Region:Middle East

Author(s):Dev

Product Code:KRAD3333

Pages:90

Published On:November 2025

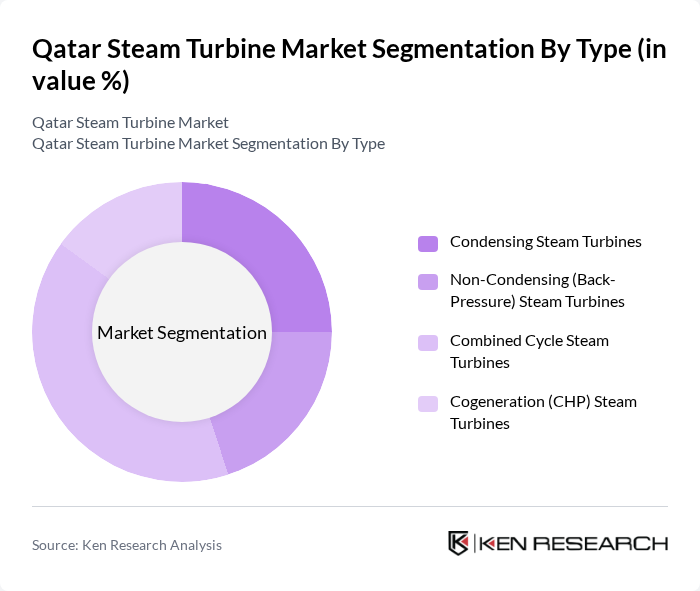

By Type:The steam turbine market in Qatar is segmented into Condensing Steam Turbines, Non-Condensing (Back-Pressure) Steam Turbines, Combined Cycle Steam Turbines, and Cogeneration (CHP) Steam Turbines. Combined Cycle Steam Turbines lead the market due to their high efficiency and ability to utilize waste heat for additional power generation. This dominance is supported by the country’s focus on energy efficiency and the need for reliable power supply, particularly in the industrial sector .

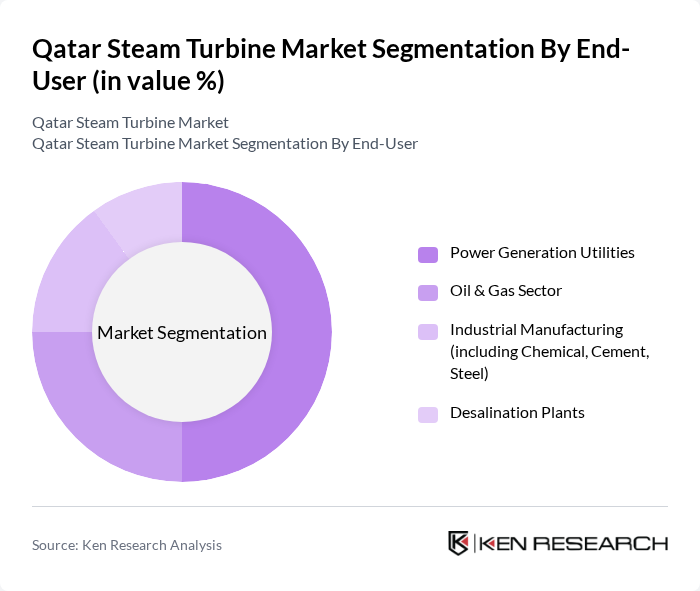

By End-User:The end-user segmentation includes Power Generation Utilities, Oil & Gas Sector, Industrial Manufacturing (including Chemical, Cement, Steel), and Desalination Plants. Power Generation Utilities are the largest segment, reflecting the nation’s ongoing investments in reliable electricity supply. The oil and gas sector remains a significant contributor, as steam turbines are essential for enhanced oil recovery and onsite power generation .

The Qatar Steam Turbine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Energy, General Electric (GE Power), Mitsubishi Power (Mitsubishi Heavy Industries Group), Ansaldo Energia, MAN Energy Solutions, Doosan Enerbility, Toshiba Energy Systems & Solutions, Bharat Heavy Electricals Limited (BHEL), Shanghai Electric Group, Harbin Electric Corporation, Alstom (now part of GE Power), Hitachi Energy, Hyundai Heavy Industries, Qatar Electricity & Water Company (QEWC), Ras Girtas Power Company contribute to innovation, geographic expansion, and service delivery in this space.

The Qatar steam turbine market is poised for significant evolution, driven by a strong emphasis on sustainability and technological innovation. As the country continues to invest in renewable energy projects, the integration of steam turbines into hybrid systems will become increasingly prevalent. Furthermore, advancements in automation and digital technologies will enhance operational efficiency, allowing for better lifecycle management of turbines. These trends indicate a robust future for the market, aligning with Qatar's long-term energy goals and economic diversification efforts.

| Segment | Sub-Segments |

|---|---|

| By Type | Condensing Steam Turbines Non-Condensing (Back-Pressure) Steam Turbines Combined Cycle Steam Turbines Cogeneration (CHP) Steam Turbines |

| By End-User | Power Generation Utilities Oil & Gas Sector Industrial Manufacturing (including Chemical, Cement, Steel) Desalination Plants |

| By Application | Baseload Power Generation Peak Load Power Generation Cogeneration/CHP Process Steam Supply |

| By Fuel Type | Natural Gas (via Combined Cycle) Fossil Fuels (Oil, Coal) Biomass & Waste Heat Geothermal |

| By Capacity | Below 40 MW –100 MW Above 100 MW |

| By Region | Doha Al Rayyan Al Wakrah Ras Laffan & Industrial Zones |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) Local Content Requirements |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Power Generation Utilities | 100 | Energy Managers, Operations Directors |

| Industrial Steam Users | 80 | Facility Managers, Process Engineers |

| Engineering and Consulting Firms | 60 | Project Managers, Technical Consultants |

| Government Energy Regulatory Bodies | 40 | Policy Makers, Regulatory Analysts |

| Renewable Energy Project Developers | 50 | Business Development Managers, Technical Directors |

The Qatar Steam Turbine Market is valued at approximately USD 180 thousand, reflecting growth driven by increased electricity demand in industrial and utility sectors, alongside ongoing infrastructure development and energy diversification initiatives in the country.