Region:North America

Author(s):Shubham

Product Code:KRAD1992

Pages:91

Published On:December 2025

By Type:The small kitchen appliances market is segmented into various types, including blenders, toasters, coffee makers, food processors, electric grills, slow cookers, and others. Among these, coffee makers and blenders are particularly popular due to their versatility and convenience, catering to the growing trend of home cooking and beverage preparation. The demand for innovative features, such as programmable settings and smart connectivity, drives the growth of these segments.

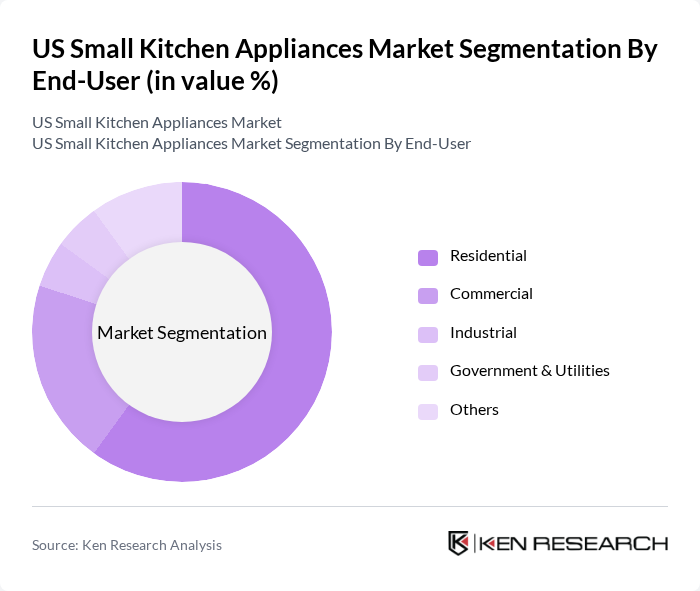

By End-User:The market is segmented by end-user into residential, commercial, industrial, government & utilities, and others. The residential segment dominates the market, driven by the increasing trend of home cooking and the desire for convenience among consumers. The rise in urban living and smaller kitchen spaces has led to a preference for compact and multifunctional appliances, further boosting the residential segment's growth.

The US Small Kitchen Appliances Market is characterized by a dynamic mix of regional and international players. Leading participants such as KitchenAid, Cuisinart, Breville, Hamilton Beach, Black+Decker, Ninja, Oster, Vitamix, Philips, GE Appliances, Sunbeam, Tefal, Braun, Smeg, and Zojirushi contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. small kitchen appliances market appears promising, driven by the proliferation of smart technology and a growing emphasis on sustainability. With over 279 million smart kitchen appliances expected to ship globally in future, the integration of IoT and AI into kitchen devices will enhance user experiences. Additionally, the increasing consumer demand for energy-efficient products, with 124 million units purchased in future, indicates a shift towards eco-friendly innovations that manufacturers can leverage for competitive advantage.

| Segment | Sub-Segments |

|---|---|

| By Type | Blenders Toasters Coffee Makers Food Processors Electric Grills Slow Cookers Others |

| By End-User | Residential Commercial Industrial Government & Utilities Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Wholesale Others |

| By Price Range | Budget Mid-Range Premium Luxury Others |

| By Material | Plastic Stainless Steel Glass Aluminum Others |

| By Brand Loyalty | Brand Loyal Customers Brand Switchers First-Time Buyers Others |

| By Innovation Level | Traditional Appliances Smart Appliances Eco-Friendly Appliances Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Kitchen Appliances | 120 | Homeowners, Renters, Kitchen Enthusiasts |

| Retail Insights on Small Kitchen Appliances | 100 | Store Managers, Category Buyers |

| Trends in E-commerce for Kitchen Appliances | 80 | E-commerce Managers, Digital Marketing Specialists |

| Product Development Feedback | 70 | Product Designers, R&D Managers |

| Market Trends from Culinary Experts | 60 | Chefs, Food Bloggers, Culinary Influencers |

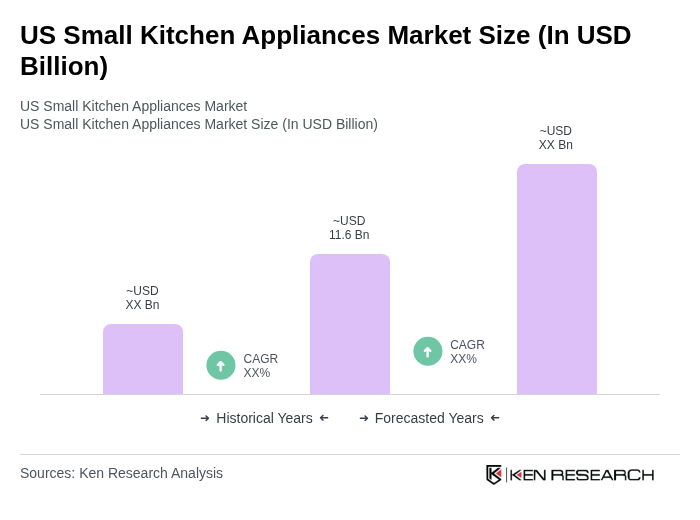

The US Small Kitchen Appliances Market is valued at approximately USD 11.6 billion, reflecting a robust demand driven by consumer preferences for convenience, smart technology, and health-conscious cooking solutions.