Region:Global

Author(s):Rebecca

Product Code:KRAC9722

Pages:90

Published On:November 2025

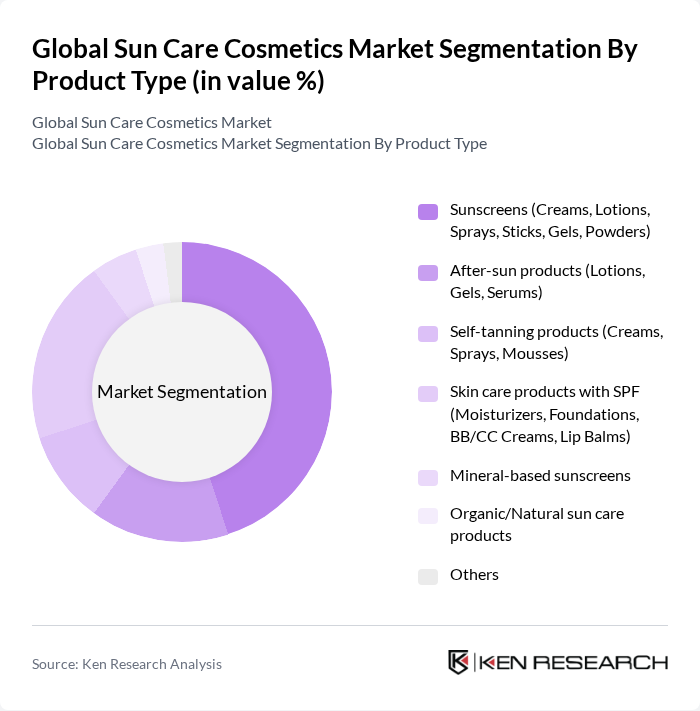

By Product Type:The product type segmentation includes various categories such as sunscreens, after-sun products, self-tanning products, skin care products with SPF, mineral-based sunscreens, organic/natural sun care products, and others. Among these,sunscreens—especially creams and lotions—dominate the market, driven by their proven efficacy in UV protection and consumer preference for easy-to-apply formulations. The market is also experiencing rising demand for mineral-based and organic/natural sun care products, reflecting a shift toward clean and eco-friendly ingredients .

By Skin Type:The skin type segmentation includes oily skin, dry skin, combination skin, sensitive skin, all skin types, and others. The market is primarily driven by products designed forsensitive skin, as consumers increasingly seek gentle, hypoallergenic formulations that address specific skin concerns. This trend is particularly pronounced in Asia-Pacific, where mineral-based and fragrance-free sunscreens are favored for their mildness and safety .

The Global Sun Care Cosmetics Market is characterized by a dynamic mix of regional and international players. Leading participants such as L'Oréal Groupe, The Estée Lauder Companies Inc., Procter & Gamble Co., Johnson & Johnson Services, Inc., Shiseido Company, Limited, Neutrogena Corporation, Beiersdorf AG (NIVEA), Avon Products, Inc., Coty Inc., Mary Kay Inc., Amway Corporation, Clarins Group, Edgewell Personal Care Co. (Banana Boat, Hawaiian Tropic), Unilever (Dove, Simple, Vaseline), Revlon, Inc., Oriflame Cosmetics S.A., and Amorepacific Group Inc. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the sun care cosmetics market appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, brands are increasingly adopting eco-friendly practices, including sustainable packaging and natural ingredients. Additionally, the rise of personalized skincare solutions is expected to reshape product offerings, allowing consumers to tailor their sun care routines. These trends indicate a dynamic market landscape, with opportunities for growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Sunscreens (Creams, Lotions, Sprays, Sticks, Gels, Powders) After-sun products (Lotions, Gels, Serums) Self-tanning products (Creams, Sprays, Mousses) Skin care products with SPF (Moisturizers, Foundations, BB/CC Creams, Lip Balms) Mineral-based sunscreens Organic/Natural sun care products Others |

| By Skin Type | Oily skin Dry skin Combination skin Sensitive skin All skin types Others |

| By Distribution Channel | Online retail (E-commerce, Brand Websites) Supermarkets/Hypermarkets Specialty stores (Beauty, Cosmetic, Pharmacy) Pharmacies/Drugstores Department stores Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, UK, France, Italy, Spain, Russia, Rest of Europe) Asia-Pacific (China, Japan, South Korea, India, Australia, Rest of APAC) Latin America (Brazil, Argentina, Rest of LATAM) Middle East & Africa (South Africa, Saudi Arabia, UAE, Rest of MEA) |

| By Age Group | Children Teenagers Adults Seniors Others |

| By Gender | Male Female Unisex Others |

| By Price Range | Premium Mid-range Economy Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Sun Care | 120 | General Consumers, Skincare Enthusiasts |

| Retail Insights on Sun Care Products | 60 | Store Managers, Beauty Advisors |

| Dermatologist Recommendations | 40 | Dermatologists, Skincare Specialists |

| Market Trends in E-commerce for Sun Care | 80 | E-commerce Managers, Digital Marketing Specialists |

| Product Development Insights | 50 | R&D Managers, Product Managers |

The Global Sun Care Cosmetics Market is valued at approximately USD 13.9 billion, driven by increasing consumer awareness of skin protection, rising disposable incomes, and a growing trend towards outdoor activities.