Region:Global

Author(s):Dev

Product Code:KRAC0411

Pages:81

Published On:August 2025

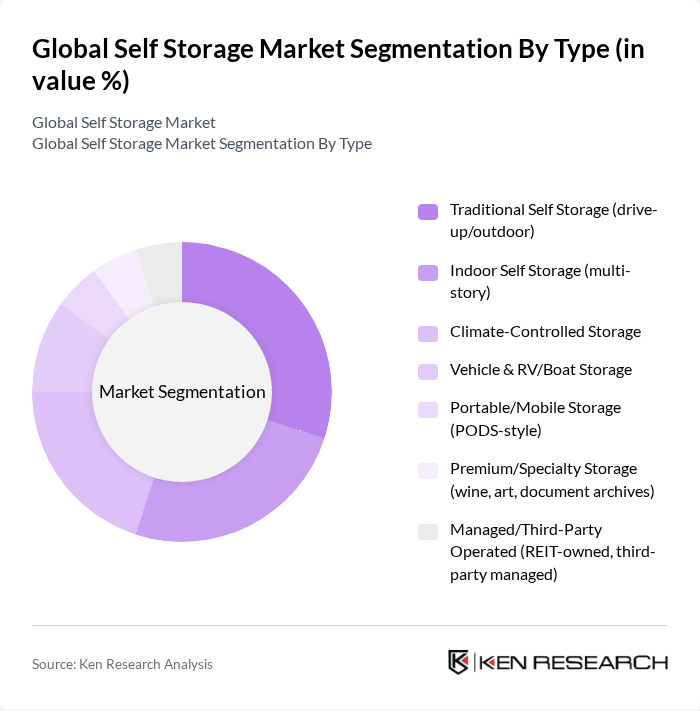

By Type:The self-storage market can be segmented into various types, including Traditional Self Storage, Indoor Self Storage, Climate-Controlled Storage, Vehicle & RV/Boat Storage, Portable/Mobile Storage, Premium/Specialty Storage, and Managed/Third-Party Operated facilities. Each type caters to different consumer needs, with specific features and benefits that appeal to various demographics. Demand continues to favor climate-controlled and multi?story indoor formats in urban cores due to temperature/humidity protection and space efficiency, while drive?up traditional units remain prevalent in suburban and exurban locations. Portable/mobile storage is supported by moving/renovation use cases and e-commerce micro-fulfillment, and specialty storage (e.g., wine, documents) serves niche, higher-yield segments .

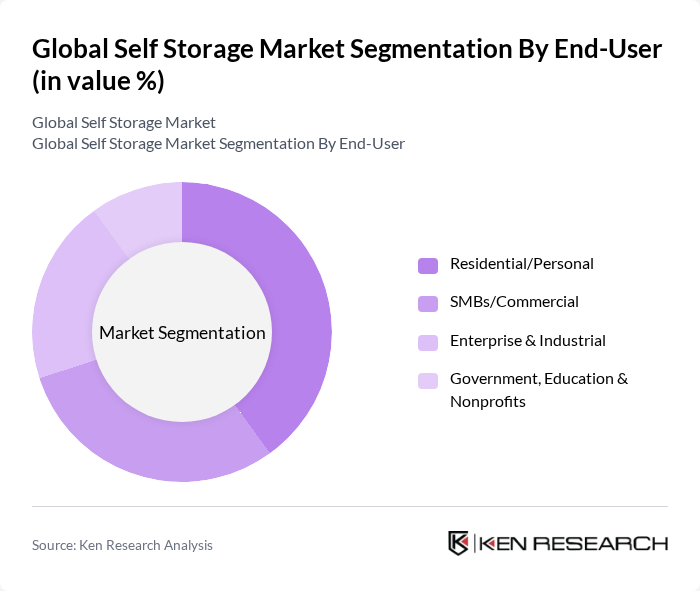

By End-User:The end-user segmentation includes Residential/Personal, SMBs/Commercial, Enterprise & Industrial, and Government, Education & Nonprofits. Each segment has unique storage needs, with residential users often seeking short-term solutions (moving, downsizing, life events), while businesses increasingly use units for inventory overflow, micro-warehousing, seasonal goods, and records. Adoption among SMBs is buoyed by e-commerce growth and last?mile logistics needs, while institutional users employ secure units for archives and equipment .

The Global Self Storage Market is characterized by a dynamic mix of regional and international players. Leading participants such as Public Storage, Extra Space Storage, CubeSmart, U-Haul (AMERCO/U-Haul Holding Company), National Storage Affiliates, Life Storage (a CubeSmart brand; formerly Life Storage, Inc.), Big Yellow Group plc, Safestore Holdings plc, Shurgard Self Storage, StorageMart, SmartStop Self Storage, Access Self Storage (UK), Metro Self Storage, A-1 Self Storage, Kennards Self Storage contribute to innovation, geographic expansion, and service delivery in this space. Ongoing trends include digital leasing and access, dynamic pricing, and expanded climate-controlled footprints, with North America maintaining the largest installed base of facilities .

The self-storage market is poised for continued evolution, driven by technological advancements and changing consumer preferences. As urbanization accelerates, facilities will increasingly integrate smart technology, enhancing security and operational efficiency. Additionally, the rise of subscription-based services will cater to consumers seeking flexibility. By in future, the market is expected to see a significant shift towards eco-friendly storage solutions, aligning with global sustainability trends and consumer demand for environmentally responsible practices.

| Segment | Sub-Segments |

|---|---|

| By Type | Traditional Self Storage (drive-up/outdoor) Indoor Self Storage (multi-story) Climate-Controlled Storage Vehicle & RV/Boat Storage Portable/Mobile Storage (PODS-style) Premium/Specialty Storage (wine, art, document archives) Managed/Third-Party Operated (REIT-owned, third-party managed) |

| By End-User | Residential/Personal SMBs/Commercial Enterprise & Industrial Government, Education & Nonprofits |

| By Size of Storage Unit | Small Units (?50 sq. ft.; 5x5, 5x10) Medium Units (50–150 sq. ft.; 10x10) Large Units (150–300 sq. ft.; 10x15, 10x20) Extra Large Units (>300 sq. ft.; 10x30 and above) |

| By Location | Urban/Infill Suburban Exurban/Rural |

| By Service Type | Self-Service (unattended, kiosk/app-enabled) Full-Service (pick-up, pack, store, return) Hybrid (self-service with value-add services) |

| By Duration of Rental | Short-term (month-to-month) Long-term (6+ months/annual) |

| By Pricing/Revenue Model | Monthly Rent (street rate) Dynamic/Yield-Managed Pricing Ancillary Revenues (insurance, admin fees, locks) Promotions & Concessions (first-month free, discounts) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Self-Storage Facilities | 120 | Facility Managers, Regional Directors |

| Residential Self-Storage Users | 100 | Homeowners, Renters |

| Commercial Self-Storage Clients | 80 | Business Owners, Office Managers |

| Self-Storage Industry Experts | 40 | Consultants, Market Analysts |

| Self-Storage Technology Providers | 70 | Product Managers, IT Directors |

The Global Self Storage Market is valued at approximately USD 60 billion, reflecting sustained demand from urban households and businesses for flexible storage solutions. This valuation is supported by various industry trackers and historical analyses.