Region:Global

Author(s):Dev

Product Code:KRAC1974

Pages:83

Published On:October 2025

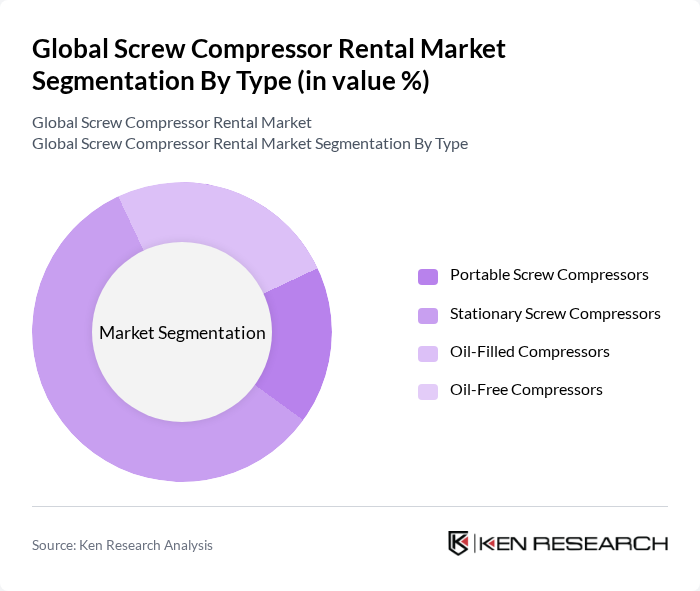

By Type:The market is segmented into Portable Screw Compressors, Stationary Screw Compressors, Oil-Filled Compressors, and Oil-Free Compressors. Among these, Portable Screw Compressors are gaining traction due to their versatility and ease of transport, making them ideal for construction sites and temporary projects. Stationary Screw Compressors, while less mobile, are preferred for long-term industrial applications due to their efficiency and durability. Oil-Filled Compressors are widely used in heavy-duty applications, while Oil-Free Compressors are favored in industries requiring clean air, such as food and beverage processing .

By Lubrication:The market is divided into Oil-Filled Compressors and Oil-Free Compressors. Oil-Filled Compressors dominate the market due to their widespread use in heavy-duty applications, providing high efficiency and reliability. Oil-Free Compressors are increasingly popular in sectors where air purity is critical, such as healthcare and food processing. The growing awareness of environmental issues and the need for sustainable practices are driving the demand for Oil-Free options .

The Global Screw Compressor Rental Market is characterized by a dynamic mix of regional and international players. Leading participants such as Atlas Copco AB, Ingersoll Rand Inc., Sullair LLC, Kaeser Kompressoren SE, Boge Compressors GmbH, Gardner Denver, Inc., Doosan Portable Power, CompAir Ltd., Hitachi Industrial Equipment Systems Co., Ltd., Fusheng Group, Elgi Equipments Ltd., Quincy Compressor, Chicago Pneumatic, Teksan Generator, Airman contribute to innovation, geographic expansion, and service delivery in this space.

The future of the screw compressor rental market appears promising, driven by technological advancements and a growing emphasis on sustainability. As industries increasingly adopt digital solutions and IoT technologies, the integration of smart compressors will enhance operational efficiency and monitoring capabilities. Furthermore, the shift towards sustainable practices will likely encourage more companies to explore rental options, particularly in emerging markets where infrastructure development is accelerating, creating new opportunities for growth and innovation.

| Segment | Sub-Segments |

|---|---|

| By Type | Portable Screw Compressors Stationary Screw Compressors Oil-Filled Compressors Oil-Free Compressors |

| By Lubrication | Oil-Filled Compressors Oil-Free Compressors |

| By End-User | Construction Manufacturing Oil & Gas Mining Food and Beverage Processing Healthcare & Medical |

| By Rental Duration | Short-term Rentals Long-term Rentals Project-based Rentals |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Cross Comparison of Key Players | Company Name Group Size (Large, Medium, or Small as per industry convention) Revenue Growth Rate Market Penetration Rate Customer Retention Rate Average Rental Duration Pricing Strategy Fleet Utilization Rate Customer Satisfaction Score Operational Efficiency Ratio Carbon Footprint Reduction Initiatives |

| By Detailed Profile of Major Companies | Atlas Copco AB Ingersoll Rand Inc. Sullair LLC Kaeser Kompressoren SE Boge Compressors GmbH Gardner Denver, Inc. Doosan Portable Power CompAir Ltd. Hitachi Industrial Equipment Systems Co., Ltd. Fusheng Group Elgi Equipments Ltd. Quincy Compressor Chicago Pneumatic Teksan Generator Airman |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Equipment Rental | 120 | Project Managers, Equipment Rental Coordinators |

| Oil & Gas Compressor Rentals | 100 | Operations Managers, Field Engineers |

| Manufacturing Sector Rentals | 80 | Production Managers, Maintenance Supervisors |

| Industrial Applications | 70 | Facility Managers, Procurement Specialists |

| Emergency and Backup Power Rentals | 90 | Safety Officers, Emergency Response Coordinators |

The Global Screw Compressor Rental Market is valued at approximately USD 4.0 billion, driven by the increasing demand for energy-efficient air compression solutions across various industries, including construction, manufacturing, and oil & gas.