Global Rutile Market Overview

- The Global Rutile Market is valued at USD 3.9 billion, based on a five?year historical analysis. This growth is primarily driven by the increasing demand for titanium dioxide in various applications, including paints, coatings, and plastics. The market is further supported by expanding industrial activities and the rising need for high-performance materials in the aerospace and automotive sectors, as manufacturers seek lightweight and durable solutions. Additionally, the adoption of advanced pigment technologies and the shift toward sustainable manufacturing practices are contributing to market expansion.

- Key players in this market includeAustralia, South Africa, and the United States, which dominate due to their rich mineral deposits and advanced mining technologies. Australia is recognized for its high-quality rutile production, while South Africa leverages its established mining infrastructure and skilled workforce to maintain a strong market presence.

- In 2023, the European Union implemented theRegulation (EU) 2023/1542 on Batteries and Waste Batteries, issued by the European Parliament and the Council. This regulation requires companies involved in mineral extraction, including rutile mining, to adhere to stricter environmental standards, such as comprehensive waste management, emissions control, and mandatory due diligence for supply chain sustainability. These measures are designed to promote environmentally responsible practices and reduce the ecological impact of mining activities across the region.

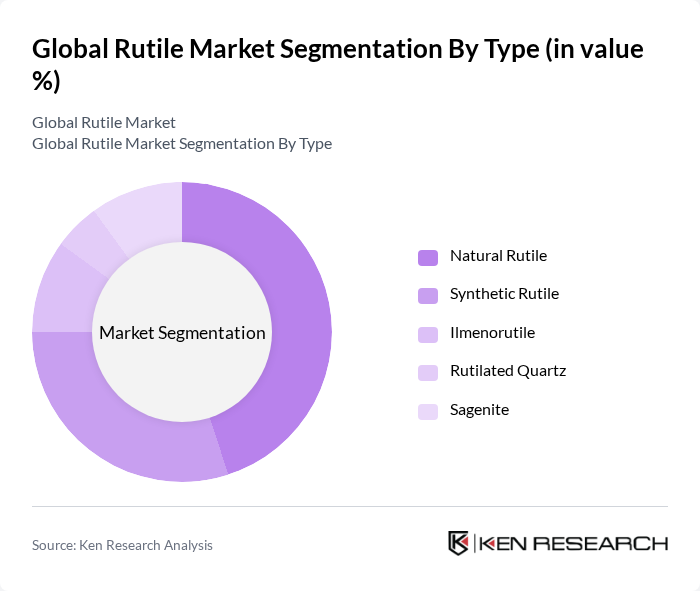

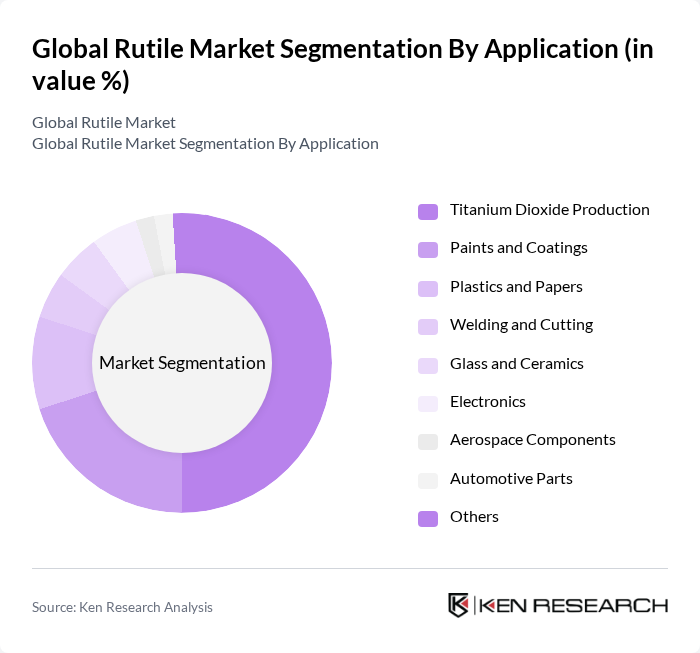

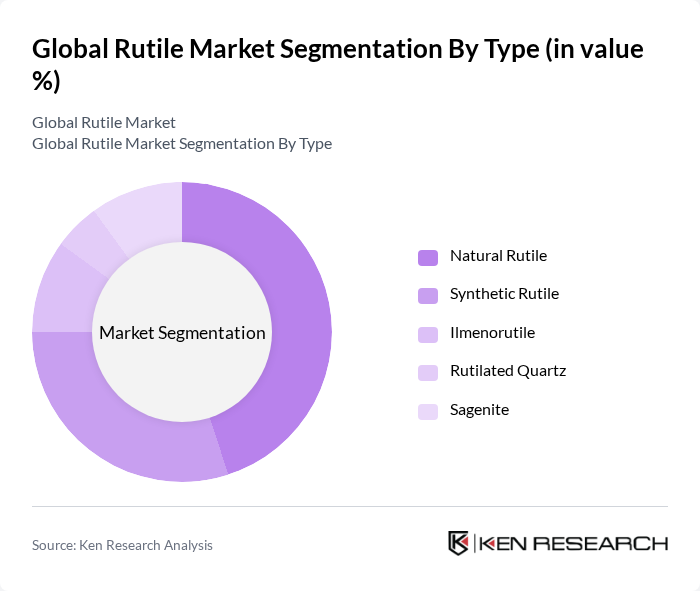

Global Rutile Market Segmentation

By Type:The rutile market can be segmented into various types, includingNatural Rutile, Synthetic Rutile, Ilmenorutile, Rutilated Quartz,andSagenite. Among these,Natural Rutileremains the most dominant due to its extensive use in titanium dioxide production, which is essential for a wide range of industrial applications, especially in pigments, ceramics, and titanium metal manufacturing. Synthetic rutile, derived from ilmenite, is also gaining traction as a cost-effective alternative in certain applications.

By Application:The rutile market is also segmented by application, which includesTitanium Dioxide Production, Paints and Coatings, Plastics and Papers, Welding and Cutting, Glass and Ceramics, Electronics, Aerospace Components, Automotive Parts,andOthers. TheTitanium Dioxide Productionsegment leads the market due to its widespread use in various industries, driven by the demand for high-quality pigments and the ongoing shift toward eco-friendly and high-performance materials in construction, automotive, and consumer goods.

Global Rutile Market Competitive Landscape

The Global Rutile Market is characterized by a dynamic mix of regional and international players. Leading participants such as Iluka Resources Limited, Tronox Holdings plc, Rio Tinto Group, Kenmare Resources plc, TiZir Limited, Southern Ionics Minerals, LLC, Doral Mineral Sands Pty Ltd, Base Resources Limited, The Chemours Company, Sibelco, V.V. Mineral, IREL (India) Limited, Sierra Rutile Limited, East Minerals, and African Rainbow Minerals Limited contribute to innovation, geographic expansion, and service delivery in this space.

Global Rutile Market Industry Analysis

Growth Drivers

- Increasing Demand in Titanium Dioxide Production:The global titanium dioxide production reached approximately 6.5 million metric tons in future, with projections indicating a rise to 7.1 million metric tons in future. This growth is driven by the expanding use of titanium dioxide in paints, coatings, and plastics, which collectively account for over 60% of the demand. The increasing focus on high-performance coatings in construction and automotive sectors further propels the need for rutile, a key feedstock in titanium dioxide production.

- Expanding Applications in Aerospace and Automotive Industries:The aerospace and automotive sectors are projected to consume around 1.3 million metric tons of rutile in future, driven by the demand for lightweight materials that enhance fuel efficiency. The aerospace industry alone is expected to grow by 4.7% annually, with manufacturers increasingly utilizing rutile-based composites for structural components. This trend is supported by the global push for more sustainable and efficient transportation solutions, further solidifying rutile's role in these industries.

- Rising Investments in Infrastructure Development:Global infrastructure investments are anticipated to reach $4.5 trillion in future, with significant allocations towards transportation and energy projects. This surge is expected to increase the demand for rutile in construction materials, particularly in high-performance concrete and asphalt applications. Countries like India and China are leading this investment wave, which is crucial for enhancing urban infrastructure and supporting economic growth, thereby driving rutile consumption in the construction sector.

Market Challenges

- Environmental Regulations and Compliance Costs:Stricter environmental regulations are imposing significant compliance costs on rutile mining operations. In future, it is estimated that compliance costs could account for up to 16% of total operational expenses. These regulations, aimed at reducing environmental impact, require investments in cleaner technologies and waste management systems, which can strain the financial resources of smaller mining companies and hinder market growth.

- Fluctuating Raw Material Prices:The volatility in raw material prices poses a significant challenge for the rutile market. In future, the price of rutile fluctuated between $1,250 and $1,600 per metric ton, influenced by geopolitical tensions and supply chain disruptions. This unpredictability can lead to increased production costs and affect profit margins for manufacturers, making it difficult to maintain stable pricing strategies in the market.

Global Rutile Market Future Outlook

The future of the rutile market appears promising, driven by technological advancements and a growing emphasis on sustainability. As industries increasingly adopt circular economy principles, the demand for recycled rutile is expected to rise. Additionally, innovations in processing technologies will enhance efficiency and reduce environmental impact. The market is likely to witness a shift towards high-purity rutile, catering to specialized applications in electronics and renewable energy sectors, further expanding its market potential.

Market Opportunities

- Growth in Renewable Energy Sector:The renewable energy sector is projected to require approximately 600,000 metric tons of rutile in future, primarily for solar panel manufacturing. This demand is driven by the global shift towards sustainable energy solutions, with investments in solar technology expected to exceed $1.2 trillion. This presents a significant opportunity for rutile producers to tap into a rapidly growing market segment.

- Expansion into Emerging Markets:Emerging markets, particularly in Asia and Africa, are expected to see a surge in rutile demand, with consumption projected to increase by 22% in future. This growth is fueled by urbanization and industrialization, creating opportunities for rutile suppliers to establish a foothold in these regions. Strategic partnerships with local industries can enhance market penetration and drive sales growth.