Region:Asia

Author(s):Geetanshi

Product Code:KRAA3322

Pages:82

Published On:September 2025

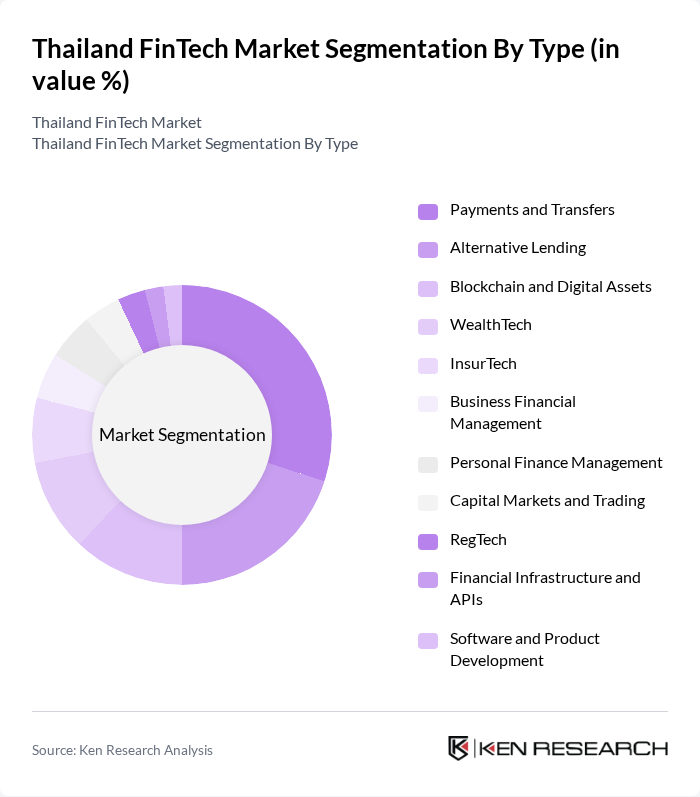

By Type:The Thailand FinTech market is segmented into various types, including Payments and Transfers, Alternative Lending, Blockchain and Digital Assets, WealthTech, InsurTech, Business Financial Management, Personal Finance Management, Capital Markets and Trading, RegTech, Financial Infrastructure and APIs, and Software and Product Development. Among these, Payments and Transfers is the leading segment, driven by the rapid adoption of mobile payment solutions and digital wallets. The increasing preference for cashless transactions among consumers and businesses has significantly contributed to the growth of this segment.

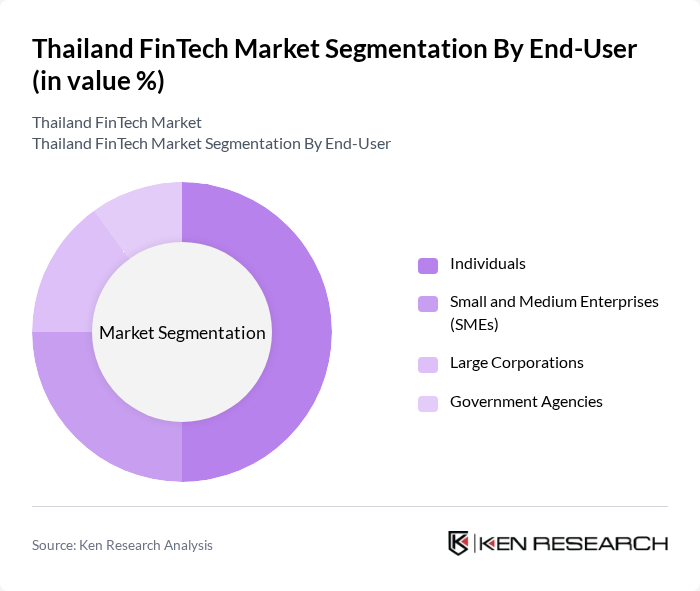

By End-User:The market is also segmented by end-users, which include Individuals, Small and Medium Enterprises (SMEs), Large Corporations, and Government Agencies. The segment of Individuals is currently the most significant, driven by the increasing use of mobile banking and digital wallets among consumers. The convenience and accessibility of these services have led to a surge in adoption, making it a key driver of market growth.

The Thailand FinTech market is characterized by a dynamic mix of regional and international players. Leading participants such as Kasikornbank PCL, Siam Commercial Bank PCL, Krung Thai Bank PCL, Bangkok Bank PCL, TrueMoney, Ascend Money, Rabbit LINE Pay, Grab Financial Group (Thailand), PayPal (Thailand), KASIKORN Business-Technology Group (KBTG), TMBThanachart Bank, Omise, Muang Thai Life Assurance, FWD Insurance, SCB 10X, Bitkub, Satang, Finnomena, MoneyTable, Sunday InsurTech contribute to innovation, geographic expansion, and service delivery in this space.

The Thailand FinTech market is poised for significant transformation as technological advancements and consumer preferences evolve. The integration of artificial intelligence and machine learning into financial services is expected to enhance customer experiences and operational efficiencies. Additionally, the shift towards open banking will facilitate greater collaboration between traditional banks and FinTech firms, fostering innovation. As the government continues to support digital initiatives, the market is likely to witness increased investment and the emergence of new financial products tailored to consumer needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Payments and Transfers Alternative Lending Blockchain and Digital Assets WealthTech InsurTech Business Financial Management Personal Finance Management Capital Markets and Trading RegTech Financial Infrastructure and APIs Software and Product Development |

| By End-User | Individuals Small and Medium Enterprises (SMEs) Large Corporations Government Agencies |

| By Application | Digital Payments Wealth Management Crowdfunding Financial Advisory Services |

| By Distribution Channel | Online Platforms Mobile Applications Direct Sales |

| By Investment Source | Venture Capital Private Equity Government Grants |

| By Customer Segment | Retail Customers Institutional Investors Corporate Clients |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Initiatives |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Payment Solutions | 120 | Product Managers, Marketing Directors |

| Peer-to-Peer Lending Platforms | 85 | Operations Managers, Risk Analysts |

| InsurTech Innovations | 75 | Underwriters, Business Development Managers |

| Blockchain Applications in Finance | 65 | Technology Officers, Compliance Managers |

| Regulatory Technology (RegTech) | 55 | Legal Advisors, Regulatory Compliance Officers |

The Thailand FinTech market is valued at approximately USD 1.37 billion, driven by the increasing adoption of digital payment solutions, e-commerce growth, and a demand for financial inclusion among the unbanked population.