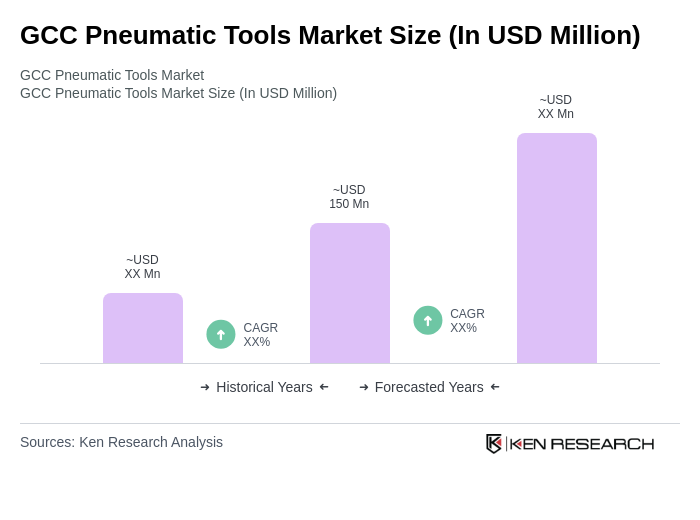

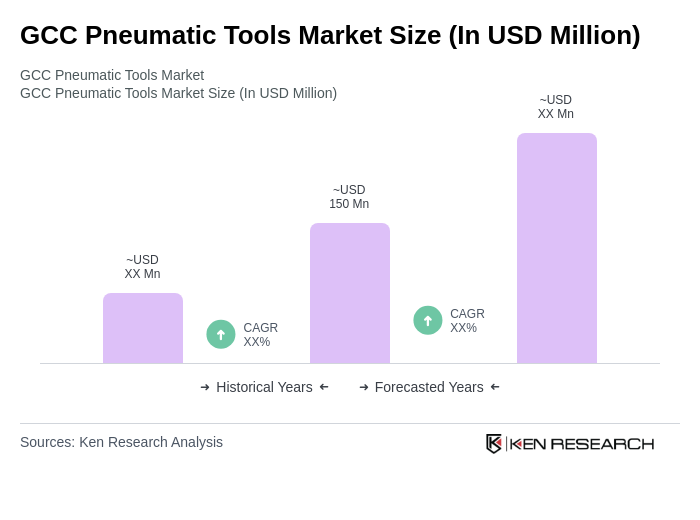

GCC Pneumatic Tools Market Overview

- The GCC Pneumatic Tools Market is valued at USD 150 million, based on a five-year historical analysis. This market size reflects the aggregate value for pneumatic or hydraulic hand tools in the GCC, with a relatively flat trend in recent years . Growth is primarily driven by increasing demand for efficient and high-performance tools in construction, automotive, and manufacturing industries. The rising trend of industrial automation, adoption of lightweight and ergonomic tool designs, and the need for precision and speed in assembly and fabrication tasks have further propelled the adoption of pneumatic tools across the region .

- Key players in this market include the UAE and Saudi Arabia, which dominate due to robust construction and manufacturing sectors. The UAE’s rapid urbanization and Saudi Arabia’s Vision 2030 initiative, focused on economic diversification and infrastructure enhancement, have significantly contributed to the demand for pneumatic tools in these countries .

- In 2023, the GCC Standardization Organization (GSO) issued the “GSO Technical Regulation for Energy Efficiency in Industrial Equipment, 2023,” mandating the use of energy-efficient pneumatic tools in construction projects. This regulation requires manufacturers and importers to comply with minimum energy performance standards, conduct product testing, and obtain certification for pneumatic tools used in large-scale construction and industrial applications. The regulation’s scope covers all pneumatic hand tools deployed in government and private sector projects, aiming to reduce energy consumption and promote sustainable practices in the industry.

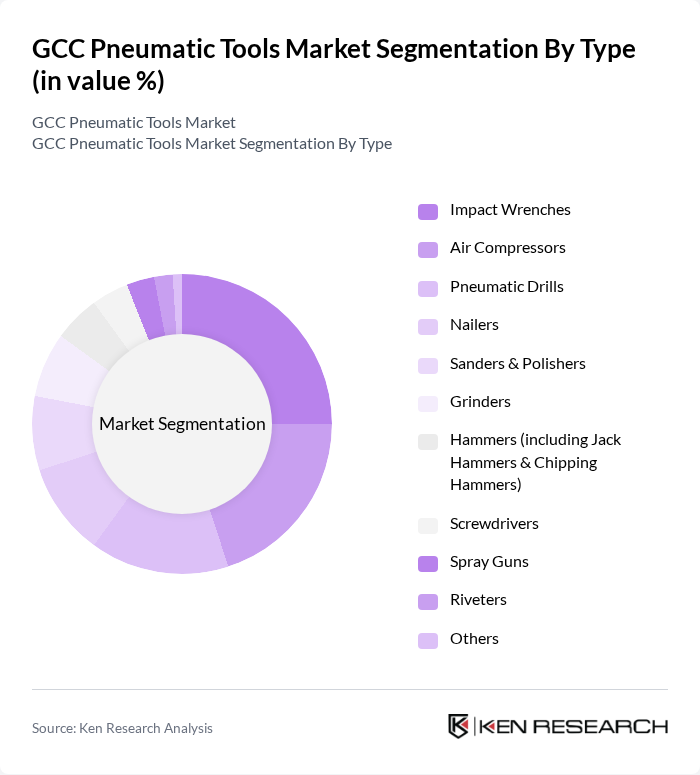

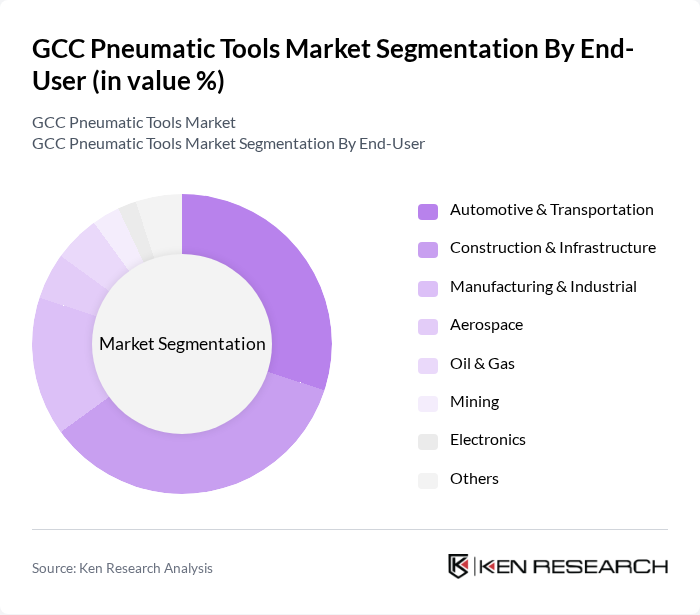

GCC Pneumatic Tools Market Segmentation

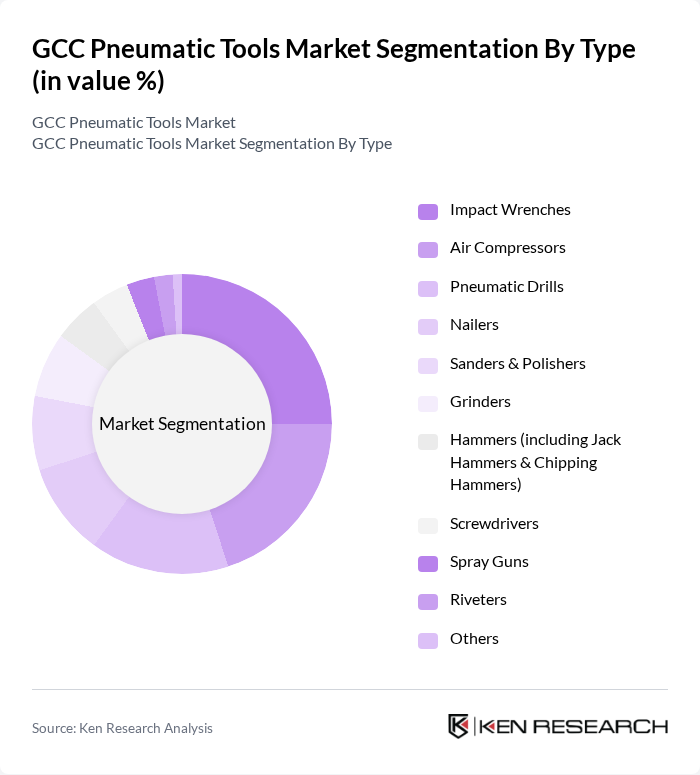

By Type:The pneumatic tools market is segmented into impact wrenches, air compressors, pneumatic drills, nailers, sanders & polishers, grinders, hammers (including jack hammers & chipping hammers), screwdrivers, spray guns, riveters, and others. Impact wrenches and air compressors are leading the market due to their widespread application in automotive repair, construction, and industrial assembly. The demand for these tools is driven by their efficiency, reliability, and ability to handle heavy-duty tasks, making them essential for professionals in high-volume and precision-driven environments .

By End-User:The end-user segmentation of the pneumatic tools market includes automotive & transportation, construction & infrastructure, manufacturing & industrial, aerospace, oil & gas, mining, electronics, and others. The construction & infrastructure segment is the largest consumer of pneumatic tools, driven by ongoing projects and investments in urban development and industrial expansion across the GCC region. The automotive sector also plays a significant role, as pneumatic tools are essential for assembly, maintenance, and repair operations in both commercial and passenger vehicle segments .

GCC Pneumatic Tools Market Competitive Landscape

The GCC Pneumatic Tools Market is characterized by a dynamic mix of regional and international players. Leading participants such as Atlas Copco, Ingersoll Rand, Chicago Pneumatic, Sullair, Makita Corporation, Robert Bosch GmbH, Stanley Black & Decker, Hikoki (formerly Hitachi Koki), AEG Powertools, DeWalt, Metabo, Bostitch, Milwaukee Tool, Toku Pneumatic Co., Ltd., Sumake Industrial Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

GCC Pneumatic Tools Market Industry Analysis

Growth Drivers

- Increasing Demand for Automation:The GCC region is witnessing a significant shift towards automation, driven by a projected increase in industrial output, which is expected to reach $1.5 trillion in future. This demand is fueled by the need for efficiency and productivity, with automation technologies being integrated into manufacturing processes. As companies invest in automated systems, the demand for pneumatic tools, which are essential for various applications, is anticipated to rise, supporting this growth trajectory.

- Rising Construction Activities:The construction sector in the GCC is projected to grow by 7.5% annually, reaching $250 billion in future. This growth is driven by large-scale infrastructure projects, including the development of smart cities and transportation networks. Pneumatic tools are crucial in construction for tasks such as drilling, fastening, and cutting, leading to increased demand as construction activities expand across the region, particularly in Saudi Arabia and the UAE.

- Technological Advancements in Tool Design:The pneumatic tools market is benefiting from innovations such as lightweight materials and ergonomic designs, enhancing user experience and efficiency. In future, the introduction of advanced pneumatic tools with improved energy efficiency is expected to increase market penetration. These innovations are projected to reduce operational costs by up to 25%, making pneumatic tools more attractive to industries focused on cost-effective solutions and productivity enhancements.

Market Challenges

- High Initial Investment Costs:The initial investment required for pneumatic tools can be substantial, often exceeding $15,000 for advanced systems. This high cost can deter small and medium-sized enterprises (SMEs) from adopting these tools, limiting market growth. Additionally, the need for skilled labor to operate these tools adds to the overall expenditure, creating a barrier for many businesses looking to modernize their operations in the GCC region.

- Availability of Alternative Tools:The market faces competition from electric and battery-operated tools, which are often perceived as more versatile and easier to use. In future, the market share of electric tools is expected to reach 45%, challenging the dominance of pneumatic tools. This shift is driven by advancements in battery technology, making electric tools more efficient and appealing, thereby posing a significant challenge to the pneumatic tools market in the GCC.

GCC Pneumatic Tools Market Future Outlook

The future of the GCC pneumatic tools market appears promising, driven by ongoing technological advancements and a strong focus on sustainability. As industries increasingly adopt eco-friendly practices, the demand for energy-efficient pneumatic tools is expected to rise. Furthermore, the integration of IoT technology into pneumatic tools will enhance operational efficiency and data analytics capabilities, allowing for better maintenance and performance monitoring. These trends indicate a dynamic market landscape that will evolve to meet the changing needs of various sectors.

Market Opportunities

- Expansion in Emerging Markets:The GCC region's emerging markets, particularly in Qatar and Oman, present significant opportunities for pneumatic tool manufacturers. With infrastructure investments projected to exceed $70 billion in future, companies can capitalize on the growing demand for construction and industrial tools, positioning themselves strategically to capture market share in these developing economies.

- Development of Smart Pneumatic Tools:The rise of smart technology offers a unique opportunity for innovation in pneumatic tools. In future, the market for smart tools is expected to grow significantly, driven by the demand for enhanced connectivity and automation. Manufacturers can leverage this trend to develop tools that integrate with smart systems, improving efficiency and user experience, thus attracting a broader customer base.