Region:Middle East

Author(s):Rebecca

Product Code:KRAB7377

Pages:83

Published On:October 2025

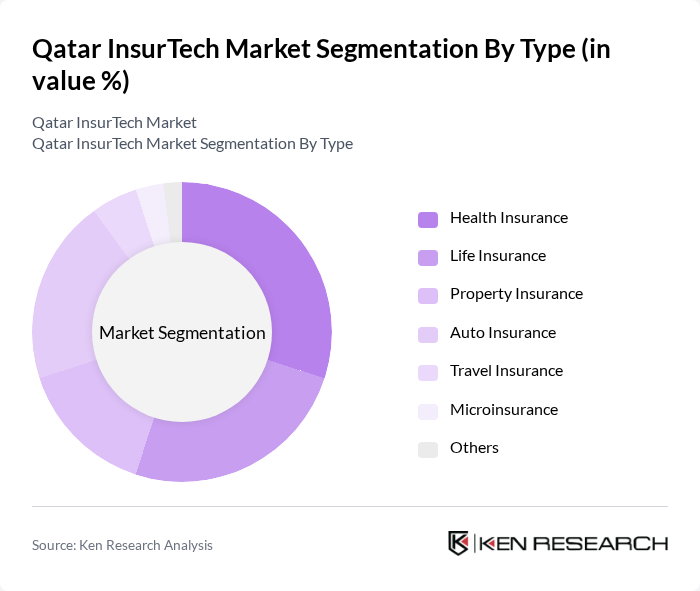

By Type:The segmentation by type includes various categories such as Health Insurance, Life Insurance, Property Insurance, Auto Insurance, Travel Insurance, Microinsurance, and Others. Each of these subsegments caters to different consumer needs and preferences, with Health Insurance and Auto Insurance being particularly prominent due to their essential nature in personal and business contexts.

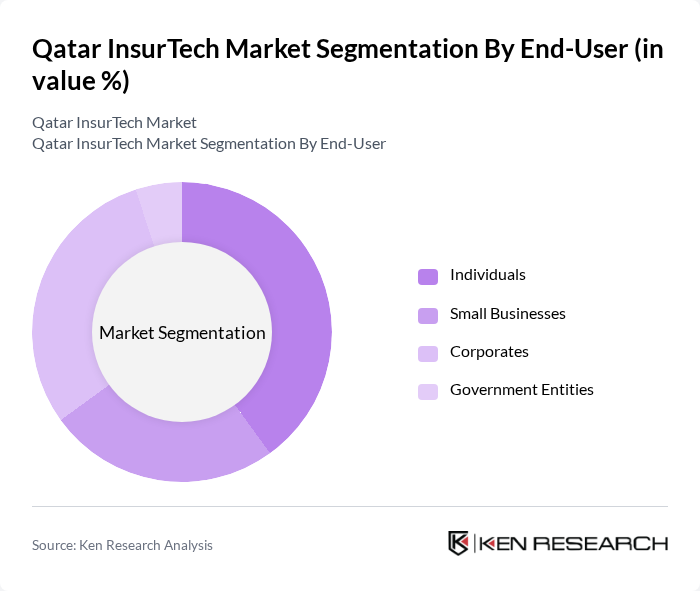

By End-User:The end-user segmentation includes Individuals, Small Businesses, Corporates, and Government Entities. Each segment has unique insurance needs, with Corporates and Government Entities typically requiring more comprehensive coverage due to their larger scale and risk exposure.

The Qatar InsurTech Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Insurance Company, Doha Insurance Company, Al Khaleej Takaful Insurance, Qatar General Insurance and Reinsurance Company, Damaan Islamic Insurance Company, QIC Group, Qatar Life & Medical Insurance Company, Gulf Insurance Group, Qatar Re, Takaful International Company, Al-Ahli Takaful Company, Qatar Islamic Bank, AIG Qatar, AXA Gulf, Zurich Insurance Group contribute to innovation, geographic expansion, and service delivery in this space.

The Qatar InsurTech market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As digital adoption continues to rise, InsurTech firms will increasingly leverage AI and data analytics to enhance customer experiences. Furthermore, collaboration with traditional insurers will likely become more prevalent, fostering innovation and expanding product offerings. The focus on sustainability and personalized insurance solutions will also shape the market, ensuring that it remains responsive to consumer needs and regulatory changes.

| Segment | Sub-Segments |

|---|---|

| By Type | Health Insurance Life Insurance Property Insurance Auto Insurance Travel Insurance Microinsurance Others |

| By End-User | Individuals Small Businesses Corporates Government Entities |

| By Distribution Channel | Direct Sales Online Platforms Brokers Agents |

| By Application | Claims Processing Underwriting Risk Assessment Customer Service |

| By Technology | Artificial Intelligence Big Data Analytics Blockchain Internet of Things (IoT) |

| By Customer Segment | Retail Customers Institutional Clients High Net-Worth Individuals |

| By Policy Type | Annual Policies Monthly Policies Pay-Per-Use Policies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Life Insurance Adoption | 100 | Insurance Agents, Financial Advisors |

| Health Insurance Technology Integration | 80 | Healthcare Providers, InsurTech Developers |

| Property Insurance Innovations | 70 | Property Managers, Risk Assessment Officers |

| Consumer Attitudes towards InsurTech | 120 | General Consumers, Tech-Savvy Individuals |

| Regulatory Impact on InsurTech | 60 | Regulatory Officials, Compliance Managers |

The Qatar InsurTech market is valued at approximately USD 1.2 billion, reflecting significant growth driven by digital technology adoption and increasing consumer demand for personalized insurance products.