Region:Global

Author(s):Rebecca

Product Code:KRAA2385

Pages:87

Published On:August 2025

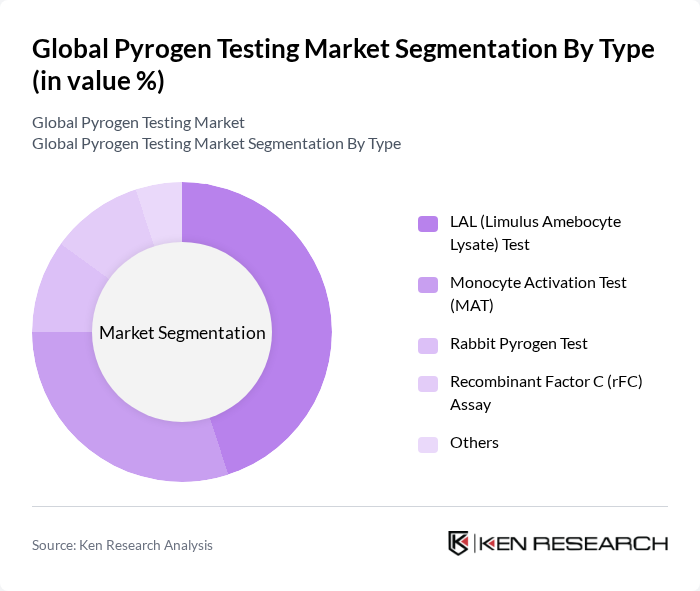

By Type:The pyrogen testing market is segmented into various types, including LAL (Limulus Amebocyte Lysate) Test, Monocyte Activation Test (MAT), Rabbit Pyrogen Test, Recombinant Factor C (rFC) Assay, and others. Among these, the LAL Test is the most widely used due to its established reliability and regulatory acceptance. The MAT is gaining traction as a humane alternative, while the rFC Assay is emerging as a promising method due to its specificity and sensitivity. The Rabbit Pyrogen Test is declining in use due to regulatory and ethical considerations, but still persists in certain applications .

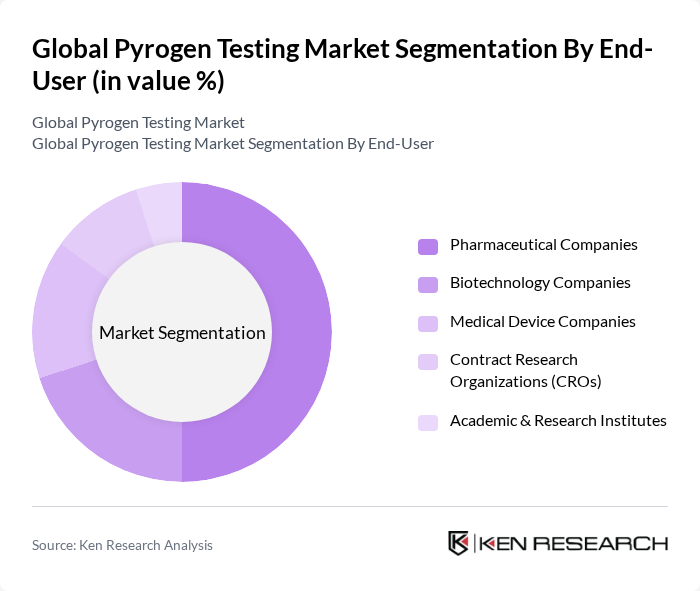

By End-User:The end-user segmentation includes pharmaceutical companies, biotechnology companies, medical device companies, contract research organizations (CROs), academic & research institutes, and others. Pharmaceutical companies dominate this segment due to their extensive need for pyrogen testing in drug development and manufacturing processes. The increasing number of biotechnology firms also contributes to the growth of this segment as they require rigorous testing for their innovative therapies. Medical device companies and CROs are also significant users, reflecting the broadening scope of pyrogen testing in compliance and product safety .

The Global Pyrogen Testing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Charles River Laboratories, Lonza Group AG, Thermo Fisher Scientific Inc., Merck KGaA, WuXi AppTec, bioMérieux SA, Hyglos GmbH (a bioMérieux company), GenScript Biotech Corporation, EMD Millipore (Merck Millipore), Becton, Dickinson and Company (BD), Sartorius AG, VWR International, LLC (Avantor), QIAGEN N.V., Seikagaku Corporation, Associates of Cape Cod, Inc., FUJIFILM Wako Chemicals U.S.A. Corporation, Ellab A/S contribute to innovation, geographic expansion, and service delivery in this space.

The future of the pyrogen testing market appears promising, driven by ongoing advancements in technology and increasing regulatory scrutiny. As the biopharmaceutical industry continues to expand, the demand for efficient and reliable testing methods will grow. Companies are likely to invest in automation and AI integration to streamline testing processes. Additionally, the focus on personalized medicine will further necessitate robust pyrogen testing, ensuring that products meet the highest safety standards for diverse patient populations.

| Segment | Sub-Segments |

|---|---|

| By Type | LAL (Limulus Amebocyte Lysate) Test Monocyte Activation Test (MAT) Rabbit Pyrogen Test Recombinant Factor C (rFC) Assay Others |

| By End-User | Pharmaceutical Companies Biotechnology Companies Medical Device Companies Contract Research Organizations (CROs) Academic & Research Institutes Others |

| By Application | Vaccine Development Drug Manufacturing Medical Device Testing Blood Product Testing Cell Therapy & Gene Therapy Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Product Type | Kits Reagents Instruments Services Consumables Others |

| By Service Type | Testing Services Validation & Consulting Services Training Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Testing Laboratories | 100 | Laboratory Managers, Quality Control Analysts |

| Biotechnology Firms | 60 | Regulatory Affairs Specialists, R&D Managers |

| Medical Device Manufacturers | 50 | Compliance Officers, Product Development Engineers |

| Contract Research Organizations (CROs) | 40 | Project Managers, Business Development Executives |

| Regulatory Bodies and Agencies | 40 | Policy Makers, Compliance Inspectors |

The Global Pyrogen Testing Market is valued at approximately USD 1.6 billion, reflecting a significant growth driven by the increasing demand for biopharmaceuticals and stringent regulatory requirements in the pharmaceutical and medical device industries.