Region:Middle East

Author(s):Geetanshi

Product Code:KRAC0010

Pages:89

Published On:August 2025

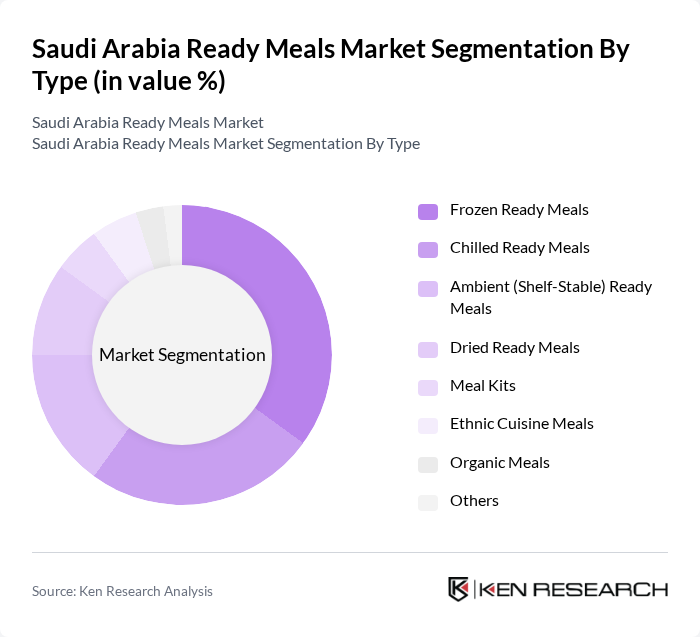

By Type:The ready meals market can be segmented into various types, including frozen, chilled, ambient (shelf-stable), dried, meal kits, ethnic cuisine meals, organic meals, and others. Among these, frozen ready meals have gained significant traction due to their long shelf life, convenience, and suitability for busy lifestyles. Chilled ready meals are also popular, particularly among health-conscious consumers seeking fresher options. The demand for meal kits has surged as consumers look for easy-to-prepare meals that offer a cooking experience, while ambient and dried meals appeal to those prioritizing shelf stability and portability.

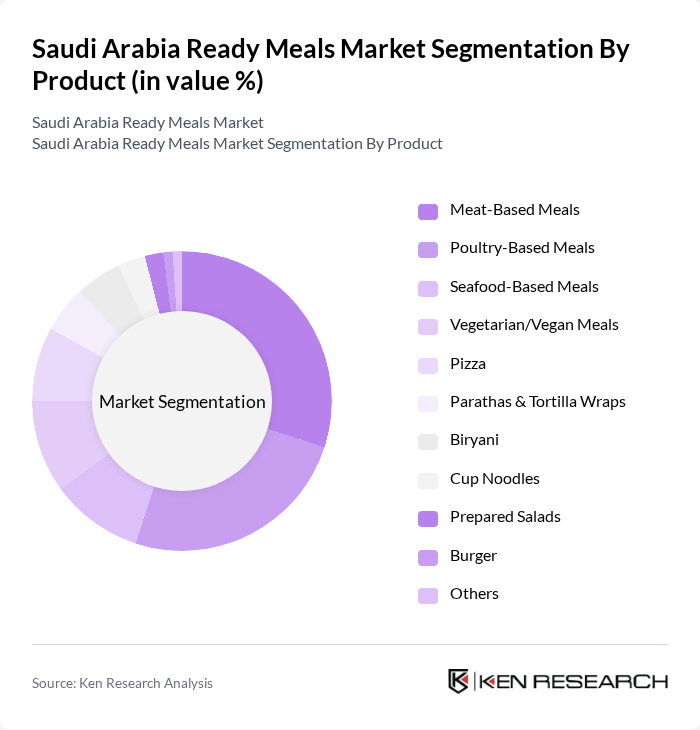

By Product:The product segmentation includes meat-based meals, poultry-based meals, seafood-based meals, vegetarian/vegan meals, pizza, parathas & tortilla wraps, biryani, cup noodles, prepared salads, burgers, and others. Meat-based meals dominate the market due to their popularity among consumers, while vegetarian and vegan options are gaining traction as more people adopt plant-based diets. The convenience of ready-to-eat pizza and biryani also contributes to their strong market presence. Additionally, demand for healthier and more diverse options, including ethnic and organic meals, is rising as consumers seek variety and nutritional value.

The Saudi Arabia Ready Meals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Almarai Company, Savola Group, Americana Group, Nestlé Saudi Arabia, Al Kabeer Group ME, Almunajem Foods, Sunbulah Group, Siwar Foods, Seara Foods (JBS Foods SA), Nutrition and Diet Center Frozen Ready Meals, Al-Watania Poultry, Al-Othaim Food Company, Nadec, Al-Jazeera Foods, Al-Baik Food Systems contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia ready meals market appears promising, driven by evolving consumer preferences and technological advancements. As urbanization continues, the demand for convenient meal solutions will likely increase, particularly among younger demographics. Additionally, the introduction of healthier options and sustainable packaging will cater to the growing health-conscious consumer base. Companies that leverage e-commerce and food delivery services will be well-positioned to capitalize on these trends, enhancing accessibility and convenience for consumers.

| Segment | Sub-Segments |

|---|---|

| By Type | Frozen Ready Meals Chilled Ready Meals Ambient (Shelf-Stable) Ready Meals Dried Ready Meals Meal Kits Ethnic Cuisine Meals Organic Meals Others |

| By Product | Meat-Based Meals Poultry-Based Meals Seafood-Based Meals Vegetarian/Vegan Meals Pizza Parathas & Tortilla Wraps Biryani Cup Noodles Prepared Salads Burger Others |

| By End-User | Households Restaurants Catering Services Institutions |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail Stores Food Service Outlets Other Distribution Channels |

| By Price Range | Economy Mid-Range Premium |

| By Packaging Type | Plastic Containers Cardboard Boxes Vacuum-Sealed Packs Pouches/Sachets |

| By Flavor Profile | Spicy Savory Sweet |

| By Meal Type | Breakfast Lunch Dinner Snacks |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Ready Meals | 120 | Household Decision Makers, Health-Conscious Consumers |

| Retail Sector Insights | 60 | Store Managers, Category Buyers |

| Food Service Industry Trends | 50 | Restaurant Owners, Catering Managers |

| Nutrition and Health Perspectives | 40 | Dietitians, Nutritionists |

| Market Entry Barriers for New Brands | 45 | Entrepreneurs, Business Development Managers |

The Saudi Arabia Ready Meals Market is valued at approximately USD 1.9 billion, reflecting a significant growth driven by increasing demand for convenience foods, urbanization, and changing dietary preferences among consumers.