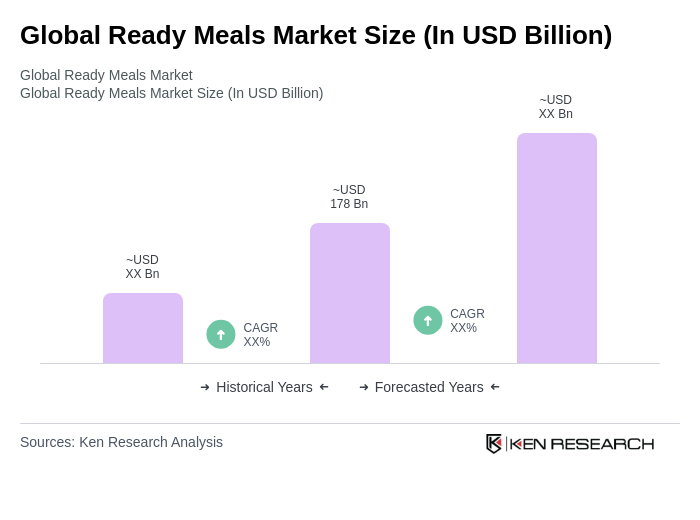

Global Ready Meals Market Overview

- The Global Ready Meals Market is valued at USD 178 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for convenience foods, changing consumer lifestyles, and the rise in dual-income households. The market has seen a significant shift towards ready-to-eat meals, as consumers seek quick and easy meal solutions without compromising on taste and quality. Additional growth drivers include advancements in food preservation and packaging technologies, the expansion of e-commerce, and the rising popularity of health-conscious and premium meal options such as gluten-free, organic, and plant-based ready meals. Urbanization and the prevalence of busy lifestyles continue to accelerate market expansion, with hypermarkets and supermarkets remaining dominant distribution channels.

- Key players in this market include the United States, China, and Germany, which dominate due to their large consumer bases, advanced retail infrastructure, and high disposable incomes. The U.S. leads in innovation and product variety, while China is experiencing rapid growth due to urbanization and changing dietary habits. Germany's strong food processing industry also contributes to its market leadership. Europe holds a significant share of the global market, accounting for over 33% of global revenue, with leading companies such as Nestlé S.A., General Mills, Tyson Foods, and Conagra Brands driving innovation and expansion.

- In 2023, the European Union implemented Regulation (EU) 2023/1115 on Food Information to Consumers, issued by the European Commission. This regulation mandates stricter labeling requirements and nutritional guidelines for ready meals, including the clear display of ingredient lists, allergen information, and nutritional content on packaging. The regulation applies to all pre-packed foods marketed within the EU, enhancing transparency, consumer protection, and trust in ready meal products.

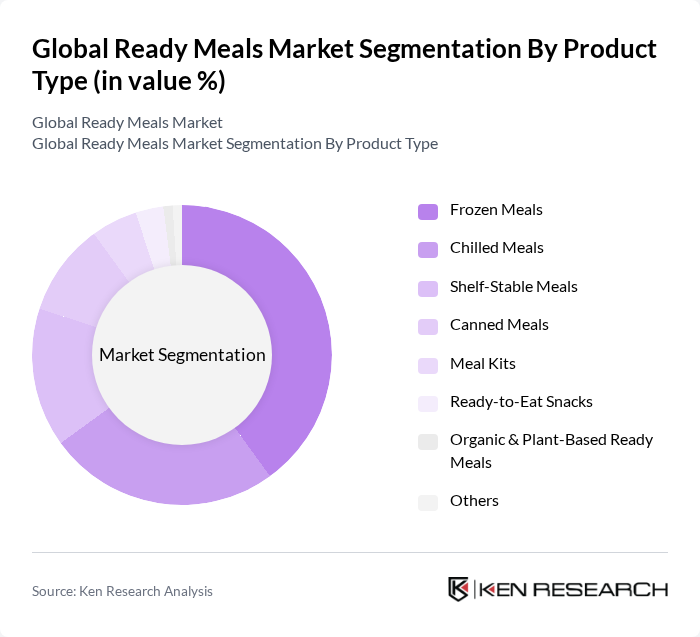

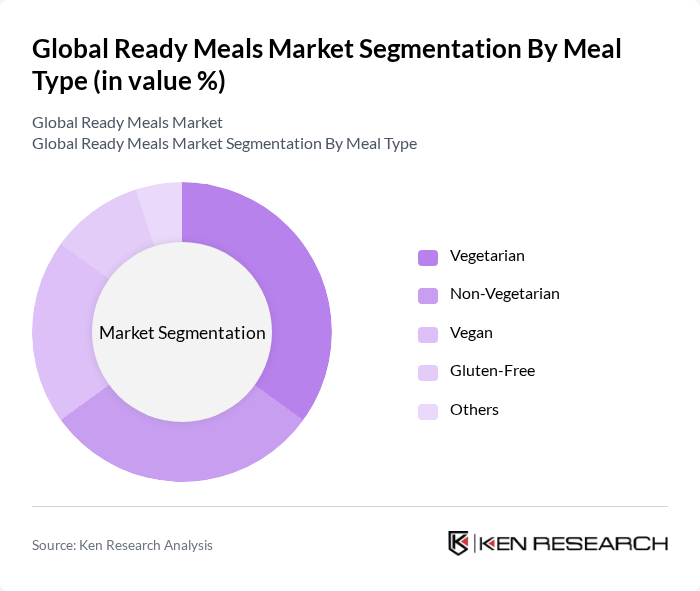

Global Ready Meals Market Segmentation

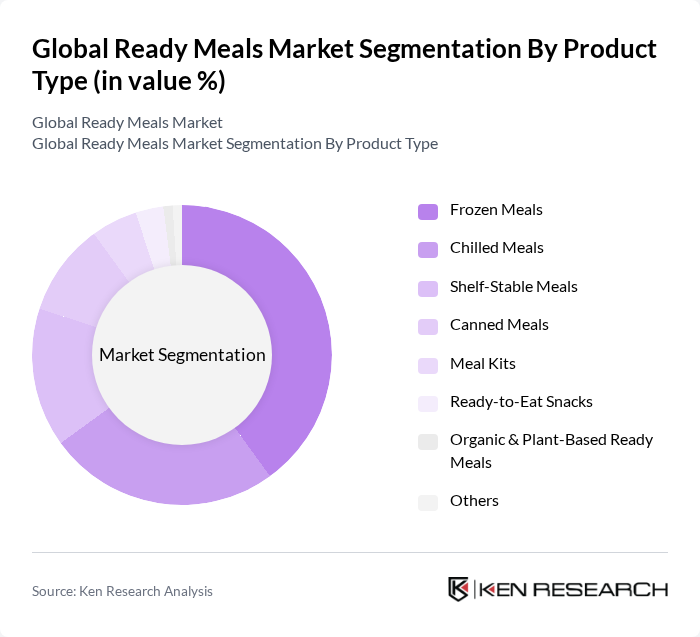

By Product Type:The product type segmentation includes various categories such as frozen meals, chilled meals, shelf-stable meals, canned meals, meal kits, ready-to-eat snacks, organic & plant-based ready meals, and others. Among these, frozen meals are currently the most popular due to their long shelf life, convenience, and wide variety. Consumers appreciate the ease of preparation and extended shelf stability that frozen meals offer, making them a staple in many households. Chilled meals are also gaining traction, particularly in urban areas where fresh meal options are preferred. The demand for organic and plant-based ready meals is increasing, reflecting a growing trend towards healthier and more sustainable eating habits. Innovations in packaging and food technology, such as high-pressure processing, are further supporting the growth of these segments.

By Meal Type:The meal type segmentation includes vegetarian, non-vegetarian, vegan, gluten-free, and others. The vegetarian segment is currently leading the market, driven by the increasing number of consumers adopting plant-based diets for health and environmental reasons. Non-vegetarian options remain popular, particularly in regions where meat consumption is high. The vegan and gluten-free segments are witnessing strong growth as more consumers seek specialized dietary options, reflecting a broader shift towards health-conscious and sustainable eating habits. Product innovation and expanded retail offerings are supporting the growth of these segments.

Global Ready Meals Market Competitive Landscape

The Global Ready Meals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé S.A., Unilever PLC, Kraft Heinz Company, Conagra Brands, Inc., Tyson Foods, Inc., Nomad Foods Limited, General Mills, Inc., Bakkavor Group plc, Greencore Group plc, Amy's Kitchen, Inc., Freshly, Inc., Blue Apron Holdings, Inc., HelloFresh SE, O Organics (Albertsons Companies, Inc.), Tasty Bite Eatables Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

Global Ready Meals Market Industry Analysis

Growth Drivers

- Increasing Consumer Demand for Convenience:The global ready meals market is experiencing a surge in consumer demand for convenience, with the market size reaching approximately $155 billion in future. This trend is driven by the fact that 62% of consumers prioritize quick meal solutions due to their busy lifestyles. The World Bank projects that urban populations will increase by 1.6 billion in future, further fueling the need for ready-to-eat meals that save time and effort in meal preparation.

- Rising Urbanization and Busy Lifestyles:Urbanization is a significant driver of the ready meals market, with the United Nations estimating that 68% of the global population will live in urban areas in future. This shift leads to increased demand for convenient meal options, as urban dwellers often have limited time for cooking. In future, over 72% of consumers in urban areas reported purchasing ready meals at least once a week, highlighting the growing reliance on these products for daily nutrition.

- Growth in E-commerce and Online Food Delivery:The rise of e-commerce and online food delivery services has significantly impacted the ready meals market, with online sales projected to reach $50 billion in future. According to Statista, the online food delivery market is expected to grow by 12% annually, driven by increased smartphone penetration and consumer preference for home delivery. This trend is reshaping how consumers access ready meals, making them more convenient and accessible than ever before.

Market Challenges

- Health Concerns Regarding Processed Foods:Health concerns surrounding processed foods pose a significant challenge to the ready meals market. A survey by the Food and Drug Administration (FDA) indicated that 47% of consumers are wary of the nutritional content of ready meals, particularly regarding high sodium and preservative levels. This skepticism can hinder market growth as consumers increasingly seek healthier, minimally processed alternatives, impacting sales of traditional ready meal options.

- Intense Competition Among Key Players:The ready meals market is characterized by intense competition, with major players like Nestlé and Unilever vying for market share. In future, the top five companies accounted for over 52% of the market, leading to price wars and aggressive marketing strategies. This competitive landscape can squeeze profit margins and make it challenging for smaller brands to establish a foothold, ultimately affecting innovation and product diversity in the market.

Global Ready Meals Market Future Outlook

The future of the ready meals market appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, companies are likely to invest in eco-friendly packaging and healthier meal options. Additionally, the integration of smart technology in meal preparation is expected to enhance convenience and personalization, catering to the growing demand for customized meal solutions. These trends will shape the market landscape, fostering innovation and expanding consumer choices in the coming years.

Market Opportunities

- Expansion into Emerging Markets:Emerging markets present significant growth opportunities for ready meal manufacturers. With rising disposable incomes and changing lifestyles, countries like India and Brazil are witnessing increased demand for convenient meal solutions. In future, the ready meals market in these regions grew by 16%, indicating a strong potential for expansion and investment in localized product offerings to cater to diverse consumer preferences.

- Development of Healthier Ready Meal Options:There is a growing opportunity for companies to develop healthier ready meal options that cater to health-conscious consumers. The market for organic and plant-based ready meals is projected to grow by 22% annually, driven by increasing awareness of nutrition and wellness. By focusing on clean ingredients and transparent labeling, brands can attract a broader customer base and address health concerns associated with traditional ready meals.