Region:Global

Author(s):Dev

Product Code:KRAA2542

Pages:98

Published On:August 2025

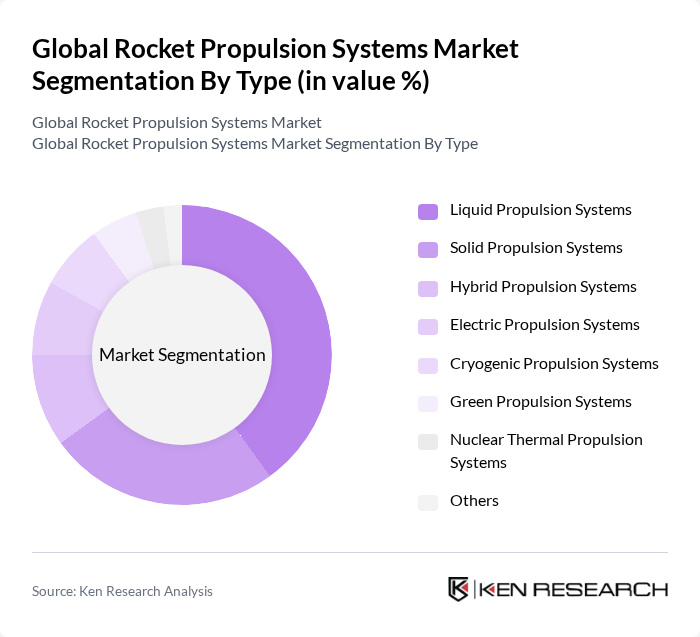

By Type:The market is segmented into various types of propulsion systems, including Liquid Propulsion Systems, Solid Propulsion Systems, Hybrid Propulsion Systems, Electric Propulsion Systems, Cryogenic Propulsion Systems, Green Propulsion Systems, Nuclear Thermal Propulsion Systems, and Others. Among these, Liquid Propulsion Systems dominate the market due to their high efficiency and reliability, making them the preferred choice for most space missions. Solid Propulsion Systems also hold a significant share, particularly in military applications, due to their simplicity and robustness .

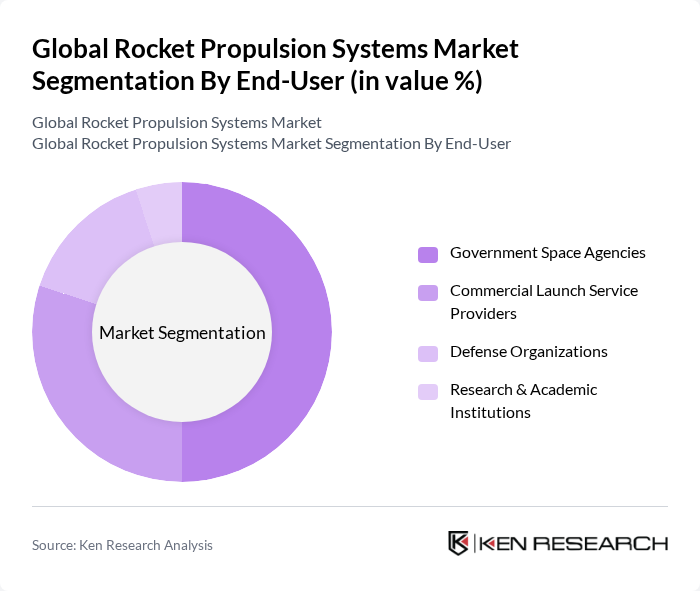

By End-User:The end-user segmentation includes Government Space Agencies, Commercial Launch Service Providers, Defense Organizations, and Research & Academic Institutions. Government Space Agencies are the leading end-users, driven by national space exploration initiatives and funding. Commercial Launch Service Providers are also growing rapidly, fueled by the increasing demand for satellite launches and space tourism, while Defense Organizations utilize propulsion systems for military applications .

The Global Rocket Propulsion Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as SpaceX, Blue Origin, Northrop Grumman, The Boeing Company, Lockheed Martin Corporation, Rocket Lab USA, Inc., Arianespace SA, Virgin Galactic Holdings, Inc., Sierra Space (Sierra Nevada Corporation), Relativity Space, Inc., Thales Alenia Space, Mitsubishi Heavy Industries, Ltd., IHI Corporation, Indian Space Research Organisation (ISRO), European Space Agency (ESA), Aerojet Rocketdyne Holdings, Inc., Safran S.A., Avio S.p.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the rocket propulsion systems market appears promising, driven by technological advancements and increasing global investments in space initiatives. As countries and private companies ramp up their space exploration efforts, the demand for innovative propulsion solutions will likely rise. Additionally, the integration of sustainable practices and the development of reusable systems are expected to reshape the industry landscape, making space more accessible and cost-effective for a broader range of applications.

| Segment | Sub-Segments |

|---|---|

| By Type | Liquid Propulsion Systems Solid Propulsion Systems Hybrid Propulsion Systems Electric Propulsion Systems Cryogenic Propulsion Systems Green Propulsion Systems Nuclear Thermal Propulsion Systems Others |

| By End-User | Government Space Agencies Commercial Launch Service Providers Defense Organizations Research & Academic Institutions |

| By Application | Satellite Launching Interplanetary Missions Space Tourism Cargo Resupply Missions Suborbital Flights |

| By Component | Engines & Thrusters Propellant Tanks & Feed Systems Control & Guidance Systems Structural Components Avionics |

| By Distribution Mode | Direct Contracts Online Tenders & Procurement Distributors & Integrators |

| By Investment Source | Private Investments Government Funding Public-Private Partnerships |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Regulatory Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Rocket Propulsion | 100 | Propulsion Engineers, Product Managers |

| Military Propulsion Systems | 70 | Defense Contractors, Program Managers |

| Research and Development in Propulsion | 60 | R&D Directors, Aerospace Researchers |

| Satellite Launch Services | 80 | Operations Managers, Launch Coordinators |

| Emerging Propulsion Technologies | 50 | Innovation Officers, Technology Analysts |

The Global Rocket Propulsion Systems Market is valued at approximately USD 13 billion, driven by increased investments in space exploration, advancements in propulsion technologies, and a growing demand for satellite launches.