Region:Global

Author(s):Dev

Product Code:KRAB1752

Pages:87

Published On:January 2026

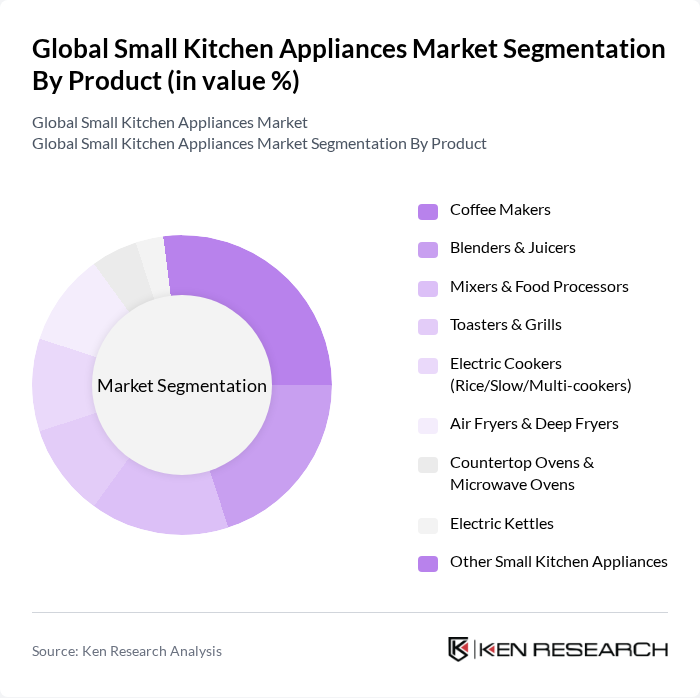

By Product:The product segmentation of the market includes various categories such as coffee makers, blenders & juicers, mixers & food processors, toasters & grills, electric cookers (rice/slow/multi-cookers), air fryers & deep fryers, countertop ovens & microwave ovens, electric kettles, and other small kitchen appliances. This reflects the standard structure used in industry analyses for small kitchen appliances. Among these, coffee makers and blenders & juicers are particularly popular due to the increasing trend of home brewing, café-style beverages at home, and health-conscious consumers seeking fresh juices and smoothies. The demand for air fryers has also surged as consumers look for healthier, low-oil cooking options, making air fryers one of the fastest-growing product categories in the segment. The market is characterized by a diverse range of products catering to different consumer preferences and lifestyles, with increasing emphasis on multifunctionality, compact designs for small urban kitchens, and smart/connected features.

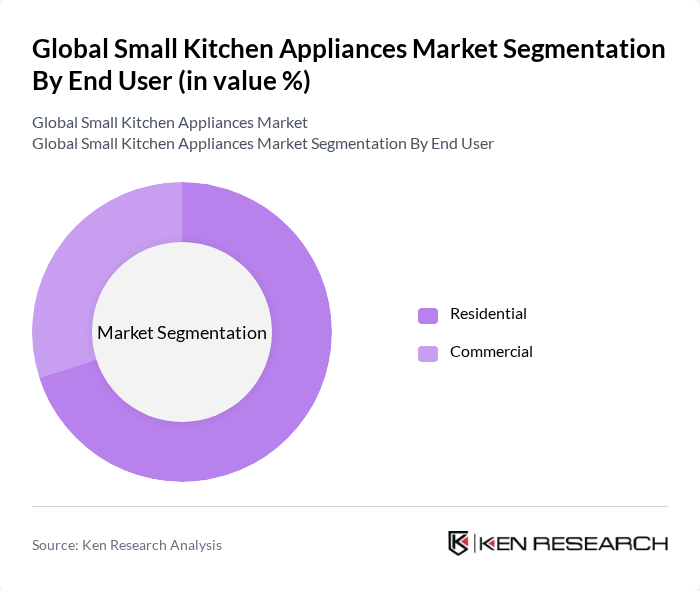

By End User:The end-user segmentation includes residential and commercial sectors, which aligns with common industry classifications for this market. The residential segment dominates the market, driven by the increasing number of households investing in small kitchen appliances for convenience, time-saving benefits, and efficiency in meal preparation, as well as the continuing popularity of home cooking and home entertainment. The commercial segment, which includes HoReCa (Hotels, Restaurants, and Catering), is also growing as businesses seek to enhance their kitchen capabilities with durable, high?performance, and often energy-efficient appliances to support professional foodservice operations. The trend towards home cooking that intensified during the pandemic, together with hybrid work patterns, has sustained elevated demand in the residential segment, making it the leading end-user category worldwide.

The Global Small Kitchen Appliances Market is characterized by a dynamic mix of regional and international players. Leading participants such as Koninklijke Philips N.V., Breville Group Limited, Cuisinart (Conair Corporation), Hamilton Beach Brands Holding Company, KitchenAid (Whirlpool Corporation), BLACK+DECKER (Stanley Black & Decker), Panasonic Corporation, Oster (Newell Brands), De'Longhi S.p.A., Smeg S.p.A., Tefal (Groupe SEB), Braun Household (De'Longhi Group), Russell Hobbs (Spectrum Brands), Vitamix Corporation, SharkNinja, Inc. contribute to innovation, geographic expansion, digital channel development, and service delivery in this space through continuous product launches, design differentiation, and smart/connected appliance offerings.

The future of the small kitchen appliances market appears promising, driven by evolving consumer preferences and technological advancements. As households increasingly prioritize convenience and energy efficiency, manufacturers are likely to focus on developing innovative, multifunctional appliances. Additionally, the integration of smart technology will enhance user experience, making appliances more appealing. The market is expected to see significant growth in emerging economies, where rising disposable incomes will lead to increased spending on kitchen appliances.

| Segment | Sub-Segments |

|---|---|

| By Product | Coffee Makers Blenders & Juicers Mixers & Food Processors Toasters & Grills Electric Cookers (Rice/Slow/Multi-cookers) Air Fryers & Deep Fryers Countertop Ovens & Microwave Ovens Electric Kettles Other Small Kitchen Appliances (waffle makers, bread makers, egg cookers, etc.) |

| By End User | Residential Commercial (HoReCa, institutional catering, etc.) |

| By Distribution Channel | Offline Retail (Supermarkets/Hypermarkets, Specialty Stores) Online Retail (E-commerce Marketplaces, Brand E-stores) B2B / Direct Sales |

| By Price Range | Economy Mid-Range Premium / Luxury |

| By Connectivity / Functionality | Conventional Smart / Connected Appliances (IoT-enabled) |

| By Geography | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Small Kitchen Appliances | 120 | Retail Managers, Category Buyers |

| Consumer Preferences for Kitchen Gadgets | 140 | Homeowners, Apartment Dwellers |

| Market Trends in E-commerce for Kitchen Appliances | 100 | E-commerce Managers, Digital Marketing Specialists |

| Product Development Insights from Manufacturers | 80 | Product Development Managers, R&D Heads |

| Consumer Feedback on Kitchen Appliance Features | 110 | Frequent Buyers, Kitchen Enthusiasts |

The Global Small Kitchen Appliances Market is valued at approximately USD 62 billion, reflecting a significant growth trend driven by consumer demand for convenience, technological innovations, and a rising interest in home cooking and meal preparation.