Region:Global

Author(s):Geetanshi

Product Code:KRAC3802

Pages:87

Published On:October 2025

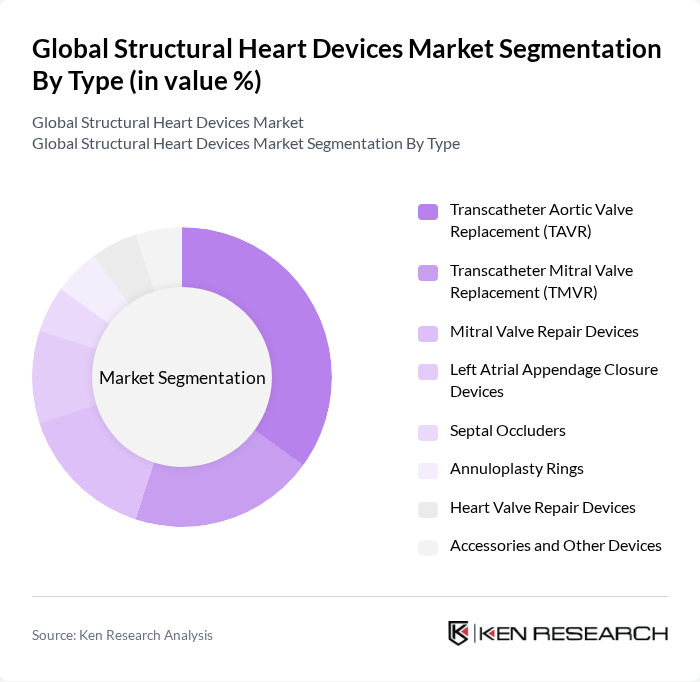

By Type:The market is segmented into various types of devices, including Transcatheter Aortic Valve Replacement (TAVR), Transcatheter Mitral Valve Replacement (TMVR), Mitral Valve Repair Devices, Left Atrial Appendage Closure Devices, Septal Occluders, Annuloplasty Rings, Heart Valve Repair Devices, and Accessories and Other Devices. Among these, TAVR has emerged as a leading sub-segment due to its minimally invasive nature, reduced hospital stays, and favorable patient outcomes, especially among elderly patients and those at high surgical risk.

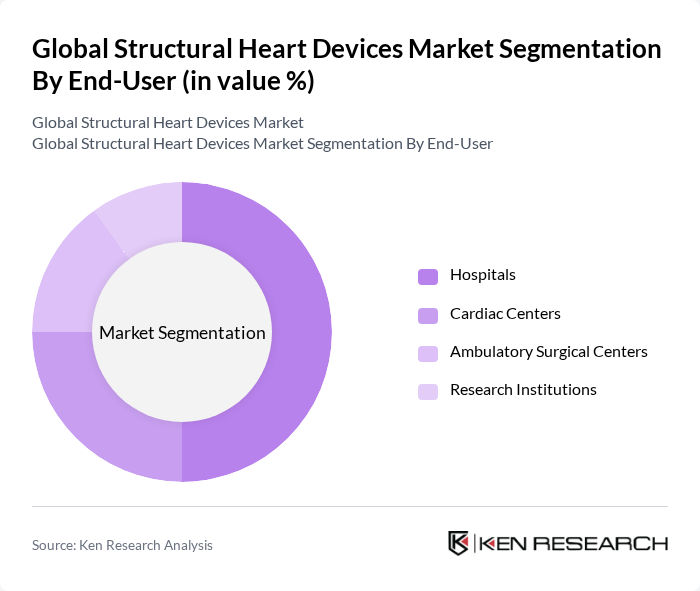

By End-User:The market is categorized by end-users, including Hospitals, Cardiac Centers, Ambulatory Surgical Centers, and Research Institutions. Hospitals are the dominant end-user segment, driven by the increasing number of cardiac procedures performed in these facilities, their comprehensive infrastructure, and their capacity to invest in advanced medical technologies.

The Global Structural Heart Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abbott Laboratories, Medtronic plc, Boston Scientific Corporation, Edwards Lifesciences Corporation, LivaNova PLC, JenaValve Technology, Inc., CardioKinetix, Biomerics, Comed BV, Braile Biomédica, JOTEC GmbH, Valcare Medical, W. L. Gore & Associates, Inc., Cardiovascular Systems, Inc., Neovasc Inc., CryoLife, Inc., Biotronik SE & Co. KG, AtriCure, Inc., Terumo Corporation, Cardiac Dimensions, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the structural heart devices market appears promising, driven by technological advancements and an increasing focus on patient-centric care. As healthcare systems continue to embrace personalized medicine, the integration of artificial intelligence and machine learning in diagnostics will enhance treatment outcomes. Additionally, the growth of outpatient procedures is expected to streamline patient care, making treatments more accessible and efficient, ultimately benefiting both patients and healthcare providers in the evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Transcatheter Aortic Valve Replacement (TAVR) Transcatheter Mitral Valve Replacement (TMVR) Mitral Valve Repair Devices Left Atrial Appendage Closure Devices Septal Occluders Annuloplasty Rings Heart Valve Repair Devices Accessories and Other Devices |

| By End-User | Hospitals Cardiac Centers Ambulatory Surgical Centers Research Institutions |

| By Application | Aortic Valve Disorders Mitral Valve Disorders Congenital Heart Defects Heart Failure |

| By Distribution Channel | Direct Sales Distributors Online Sales |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Premium Mid-range Economy |

| By Patient Demographics | Pediatric Patients Adult Patients Geriatric Patients |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cardiologists in Major Hospitals | 80 | Interventional Cardiologists, Electrophysiologists |

| Healthcare Procurement Managers | 60 | Hospital Procurement Officers, Supply Chain Managers |

| Medical Device Sales Representatives | 50 | Sales Managers, Territory Managers |

| Clinical Researchers in Cardiology | 40 | Clinical Trial Coordinators, Research Scientists |

| Regulatory Affairs Specialists | 40 | Regulatory Managers, Compliance Officers |

The Global Structural Heart Devices Market is valued at approximately USD 16 billion, driven by the increasing prevalence of heart diseases, advancements in minimally invasive surgical techniques, and rising healthcare expenditure, particularly among aging populations.