Region:North America

Author(s):Dev

Product Code:KRAC0507

Pages:97

Published On:August 2025

By Type:The ready meals market is segmented into various types, including frozen, chilled, canned, dried/dehydrated, ready-to-eat salads & sandwiches, meal kits, plant-based/vegan options, and others. Among these, frozen ready meals have gained significant traction due to their long shelf life and convenience. The trend towards healthier eating has also led to a rise in demand for plant-based and vegan options, appealing to health-conscious consumers.

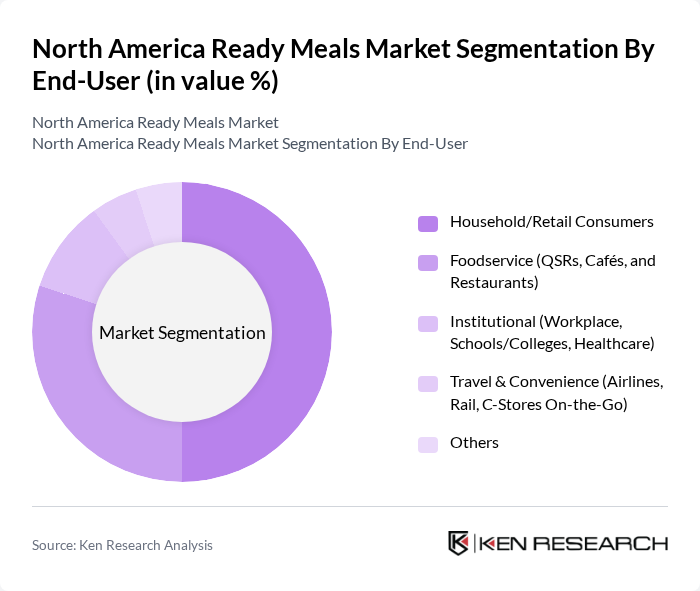

By End-User:The end-user segmentation includes household/retail consumers, foodservice (QSRs, cafés, and restaurants), institutional (workplace, schools/colleges, healthcare), travel & convenience (airlines, rail, C-stores on-the-go), and others. Household consumers represent the largest segment, driven by the increasing trend of home cooking and meal preparation, while foodservice is also growing due to the demand for quick and easy meal solutions in restaurants and cafes.

The North America Ready Meals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé S.A. (Stouffer’s, Lean Cuisine), Conagra Brands, Inc. (Marie Callender’s, Healthy Choice, Banquet), The Kraft Heinz Company (Devour, Smart Ones), Campbell Soup Company (Campbell’s, Swanson, Pace, Pacific Foods), General Mills, Inc. (Totino’s, Annie’s), Tyson Foods, Inc. (Jimmy Dean, Hillshire Farm), Unilever PLC (Knorr, Lipton meal solutions), Amy’s Kitchen, Inc., HelloFresh SE (U.S. & Canada operations), Blue Apron Holdings, Inc., Freshly, Inc. (a Nestlé company), Aldi Einkauf SE & Co. KG (Private Label Ready Meals in North America), Buitoni Food Company, Nomad Foods Limited (via licensed/imported brands), Walmart Inc. (Great Value and Marketside ready meals/private label) contribute to innovation, geographic expansion, and service delivery in this space.

The North America ready meals market is poised for continued evolution, driven by consumer preferences for convenience and health. Innovations in product offerings, such as organic and plant-based options, are expected to gain traction. Additionally, the integration of technology in meal preparation and delivery services will enhance consumer experiences. As sustainability becomes a priority, brands will likely focus on eco-friendly packaging solutions, aligning with the growing demand for environmentally responsible products in the food sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Frozen Ready Meals Chilled Ready Meals Canned Ready Meals Dried/Dehydrated Ready Meals Ready-to-Eat Salads & Sandwiches Meal Kits (Ready-to-Cook) Plant-Based/Vegan Ready Meals Others |

| By End-User | Household/Retail Consumers Foodservice (QSRs, Cafés, and Restaurants) Institutional (Workplace, Schools/Colleges, Healthcare) Travel & Convenience (Airlines, Rail, C-Stores On-the-Go) Others |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail and Meal-Delivery Platforms Convenience Stores Club/Wholesale Stores Specialty & Natural Food Stores Others |

| By Price Range | Economy Mid-Range Premium Private Label Value Packs |

| By Packaging Type | Trays & Bowls (CPET/PP) Pouches & Retort Pouches Cans Paperboard Sleeves & Cartons Others |

| By Flavor/Cuisine Profile | American/Comfort Italian & Mediterranean Asian (Chinese, Japanese, Thai, Indian) Mexican/Latin Others |

| By Nutritional/Claim Profile | High Protein Low Calorie/Weight Management Low Carb/Keto Organic/Clean Label Gluten-Free/Allergen-Friendly Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Grocery Chains | 120 | Store Managers, Category Buyers |

| Food Service Providers | 100 | Operations Managers, Menu Planners |

| Consumer Preferences | 150 | Household Decision Makers, Health-Conscious Consumers |

| Meal Kit Services | 80 | Product Development Leads, Marketing Managers |

| Frozen Food Manufacturers | 70 | Production Managers, Quality Assurance Officers |

The North America Ready Meals Market is valued at approximately USD 54 billion, reflecting a significant growth trend driven by consumer demand for convenience foods and healthier meal options.