Region:Global

Author(s):Shubham

Product Code:KRAA2481

Pages:84

Published On:August 2025

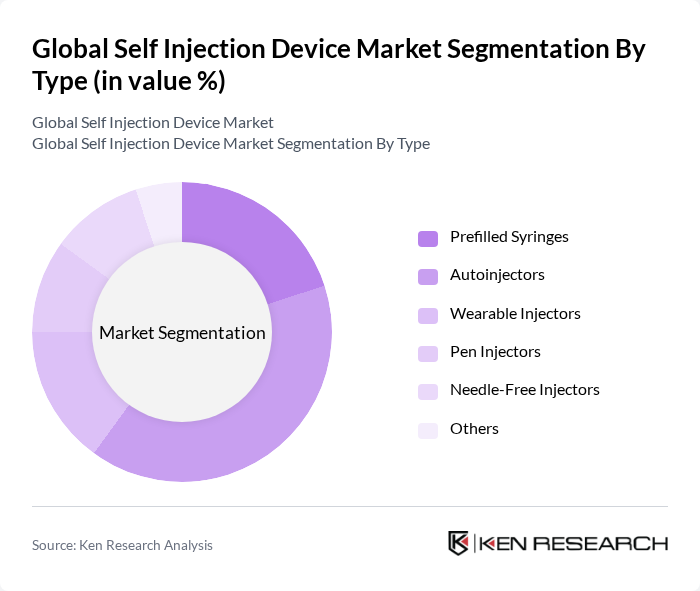

By Type:The self-injection device market can be segmented into various types, including prefilled syringes, autoinjectors, wearable injectors, pen injectors, needle-free injectors, and others. Each of these subsegments caters to different patient needs and preferences, influencing their market share and growth potential .

The autoinjectors segment is currently dominating the market due to their ease of use and convenience for patients, particularly those managing chronic conditions like diabetes and rheumatoid arthritis. The design of autoinjectors allows for quick and less painful administration, which is a significant factor in patient compliance. Additionally, the increasing prevalence of conditions requiring regular injections has led to a higher demand for these devices, making them a preferred choice among consumers .

By Usability:The usability of self-injection devices is categorized into disposable devices and reusable devices. This segmentation reflects the varying preferences of patients regarding convenience, cost, and environmental impact .

Disposable devices are leading the market due to their convenience and reduced risk of contamination, making them particularly appealing for patients who prioritize hygiene and ease of use. The growing trend towards home healthcare solutions has further accelerated the demand for disposable devices, as they eliminate the need for cleaning and maintenance, thus enhancing patient compliance and satisfaction .

The Global Self Injection Device Market is characterized by a dynamic mix of regional and international players. Leading participants such as AbbVie Inc., Amgen Inc., Becton, Dickinson and Company, Eli Lilly and Company, Johnson & Johnson, Medtronic plc, Novo Nordisk A/S, Sanofi S.A., Teva Pharmaceutical Industries Ltd., Ypsomed AG, Gerresheimer AG, Sandoz International GmbH, F. Hoffmann-La Roche Ltd., Bayer AG, Pfizer Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the self-injection device market appears promising, driven by technological advancements and a growing emphasis on patient-centric healthcare. As healthcare systems increasingly adopt digital health technologies, the integration of telehealth and remote monitoring will enhance the usability of self-injection devices. Furthermore, the rise of personalized medicine will likely lead to tailored self-injection solutions, improving patient outcomes and adherence rates, thereby fostering market expansion in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Prefilled Syringes Autoinjectors Wearable Injectors Pen Injectors Needle-Free Injectors Others |

| By Usability | Disposable Devices Reusable Devices |

| By Application | Diabetes Management Rheumatoid Arthritis Treatment Multiple Sclerosis Treatment Cancer Treatment Hormonal Disorders Pain Management Anaphylaxis Others |

| By End-User | Hospitals Homecare Settings Specialty Clinics Pharmacies |

| By Distribution Channel | Direct Sales Online Retail Hospital Pharmacy Retail Pharmacy |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Technology | Manual Injection Devices Semi-automatic Injection Devices Fully Automatic/Smart Injection Devices Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Chronic Disease Management | 120 | Patients, Healthcare Providers |

| Diabetes Self-Management | 90 | End-users, Diabetes Educators |

| Auto-Injectors for Allergies | 60 | Allergists, Patients with Allergies |

| Biologics Administration | 50 | Oncologists, Rheumatologists |

| Patient Experience with Devices | 70 | Patient Advocates, Caregivers |

The Global Self Injection Device Market is valued at approximately USD 22.8 billion, driven by the increasing prevalence of chronic diseases, demand for home healthcare solutions, and advancements in technology that enhance user experience and safety.