Region:Asia

Author(s):Rebecca

Product Code:KRAA1408

Pages:83

Published On:August 2025

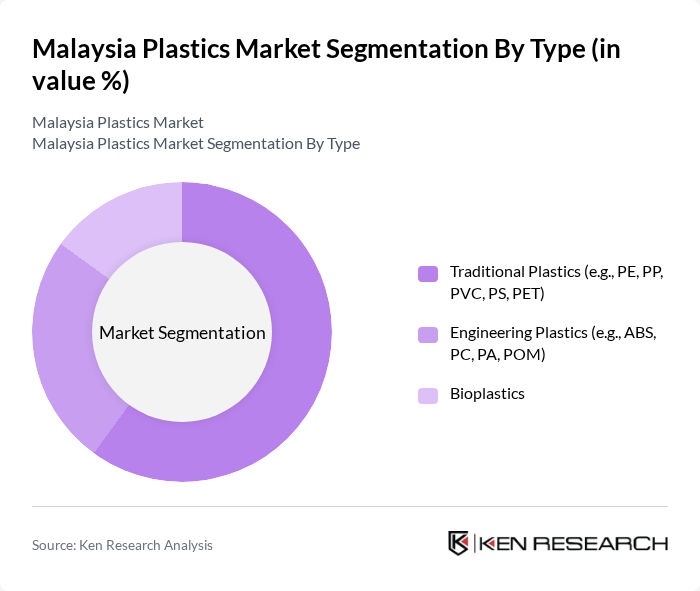

By Type:The market is segmented into Traditional Plastics, Engineering Plastics, and Bioplastics. Traditional Plastics, including polyethylene (PE), polypropylene (PP), polyvinyl chloride (PVC), polystyrene (PS), and polyethylene terephthalate (PET), dominate the market due to their widespread use in packaging, automotive components, and construction materials. Engineering Plastics, such as acrylonitrile butadiene styrene (ABS), polycarbonate (PC), polyamide (PA), and polyoxymethylene (POM), are gaining traction for their superior mechanical, thermal, and chemical properties, making them suitable for high-performance applications in electronics, automotive, and industrial sectors. Bioplastics are emerging as a sustainable alternative, driven by increasing environmental concerns and regulatory support for biodegradable and compostable materials .

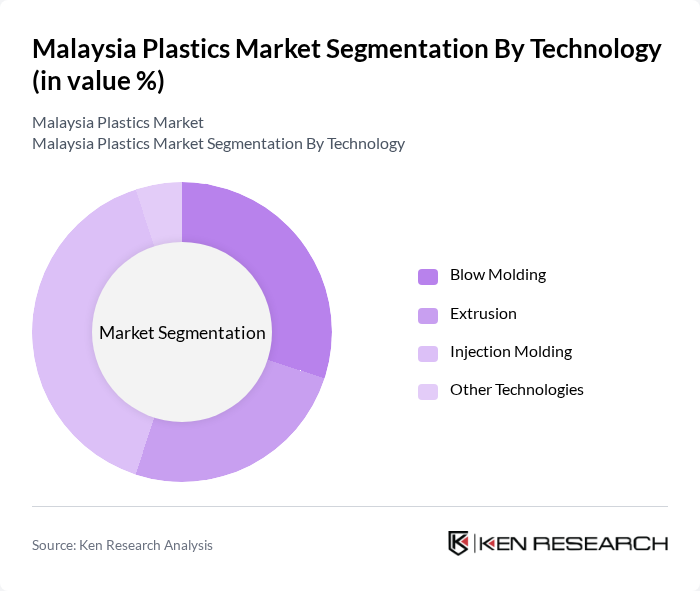

By Technology:The market is segmented into Blow Molding, Extrusion, Injection Molding, and Other Technologies. Injection Molding leads due to its efficiency, versatility, and suitability for high-volume production of complex shapes, especially in packaging, automotive, and consumer goods. Blow Molding is significant for manufacturing bottles and containers, primarily serving the packaging sector. Extrusion is widely used for producing films, sheets, and pipes, catering to packaging and construction needs. Other technologies, such as rotational molding and thermoforming, address niche applications in industrial and specialty products .

The Malaysia Plastics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Petronas Chemicals Group Berhad, Lotte Chemical Titan Holding Berhad, Scientex Berhad, SLP Resources Berhad, Thong Guan Industries Berhad, Polyplas Sdn Bhd, BP Plastics Holding Bhd, Daibochi Berhad, Harta Packaging Industries Sdn Bhd, Teck See Plastic Sdn Bhd, Hextar Industries Berhad, Muda Holdings Berhad, Kossan Rubber Industries Bhd, Top Glove Corporation Bhd, Polyplastics Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Malaysian plastics market is poised for transformation, driven by technological advancements and a shift towards sustainability. As the government intensifies efforts to manage plastic waste, companies are likely to invest in innovative recycling technologies and bioplastics. Additionally, the growing emphasis on smart packaging solutions will enhance product traceability and consumer engagement. These trends indicate a dynamic market landscape, where adaptability and innovation will be crucial for success in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Traditional Plastics (e.g., PE, PP, PVC, PS, PET) Engineering Plastics (e.g., ABS, PC, PA, POM) Bioplastics |

| By Technology | Blow Molding Extrusion Injection Molding Other Technologies |

| By Application | Packaging Electrical and Electronics Building and Construction Automotive and Transportation Houseware Furniture and Bedding Other Applications |

| By End-Use Industry | Food and Beverage Healthcare Retail Industrial Others |

| By Material Source | Virgin Plastics Recycled Plastics Bioplastics |

| By Product Form | Sheets Films Molds Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Packaging Industry Insights | 100 | Product Managers, Marketing Directors |

| Automotive Plastics Usage | 60 | Supply Chain Managers, Design Engineers |

| Construction Material Applications | 50 | Project Managers, Procurement Specialists |

| Consumer Behavior in Retail | 80 | Retail Managers, Customer Experience Officers |

| Recycling and Waste Management Practices | 40 | Environmental Managers, Operations Supervisors |

The Malaysia Plastics Market is valued at approximately USD 3.9 billion, reflecting a five-year historical analysis. This valuation is driven by increasing demand in sectors such as packaging, automotive, and construction, alongside a growing focus on sustainability and recycling initiatives.