Region:Global

Author(s):Geetanshi

Product Code:KRAA2778

Pages:99

Published On:August 2025

By Type:The market is segmented into various types of risk analytics, includingOperational Risk Analytics,Credit Risk Analytics,Market Risk Analytics,Liquidity Risk Analytics,Compliance Risk Analytics,Fraud Risk Analytics,Strategic Risk Analytics,Reputational Risk Analytics,Environmental Risk Analytics, andOthers. Each of these sub-segments addresses specific risk management needs across industries. Operational risk analytics focuses on identifying and mitigating risks arising from internal processes and systems. Credit risk analytics evaluates borrower creditworthiness and exposure. Market risk analytics assesses risks related to market fluctuations. Liquidity risk analytics monitors the ability to meet financial obligations. Compliance risk analytics ensures adherence to regulatory standards. Fraud risk analytics detects and prevents fraudulent activities. Strategic risk analytics supports long-term planning. Reputational risk analytics safeguards brand value. Environmental risk analytics evaluates exposure to environmental and climate-related risks. The "Others" category encompasses emerging risk types, such as cyber and third-party risks .

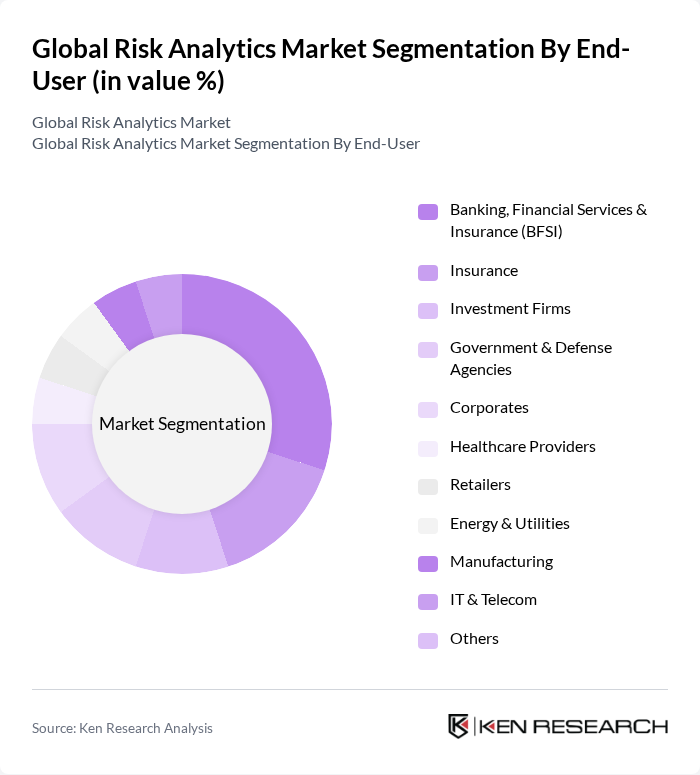

By End-User:The end-user segmentation includesBanking, Financial Services & Insurance (BFSI),Insurance,Investment Firms,Government & Defense Agencies,Corporates,Healthcare Providers,Retailers,Energy & Utilities,Manufacturing,IT & Telecom, andOthers. BFSI remains the largest adopter due to stringent regulatory requirements and high exposure to financial risks. Insurance and investment firms leverage risk analytics for underwriting and portfolio management. Government and defense agencies utilize analytics for threat assessment and compliance. Corporates apply risk analytics for operational efficiency and strategic planning. Healthcare providers focus on patient safety and regulatory compliance. Retailers use analytics for fraud detection and supply chain risk. Energy & utilities and manufacturing sectors rely on risk analytics for operational reliability and environmental risk management. IT & telecom companies utilize analytics for cybersecurity and network resilience. The "Others" category includes sectors such as transportation and logistics .

The Global Risk Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAS Institute Inc., IBM Corporation, Oracle Corporation, FICO (Fair Isaac Corporation), Moody's Analytics, Inc., S&P Global Market Intelligence, Aon plc, Deloitte Touche Tohmatsu Limited, PwC (PricewaterhouseCoopers), KPMG International, Verisk Analytics, Inc., SAP SE, Microsoft Corporation, Accenture plc, BAE Systems plc, FIS (Fidelity National Information Services, Inc.), Experian plc, CRISIL Limited (A S&P Global Company), RiskEdge Solutions, QlikTech International AB contribute to innovation, geographic expansion, and service delivery in this space. Industry leaders are focusing on platform-based integration, industry-specific customization, and advanced technology adoption (AI/ML, real-time analytics, cloud capabilities) to differentiate their offerings and address evolving client needs .

The future of the risk analytics market is poised for transformative growth, driven by technological advancements and evolving regulatory landscapes. Organizations are increasingly adopting real-time analytics to enhance decision-making and operational efficiency. Additionally, the integration of artificial intelligence and machine learning technologies is expected to revolutionize risk assessment methodologies, enabling more accurate predictions and proactive risk management strategies. As businesses navigate complex environments, the demand for innovative risk analytics solutions will continue to rise, shaping the industry's trajectory.

| Segment | Sub-Segments |

|---|---|

| By Type | Operational Risk Analytics Credit Risk Analytics Market Risk Analytics Liquidity Risk Analytics Compliance Risk Analytics Fraud Risk Analytics Strategic Risk Analytics Reputational Risk Analytics Environmental Risk Analytics Others |

| By End-User | Banking, Financial Services & Insurance (BFSI) Insurance Investment Firms Government & Defense Agencies Corporates Healthcare Providers Retailers Energy & Utilities Manufacturing IT & Telecom Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Application | Risk Assessment Risk Monitoring Risk Reporting Risk Mitigation Regulatory Compliance Fraud Detection Credit Scoring Others |

| By Industry Vertical | Financial Services (BFSI) Healthcare Retail Manufacturing Energy & Utilities IT & Telecom Government & Defense Transportation & Logistics Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Pricing Model | Subscription-Based Pay-Per-Use License Fee Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector Risk Management | 100 | Risk Officers, Compliance Managers |

| Insurance Analytics Solutions | 60 | Actuaries, Underwriting Managers |

| Healthcare Risk Assessment | 40 | Healthcare Administrators, Risk Managers |

| Enterprise Risk Management Software | 50 | IT Managers, Data Analysts |

| Regulatory Compliance Analytics | 45 | Compliance Officers, Legal Advisors |

The Global Risk Analytics Market is valued at approximately USD 44 billion, driven by the need for effective risk management in a volatile economic environment and advancements in technologies like AI and machine learning.