Region:Global

Author(s):Shubham

Product Code:KRAA3103

Pages:100

Published On:August 2025

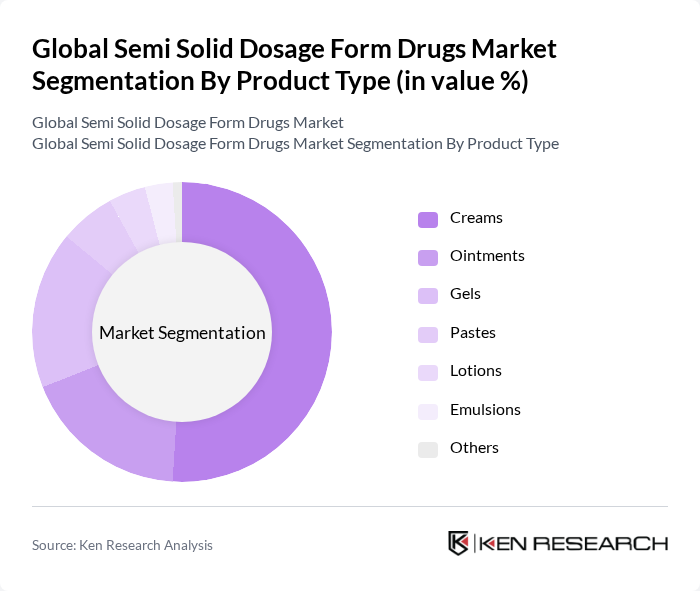

By Product Type:The product type segmentation includes various forms of semi-solid dosage, such as creams, ointments, gels, pastes, lotions, emulsions, and others. Among these, creams and ointments are the most widely used due to their versatility and effectiveness in treating a range of dermatological conditions. The demand for gels is also increasing, particularly in cosmetic and dermatological applications, while pastes and lotions cater to specific therapeutic needs.

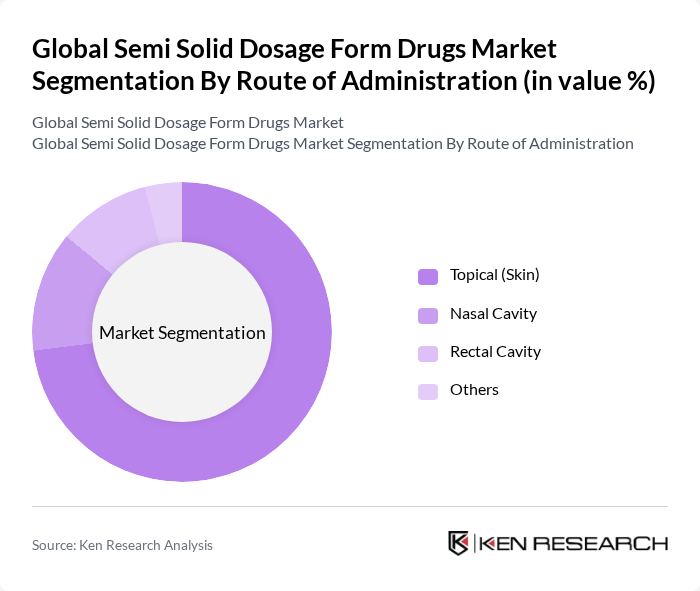

By Route of Administration:The route of administration for semi-solid dosage forms includes topical (skin), nasal cavity, rectal cavity, and others. The topical route is the most dominant due to its direct application and effectiveness in localized treatment. The nasal cavity route is gaining traction for its rapid absorption and convenience, while the rectal route is primarily used for specific therapeutic applications, particularly in pediatric and geriatric patients.

The Global Semi Solid Dosage Form Drugs Market is characterized by a dynamic mix of regional and international players. Leading participants such as Johnson & Johnson, Pfizer Inc., GlaxoSmithKline plc, Novartis AG, Merck & Co., Inc., Sanofi S.A., AbbVie Inc., Bayer AG, Amgen Inc., Teva Pharmaceutical Industries Ltd., Astellas Pharma Inc., Mylan N.V., Hikma Pharmaceuticals PLC, Sandoz International GmbH, Dr. Reddy's Laboratories Ltd., Hisamitsu Pharmaceutical Co., Inc., Glenmark Pharmaceuticals Ltd., Cipla Ltd., Piramal Pharma Solutions, DPT Laboratories, Ltd., Pierre Fabre S.A., Lubrizol Life Science, Cambrex Corporation, Bora Pharmaceuticals Co., Ltd., LGM Pharma contribute to innovation, geographic expansion, and service delivery in this space.

The future of the semi-solid dosage form market appears promising, driven by the increasing demand for personalized medicine and the growth of e-commerce in pharmaceutical sales. As healthcare systems evolve, there is a notable shift towards tailored treatments that cater to individual patient needs. Additionally, the rise of online pharmacies is expected to enhance accessibility, allowing consumers to obtain semi-solid formulations conveniently, thus expanding market reach and driving sales growth.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Creams Ointments Gels Pastes Lotions Emulsions Others |

| By Route of Administration | Topical (Skin) Nasal Cavity Rectal Cavity Others |

| By Therapeutic Application | Dermatology Pain Management Hormonal Therapy Wound Care Ophthalmic Disorders Antifungal Treatments Others |

| By End-User | Hospitals Clinics Home Care Settings Ambulatory Surgical Centers Pharmacies Others |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies Online Pharmacies Drug Stores Wholesalers Others |

| By Region | North America United States Canada Europe Germany United Kingdom France Italy Spain Rest of Europe Asia-Pacific China Japan India Australia South Korea Rest of Asia-Pacific Middle East & Africa GCC South Africa Rest of Middle East & Africa Latin America Brazil Argentina Rest of Latin America |

| By Packaging Type | Tubes Jars Sachets Pumps Others |

| By Price Range | Economy Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Manufacturers | 100 | Production Managers, Quality Control Officers |

| Healthcare Professionals | 80 | Pharmacists, Physicians, Nurse Practitioners |

| Regulatory Bodies | 40 | Regulatory Affairs Specialists, Compliance Officers |

| Market Analysts | 40 | Market Research Analysts, Business Development Managers |

| End-users (Patients) | 60 | Patients using semi-solid dosage forms, Caregivers |

The Global Semi Solid Dosage Form Drugs Market is valued at approximately USD 130 billion, driven by factors such as the rising prevalence of skin disorders and advancements in drug formulation technologies.