 50 | Nutritionists, Procurement Officers |

| Biotechnology Firms | 70 | R&D Directors, Business Development Managers |

The Global Proteases Market is valued at approximately USD 3.5 billion, reflecting a robust growth trajectory driven by increasing demand across various sectors, including food and beverage, pharmaceuticals, and animal feed.