Region:Middle East

Author(s):Dev

Product Code:KRAC2096

Pages:93

Published On:October 2025

By Type:The market is segmented into various types, including Active Pharmaceutical Ingredients (APIs), Finished Dosage Forms, Biologics, Over-the-Counter (OTC) Products, Semi-solid Formulations, Liquid Formulations, Solid Formulations, Advanced Drug Delivery Formulations, and Packaging Services. Among these, Finished Dosage Forms are currently leading the market due to their high demand from pharmaceutical companies looking for ready-to-use products. The trend towards personalized medicine and the increasing prevalence of chronic diseases are also driving the growth of this segment.

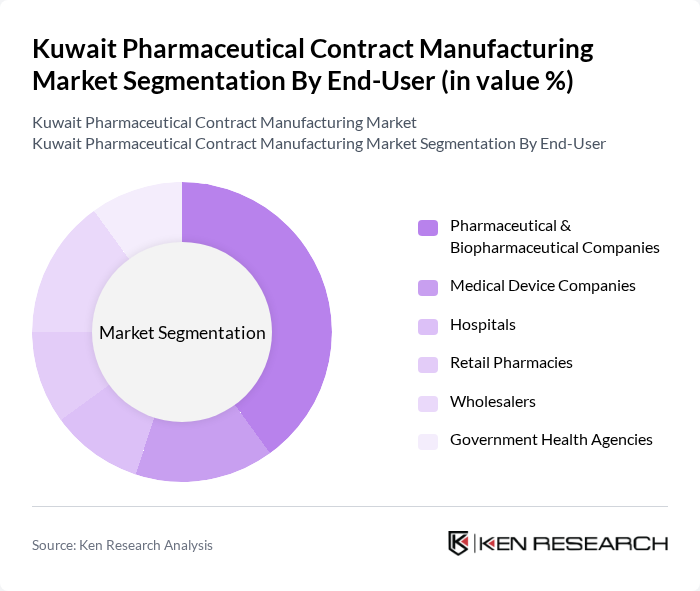

By End-User:The end-user segmentation includes Pharmaceutical & Biopharmaceutical Companies, Medical Device Companies, Hospitals, Retail Pharmacies, Wholesalers, and Government Health Agencies. Pharmaceutical & Biopharmaceutical Companies dominate this segment, driven by the increasing need for contract manufacturing services to meet the growing demand for medications. The trend towards outsourcing manufacturing processes allows these companies to focus on research and development while ensuring high-quality production.

The Kuwait Pharmaceutical Contract Manufacturing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Saudi Pharmaceutical Industries Company (KSPICO), Warba Medical Supplies Company, Al-Mahaba Medical Company, Gulf Pharmaceutical Industries (Julphar), Kuwait United Pharmaceutical Company (KUPC), Al-Qabas Pharmaceutical Company, Kuwait Medical Supplies Company, Al-Hikma Pharmaceuticals, Pharmax Pharmaceuticals, Al-Dawaa Pharmacies, United Pharmacies, Regional Medical Device Manufacturers (e.g., Advanced Technology Company), International Contract Manufacturers with Kuwait Operations (e.g., Pfizer, Sanofi, Novartis – local contract manufacturing partnerships), Al-Majed Group, Al-Jazeera Pharmaceutical Company contribute to innovation, geographic expansion, and service delivery in this space.

The Kuwait Pharmaceutical Contract Manufacturing Market is driven by several key factors:

These factors are supported by Kuwait's strategic location and government support for the healthcare sector, making it an attractive hub for pharmaceutical contract manufacturing in the Middle East.

The future of the Kuwait pharmaceutical contract manufacturing market appears promising, driven by increasing investments in local production capabilities and a growing focus on research and development. As the government continues to support local manufacturers through favorable policies, the sector is likely to attract foreign partnerships. Additionally, the integration of digital technologies and automation in manufacturing processes will enhance efficiency and product quality, positioning Kuwait as a competitive player in the regional pharmaceutical landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Active Pharmaceutical Ingredients (APIs) Finished Dosage Forms Biologics Over-the-Counter (OTC) Products Semi-solid Formulations Liquid Formulations Solid Formulations Advanced Drug Delivery Formulations Packaging Services |

| By End-User | Pharmaceutical & Biopharmaceutical Companies Medical Device Companies Hospitals Retail Pharmacies Wholesalers Government Health Agencies |

| By Product Category | Prescription Medications Branded Generics Unbranded Generics Nutraceuticals Veterinary Medicines Others |

| By Distribution Channel | Direct Sales Online Sales Distributors Others |

| By Regulatory Compliance Level | GMP Compliant Non-GMP Compliant |

| By Market Segment | Contract Manufacturing Organizations (CMOs) Contract Development and Manufacturing Organizations (CDMOs) |

| By Pricing Strategy | Cost-Plus Pricing Value-Based Pricing Competitive Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Contract Manufacturers | 40 | Production Managers, Operations Directors |

| Regulatory Compliance Experts | 50 | Regulatory Affairs Managers, Quality Control Officers |

| Healthcare Providers and Distributors | 60 | Pharmacy Managers, Supply Chain Coordinators |

| Market Analysts and Consultants | 45 | Market Research Analysts, Business Development Managers |

| Industry Associations and Regulatory Bodies | 40 | Policy Makers, Industry Representatives |

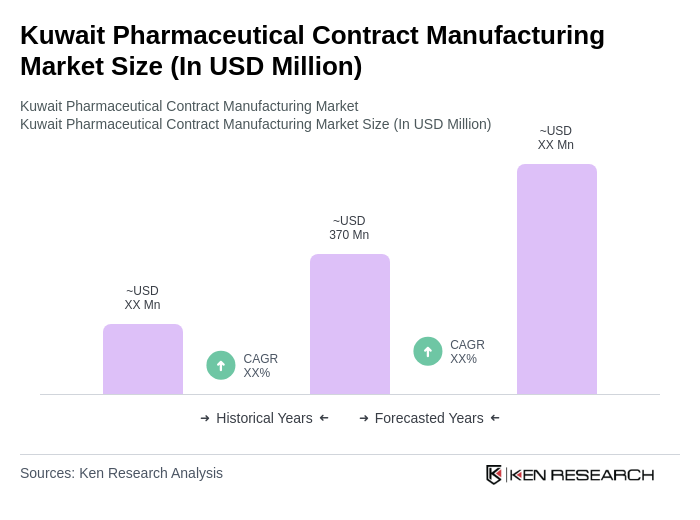

The Kuwait Pharmaceutical Contract Manufacturing Market is valued at approximately USD 370 million, driven by increasing healthcare expenditure, a rising demand for generic drugs, and the expansion of pharmaceutical companies seeking cost-effective manufacturing solutions.