Region:Global

Author(s):Rebecca

Product Code:KRAD0297

Pages:91

Published On:August 2025

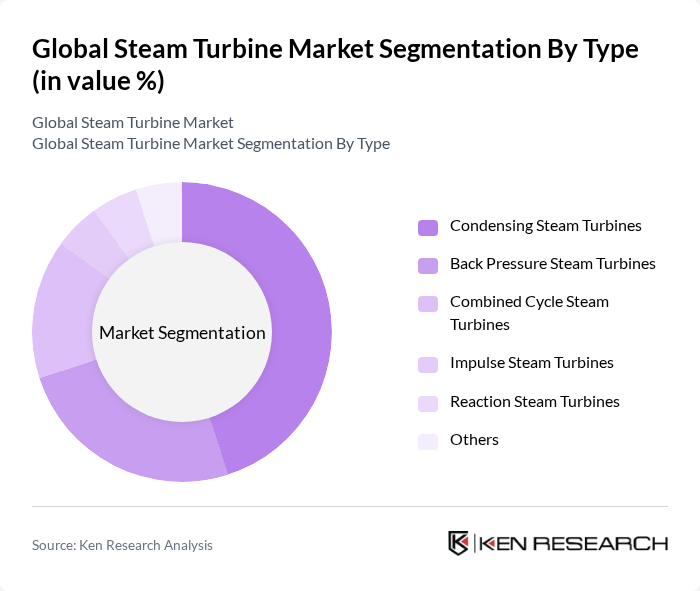

By Type:The steam turbine market is segmented into condensing steam turbines, back pressure steam turbines, combined cycle steam turbines, impulse steam turbines, reaction steam turbines, and others. Condensing steam turbines are the most widely used, driven by their high efficiency and suitability for large-scale power generation facilities. Back pressure steam turbines are prominent in industrial applications where process heat recovery is essential. The impulse segment is notable for its compact size and low operating costs, while the reaction segment is gaining traction due to its higher efficiency and increasing utility sector investments .

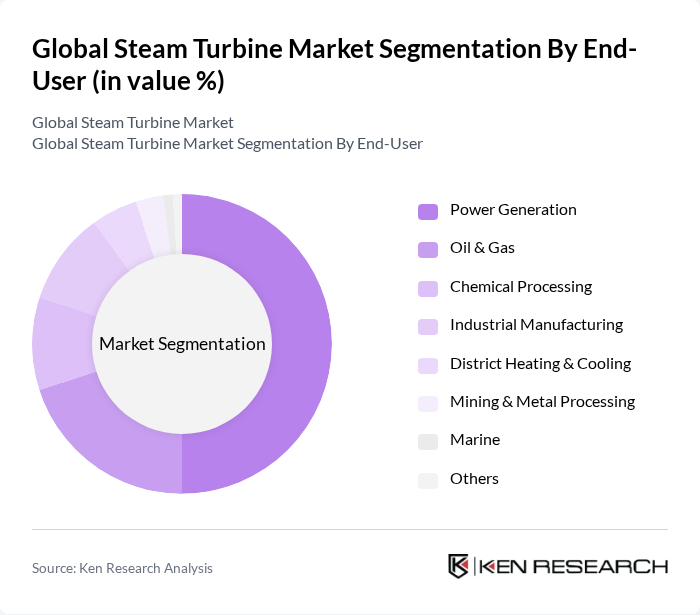

By End-User:The steam turbine market is further segmented by end-user applications, including power generation, oil & gas, chemical processing, industrial manufacturing, district heating & cooling, mining & metal processing, marine, and others. The power generation sector is the largest end-user, driven by the increasing demand for electricity and the need for efficient, reliable energy production. The oil & gas sector is also significant, utilizing steam turbines for enhanced oil recovery and power generation in refineries. Industrial manufacturing and chemical processing remain important segments due to the need for process steam and cogeneration .

The Global Steam Turbine Market is characterized by a dynamic mix of regional and international players. Leading participants such as General Electric (GE Vernova), Siemens Energy AG, Mitsubishi Power (Mitsubishi Heavy Industries Group), Toshiba Energy Systems & Solutions Corporation, Doosan Enerbility Co., Ltd., Bharat Heavy Electricals Limited (BHEL), Ansaldo Energia S.p.A., MAN Energy Solutions SE, Hitachi, Ltd., TMEIC Corporation, Shanghai Electric Group Co., Ltd., Harbin Electric Corporation, Elliott Group (Ebara Corporation), Fuji Electric Co., Ltd., Kawasaki Heavy Industries, Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the steam turbine market appears promising, driven by the increasing integration of renewable energy sources and technological advancements. As countries strive to meet ambitious emission reduction targets, the demand for efficient steam turbines will likely rise. Additionally, the trend towards decentralized energy production and hybrid energy systems will create new opportunities for innovation. Companies that adapt to these trends and invest in advanced technologies will be well-positioned to thrive in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Condensing Steam Turbines Back Pressure Steam Turbines Combined Cycle Steam Turbines Impulse Steam Turbines Reaction Steam Turbines Others |

| By End-User | Power Generation Oil & Gas Chemical Processing Industrial Manufacturing District Heating & Cooling Mining & Metal Processing Marine Others |

| By Application | Industrial Power Generation District Heating Cogeneration Waste Heat Recovery Others |

| By Component | Turbine Blades Turbine Casings Control Systems Rotors Bearings Others |

| By Sales Channel | Direct Sales Distributors Online Sales Others |

| By Distribution Mode | Wholesale Retail E-commerce Others |

| By Price Range | Low Price Range Mid Price Range High Price Range Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Power Generation Sector | 120 | Plant Managers, Energy Analysts |

| Oil & Gas Industry | 90 | Operations Directors, Technical Engineers |

| Manufacturing Applications | 60 | Production Managers, Maintenance Supervisors |

| Renewable Energy Integration | 50 | Renewable Energy Consultants, Project Managers |

| Research & Development | 40 | R&D Engineers, Innovation Managers |

The Global Steam Turbine Market is valued at approximately USD 23 billion, driven by the increasing demand for electricity generation and advancements in turbine technology that enhance performance and reduce emissions.