Region:Europe

Author(s):Dev

Product Code:KRAD0434

Pages:81

Published On:August 2025

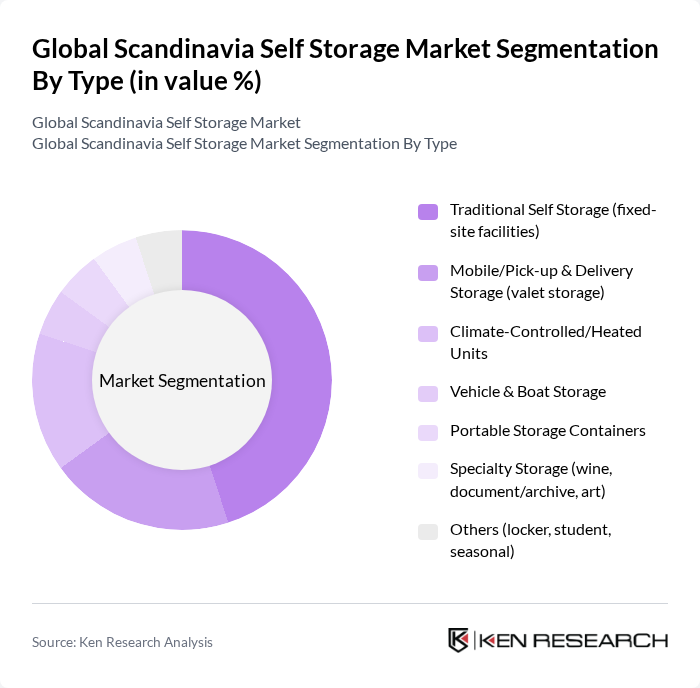

By Type:The self-storage market is segmented into various types, including Traditional Self Storage, Mobile/Pick-up & Delivery Storage, Climate-Controlled Units, Vehicle & Boat Storage, Portable Storage Containers, Specialty Storage, and Others. Among these, Traditional Self Storage remains the most dominant segment due to its established presence and consumer familiarity. The demand for mobile storage solutions is also rising, driven by the convenience they offer to urban dwellers. Climate-controlled units are gaining traction, particularly among customers needing to store sensitive items .

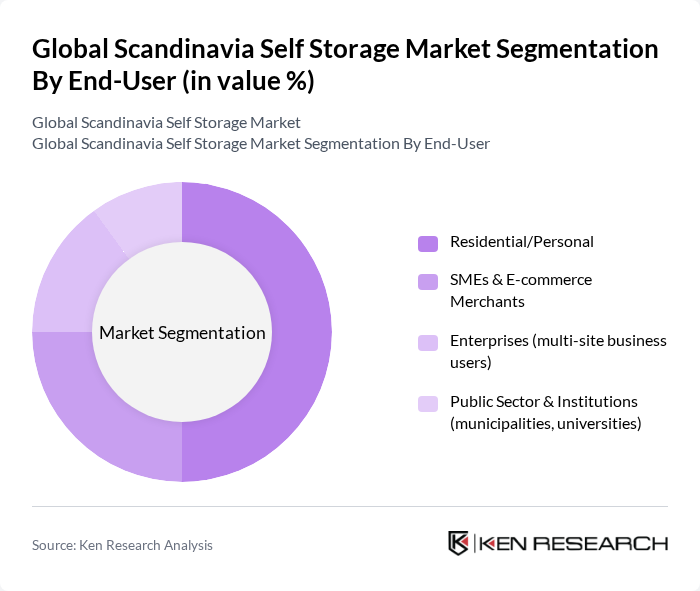

By End-User:The end-user segmentation includes Residential/Personal, SMEs & E-commerce Merchants, Enterprises, and Public Sector & Institutions. The Residential/Personal segment leads the market, driven by individuals seeking additional space for personal belongings, especially in urban areas. SMEs and e-commerce merchants are increasingly utilizing storage solutions for inventory management, while enterprises and public institutions also contribute to the demand through their operational needs .

The Global Scandinavia Self Storage Market is characterized by a dynamic mix of regional and international players. Leading participants such as 24Storage (Sweden), Shurgard Self Storage (Nordics), Pelican Self Storage (Denmark/Finland), City Self-Storage (Norway/Denmark/Finland), Self Storage Group ASA (OK Minilager & City Self-Storage Norway), FirstOffice/Big Easy Self Storage (Finland), Green Storage (Grön Bostad/Sweden), Storemore (Sweden), Easy Storage (Norway), Magasinering (Denmark), Boxit A/S (Denmark), Pelican Self Storage Finland Oy (Finland), City Self-Storage Danmark ApS (Denmark), Ettevõte Cityvarasto Oyj (Cityvarasto Plc, Finland), Shurgard Sweden AB (Sweden) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the self-storage market in Scandinavia appears promising, driven by ongoing urbanization and the increasing need for flexible storage solutions. As e-commerce continues to expand, self-storage facilities will likely evolve to meet the demands of online retailers. Additionally, technological advancements, such as smart storage solutions, will enhance operational efficiency and customer experience. The market is expected to adapt to these trends, positioning itself for sustained growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Traditional Self Storage (fixed-site facilities) Mobile/Pick-up & Delivery Storage (valet storage) Climate-Controlled/Heated Units Vehicle & Boat Storage Portable Storage Containers Specialty Storage (wine, document/archive, art) Others (locker, student, seasonal) |

| By End-User | Residential/Personal SMEs & E-commerce Merchants Enterprises (multi-site business users) Public Sector & Institutions (municipalities, universities) |

| By Size of Storage Unit | Small Units (up to 2.5 m² / ~25–35 sq ft) Medium Units (2.6–7.5 m² / ~36–80 sq ft) Large Units (7.6–15 m² / ~81–160 sq ft) Extra Large Units (>15 m² / >160 sq ft) |

| By Location | Urban/Infill Suburban/Edge-of-city Regional/Rural |

| By Duration of Rental | Short-term (?3 months) Medium-term (3–12 months) Long-term (>12 months) |

| By Security & Access Features | Basic Security (locks, perimeter fencing) Advanced Security (CCTV, PIN/app access, alarms) Enhanced Environmental Control (temperature/humidity monitoring) |

| By Pricing & Contract Model | Month-to-month (rolling) Fixed-term contracts (6–12 months) Dynamic/Revenue-managed Pricing Bundled Services (insurance, pickup/delivery, locks) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Self-Storage Facilities | 120 | Facility Managers, Regional Directors |

| Residential Storage Needs | 120 | Homeowners, Renters |

| Commercial Storage Solutions | 90 | Business Owners, Office Managers |

| Climate-Controlled Storage Demand | 70 | Facility Operators, Real Estate Investors |

| Self-Storage Market Trends | 80 | Market Analysts, Industry Experts |

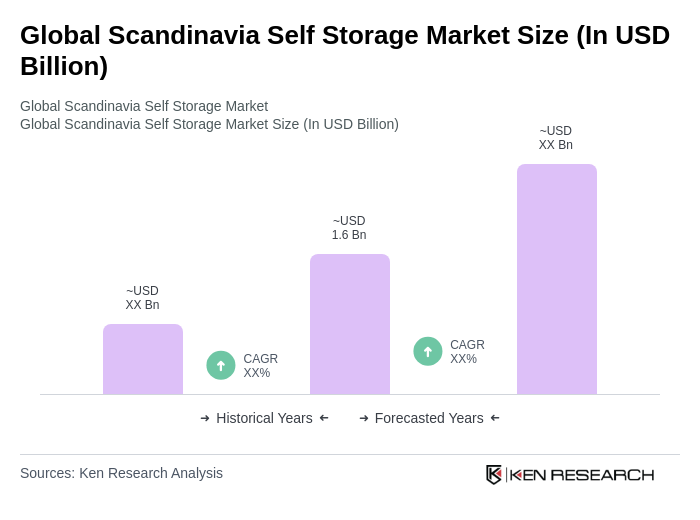

The Global Scandinavia Self Storage Market is valued at approximately USD 1.6 billion, reflecting robust demand trends in urban areas across Sweden, Denmark, Norway, and Finland, supported by a historical analysis over the past five years.