Region:Global

Author(s):Shubham

Product Code:KRAA2706

Pages:98

Published On:August 2025

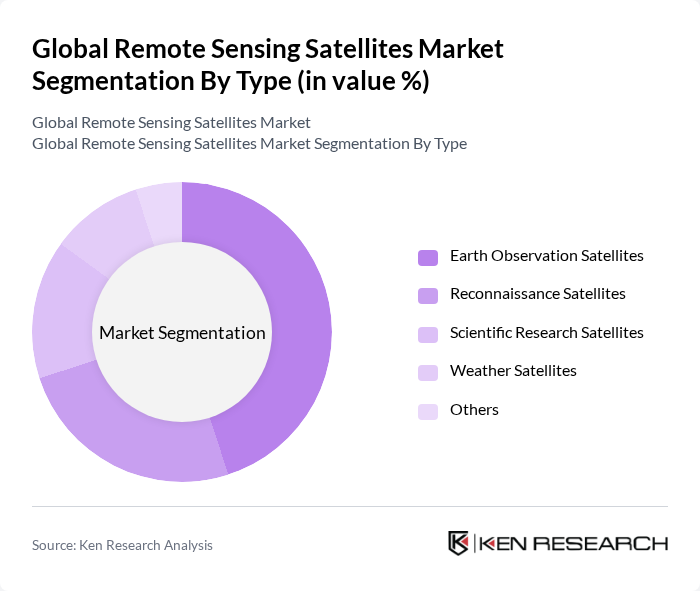

By Type:The market is segmented into Earth Observation Satellites, Reconnaissance Satellites, Scientific Research Satellites, Weather Satellites, and Others. Among these, Earth Observation Satellites dominate the market due to their extensive applications in agriculture, forestry, urban planning, and environmental monitoring. The increasing reliance on satellite data for decision-making in sectors such as smart agriculture, infrastructure development, and resource management has led to a surge in demand for these satellites. The trend towards sustainable development, climate resilience, and smart city initiatives further drives the growth of Earth Observation Satellites .

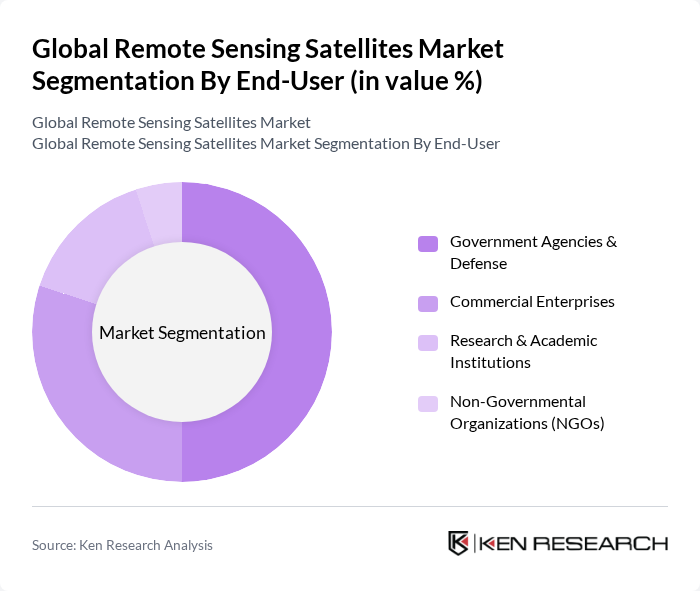

By End-User:The end-user segmentation includes Government Agencies & Defense, Commercial Enterprises, Research & Academic Institutions, and Non-Governmental Organizations (NGOs). Government Agencies & Defense hold a significant share of the market, driven by the need for national security, surveillance, and environmental monitoring. The increasing use of satellite data for strategic planning, border security, and operational efficiency in defense applications further solidifies the dominance of this segment. Commercial enterprises are rapidly adopting remote sensing for applications such as asset monitoring, precision agriculture, and infrastructure management, while research and academic institutions leverage satellite data for scientific studies and innovation .

The Global Remote Sensing Satellites Market is characterized by a dynamic mix of regional and international players. Leading participants such as Airbus Defence and Space, Maxar Technologies, Planet Labs PBC, Northrop Grumman Corporation, Thales Alenia Space, Lockheed Martin Corporation, Boeing Defense, Space & Security, ICEYE, Satellogic, BlackSky Technology Inc., Spire Global, Capella Space, OHB SE, GeoIQ, DigitalGlobe (now part of Maxar Technologies) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the remote sensing satellites market is poised for significant transformation, driven by technological advancements and increasing demand for data-driven insights. As satellite miniaturization continues, more compact and cost-effective solutions will emerge, enabling broader access to satellite data. Furthermore, the integration of artificial intelligence and machine learning will enhance data analytics capabilities, allowing for real-time decision-making across various sectors, including agriculture, urban planning, and disaster management, thereby expanding the market's potential.

| Segment | Sub-Segments |

|---|---|

| By Type | Earth Observation Satellites Reconnaissance Satellites Scientific Research Satellites Weather Satellites Others |

| By End-User | Government Agencies & Defense Commercial Enterprises Research & Academic Institutions Non-Governmental Organizations (NGOs) |

| By Application | Agriculture & Forestry Monitoring Urban Planning & Infrastructure Disaster Management & Emergency Response Climate Change & Environmental Studies Maritime & Border Surveillance Others |

| By Payload | Optical Imaging Sensors Synthetic Aperture Radar (SAR) Sensors Multispectral & Hyperspectral Sensors Thermal Imaging Sensors |

| By Distribution Channel | Direct Government Contracts Commercial Service Providers Online Data Platforms Partnerships & Alliances |

| By Investment Source | Government Funding Private Investments & Venture Capital Public-Private Partnerships |

| By Policy Support | Government Subsidies Tax Incentives Research & Innovation Grants Regulatory Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Remote Sensing Applications | 100 | Agronomists, Farm Managers |

| Environmental Monitoring Services | 80 | Environmental Scientists, Policy Makers |

| Urban Planning and Development | 70 | Urban Planners, City Officials |

| Disaster Management and Response | 60 | Emergency Response Coordinators, NGO Representatives |

| Geospatial Data Analytics | 90 | Data Analysts, GIS Specialists |

The Global Remote Sensing Satellites Market is valued at approximately USD 48.6 billion, reflecting significant growth driven by advancements in satellite technology and increasing demand for earth observation data across various sectors, including agriculture and urban planning.