Region:Global

Author(s):Dev

Product Code:KRAA3019

Pages:92

Published On:August 2025

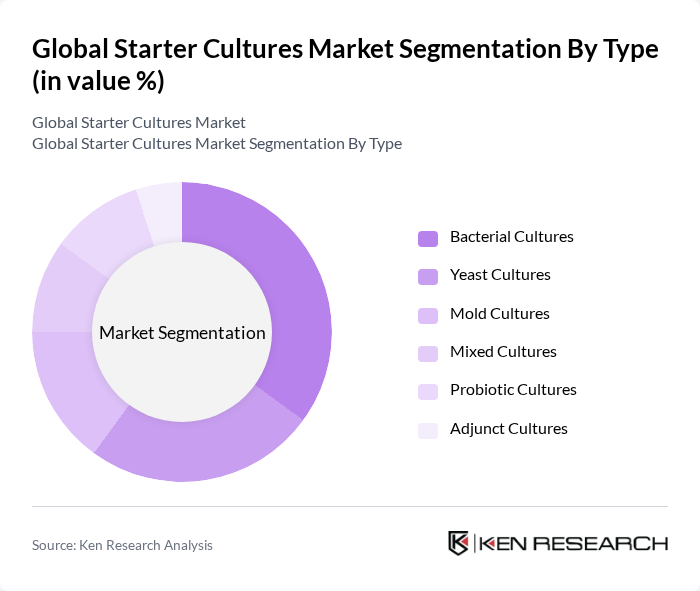

By Type:The market is segmented into various types of starter cultures, includingBacterial Cultures,Yeast Cultures,Mold Cultures,Mixed Cultures,Probiotic Cultures, andAdjunct Cultures. Each type serves specific applications in food production, contributing to the overall market dynamics .

TheBacterial Culturessegment is currently dominating the market due to their extensive use in dairy products, particularly yogurt and cheese. The increasing consumer preference for probiotic-rich foods has further propelled the demand for bacterial cultures. Additionally, advancements in bacterial culture technology have improved product quality and consistency, making them a preferred choice among manufacturers. The trend towards health and wellness is also driving the growth of this segment, as consumers seek out products that support gut health .

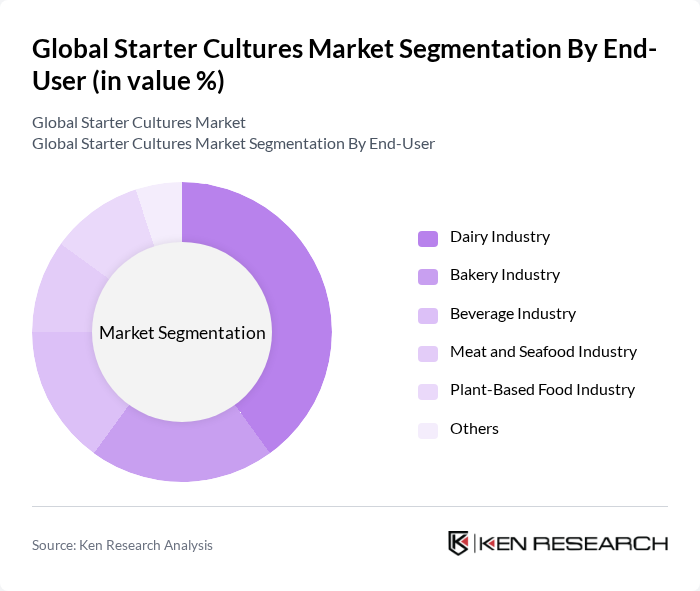

By End-User:The market is segmented based on end-users, including theDairy Industry,Bakery Industry,Beverage Industry,Meat and Seafood Industry,Plant-Based Food Industry, andOthers. Each end-user segment has unique requirements and applications for starter cultures .

TheDairy Industryis the leading end-user segment, primarily due to the high demand for fermented dairy products such as yogurt and cheese. The growing trend of health-conscious eating has led to an increased consumption of probiotic dairy products, which utilize starter cultures extensively. Additionally, innovations in dairy processing and the introduction of new flavors and varieties have further fueled the growth of this segment, making it a key driver in the starter cultures market .

The Global Starter Cultures Market is characterized by a dynamic mix of regional and international players. Leading participants such as Chr. Hansen Holding A/S, DuPont Nutrition & Health (IFF), DSM-Firmenich, Kerry Group plc, Lallemand Inc., Sacco System S.r.l., BioCare Copenhagen A/S, ProbioFerm GmbH, Bifodan A/S, Bioprox (Lesaffre Group), THT S.A.S., Mediterranea Biotecnologie S.r.l., AB Biotek, Proquiga Group, Ginkgo Bioworks, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the starter cultures market appears promising, driven by evolving consumer preferences and technological advancements. As the demand for plant-based and probiotic products continues to rise, manufacturers are likely to invest in innovative starter cultures tailored to these trends. Furthermore, the expansion into emerging markets, particularly in Asia and Africa, presents significant growth potential, as these regions increasingly adopt fermented foods into their diets, enhancing market dynamics and opportunities.

| Segment | Sub-Segments |

|---|---|

| By Type | Bacterial Cultures Yeast Cultures Mold Cultures Mixed Cultures Probiotic Cultures Adjunct Cultures |

| By End-User | Dairy Industry Bakery Industry Beverage Industry Meat and Seafood Industry Plant-Based Food Industry Others |

| By Application | Fermented Dairy Products (Cheese, Yogurt, Kefir, etc.) Fermented Beverages (Alcoholic & Non-Alcoholic) Baked Goods (Sourdough, etc.) Fermented Meat and Seafood Products Plant-Based Fermented Foods Others |

| By Distribution Channel | Direct Sales Distributors Online Retail Supermarkets/Hypermarkets Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Packaging Type | Bulk Packaging Retail Packaging Others |

| By Price Range | Economy Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dairy Product Manufacturers | 100 | Production Managers, Quality Control Specialists |

| Bakery Product Developers | 80 | Product Development Managers, R&D Scientists |

| Beverage Industry Stakeholders | 70 | Operations Managers, Supply Chain Coordinators |

| Probiotic Supplement Manufacturers | 40 | Regulatory Affairs Managers, Marketing Directors |

| Food Safety and Quality Assurance Experts | 90 | Quality Assurance Managers, Compliance Officers |

The Global Starter Cultures Market is valued at approximately USD 1.2 billion, driven by the increasing demand for fermented products and innovations in starter culture technology that enhance product quality and shelf life.