Region:Global

Author(s):Dev

Product Code:KRAA2529

Pages:83

Published On:August 2025

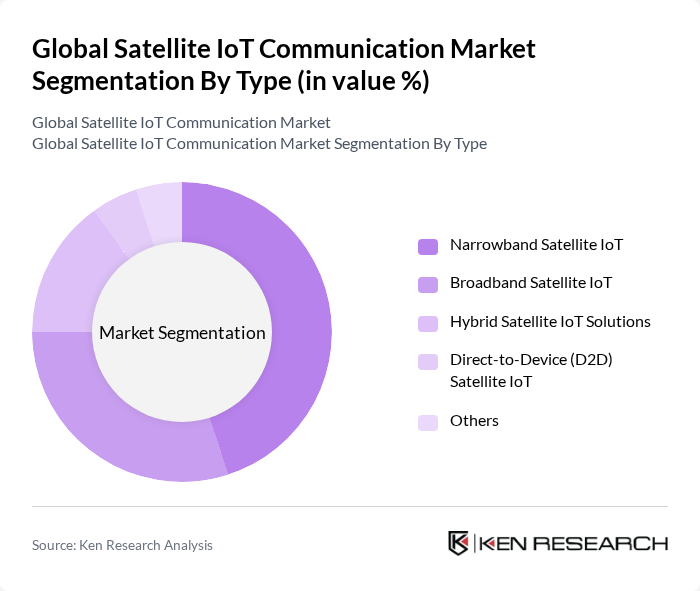

By Type:The market is segmented into various types, including Narrowband Satellite IoT, Broadband Satellite IoT, Hybrid Satellite IoT Solutions, Direct-to-Device (D2D) Satellite IoT, and Others. Among these,Narrowband Satellite IoTremains the leading subsegment due to its cost-effectiveness, low power consumption, and suitability for applications requiring intermittent, small data transmissions. Demand for Narrowband solutions is driven by industries such as agriculture and logistics, where efficient remote monitoring and asset tracking are crucial.Broadband Satellite IoTis gaining traction in sectors requiring high data rates, such as energy, utilities, and maritime, supported by advancements in high-throughput satellite (HTS) systems and multi-orbit capabilities .

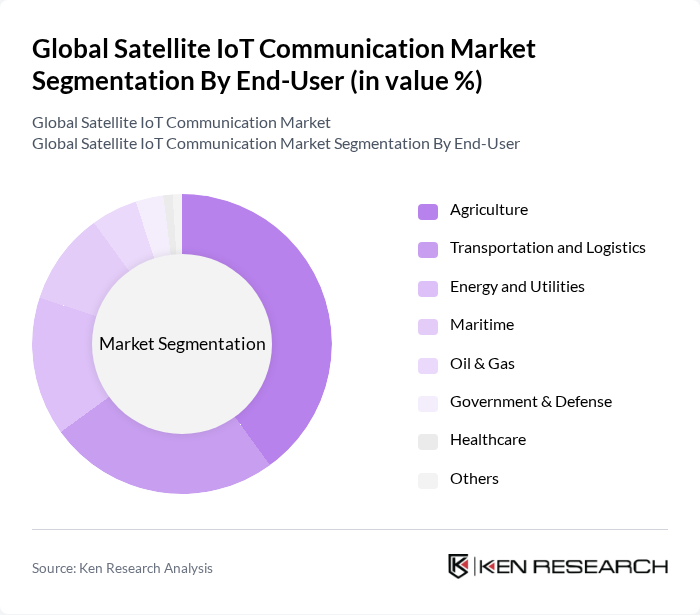

By End-User:The end-user segmentation includes Agriculture, Transportation and Logistics, Energy and Utilities, Maritime, Oil & Gas, Government & Defense, Healthcare, and Others.Agricultureis the dominant end-user, leveraging satellite IoT for precision farming, livestock monitoring, and resource management. The increasing need for efficient data access and real-time monitoring in agriculture drives adoption.Transportation and Logisticsis a significant segment, utilizing satellite communication for fleet management, asset tracking, and supply chain optimization. Energy and Utilities, Maritime, and Oil & Gas sectors are also expanding their use of satellite IoT for remote operations, safety, and regulatory compliance .

The Global Satellite IoT Communication Market is characterized by a dynamic mix of regional and international players. Leading participants such as Iridium Communications Inc., Inmarsat Global Limited, Globalstar, Inc., SES S.A., Eutelsat Communications S.A., Hughes Network Systems, LLC, ORBCOMM Inc., Thales Group, Viasat, Inc., Telesat Canada, Kymeta Corporation, OneWeb, Amazon Web Services, Inc. (AWS Ground Station), SpaceX (Starlink), Nokia Corporation, Intelsat S.A., Swarm Technologies, Inc., Fleet Space Technologies Pty Ltd, Myriota Pty Ltd, Astrocast SA, Kepler Communications Inc., Northrop Grumman Corporation, Airbus S.A.S., Head Aerospace Group, NanoAvionics (Kongsberg NanoAvionics) contribute to innovation, geographic expansion, and service delivery in this space.

The future of satellite IoT communication is poised for transformative growth, driven by technological advancements and increasing integration with 5G networks. As industries seek enhanced connectivity and real-time data analytics, the demand for low Earth orbit satellites is expected to rise significantly. Furthermore, the focus on sustainable practices will likely lead to innovative applications in environmental monitoring and disaster management, creating a dynamic landscape for satellite IoT solutions in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Narrowband Satellite IoT Broadband Satellite IoT Hybrid Satellite IoT Solutions Direct-to-Device (D2D) Satellite IoT Others |

| By End-User | Agriculture Transportation and Logistics Energy and Utilities Maritime Oil & Gas Government & Defense Healthcare Others |

| By Application | Asset Tracking & Monitoring Environmental & Wildlife Monitoring Fleet Management Smart Agriculture Pipeline & Infrastructure Monitoring Disaster Management Remote Industrial Automation Others |

| By Component | Satellite Terminals & Hardware IoT Modules & Devices Software Platforms Connectivity Services Others |

| By Distribution Mode | Direct Sales Online Sales Distributors and Resellers System Integrators Others |

| By Pricing Strategy | Subscription-Based Pay-As-You-Go One-Time Purchase Tiered Pricing Others |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Regulatory Mandates Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural IoT Solutions | 100 | Agronomists, Farm Managers |

| Transportation and Logistics | 80 | Fleet Managers, Logistics Coordinators |

| Smart City Applications | 70 | Urban Planners, City Officials |

| Energy Management Systems | 90 | Energy Analysts, Facility Managers |

| Healthcare Monitoring Solutions | 50 | Healthcare Administrators, IT Managers |

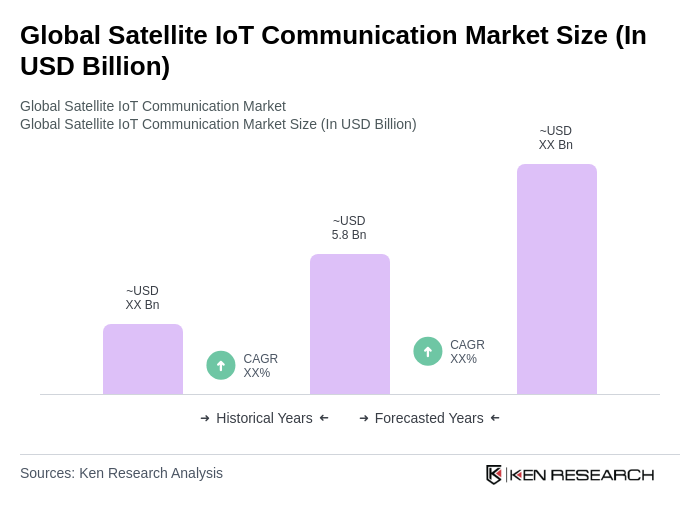

The Global Satellite IoT Communication Market is valued at approximately USD 5.8 billion, driven by the increasing demand for connectivity in remote areas and advancements in satellite technology, including multi-orbit networks and direct-to-device solutions.