Region:Middle East

Author(s):Dev

Product Code:KRAD1776

Pages:82

Published On:November 2025

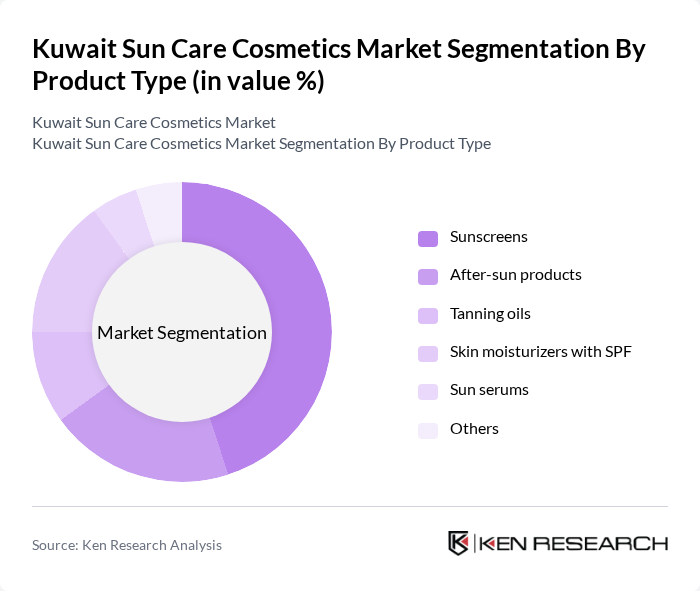

By Product Type:The product type segmentation includes various categories such as sunscreens, after-sun products, tanning oils, skin moisturizers with SPF, sun serums, and others. Among these,sunscreensdominate the market due to their essential role in protecting against UV radiation. Increasing awareness of skin cancer and other sun-related skin issues has led to a surge in sunscreen usage, particularly among younger, health-conscious consumers. The trend toward natural and organic formulations is also gaining traction, with brands increasingly focusing on clean-label and eco-friendly sun care products to meet evolving consumer preferences .

By Distribution Channel:The distribution channels for sun care products include online retail, supermarkets/hypermarkets, specialty beauty stores, pharmacies, beauty salons and clinics, and others.Online retailis rapidly gaining traction, especially among younger consumers who value convenience and access to a wide range of brands. Supermarkets and hypermarkets remain significant due to their broad reach and ability to offer multiple brands under one roof. Specialty beauty stores are increasingly catering to niche markets, providing premium and organic options that appeal to health-conscious consumers. The robust growth of e-commerce in Kuwait is a key driver, with online sales in the beauty and fitness category representing a substantial share of total online sales in the region .

The Kuwait Sun Care Cosmetics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nivea (Beiersdorf AG), L'Oréal (Garnier Ambre Solaire, La Roche-Posay), Neutrogena (Johnson & Johnson), Banana Boat (Edgewell Personal Care), Coppertone (Beiersdorf AG), La Roche-Posay (L'Oréal), Vichy (L'Oréal), Bioderma (NAOS Group), Aveeno (Johnson & Johnson), Eucerin (Beiersdorf AG), Hawaiian Tropic (Edgewell Personal Care), Sun Bum (Sun Bum LLC), Piz Buin (Johnson & Johnson), Australian Gold (New Sunshine LLC), SkinCeuticals (L'Oréal), Souffle Beauty (Kuwait-based), Estée Lauder Companies, Procter & Gamble, Unilever, Shiseido Co., Ltd., Kao Corporation, and Amorepacific Corporation contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Kuwait sun care cosmetics market appears promising, driven by evolving consumer preferences and increasing health consciousness. As the demand for multifunctional products rises, brands that innovate to combine sun protection with skincare benefits are likely to thrive. Additionally, the growing trend of sustainability will push companies to adopt eco-friendly practices, enhancing their appeal to environmentally conscious consumers. The market is poised for dynamic growth as these trends continue to shape consumer behavior and industry standards.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Sunscreens After-sun products Tanning oils Skin moisturizers with SPF Sun serums Others |

| By Distribution Channel | Online retail (e-commerce platforms, brand websites) Supermarkets/Hypermarkets Specialty beauty stores Pharmacies Beauty salons and clinics Others |

| By Consumer Demographics | Age group (Children, Adults, Seniors) Gender (Male, Female) Income level (Low, Middle, High) Nationality (Kuwaiti, Expatriate) Others |

| By Formulation | Creams Gels Sprays Sticks Lotions Others |

| By Brand Positioning | Premium Mid-range Budget Natural/Organic Others |

| By Packaging Type | Bottles Tubes Jars Sachets Airless pumps Others |

| By Usage Occasion | Daily use Special occasions Sports and outdoor activities Travel Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Sun Care | 120 | General Consumers, Beauty Enthusiasts |

| Retail Insights on Sun Care Products | 60 | Store Managers, Beauty Advisors |

| Expert Opinions on Sun Care Efficacy | 40 | Dermatologists, Skincare Specialists |

| Distribution Channel Effectiveness | 60 | Distributors, Wholesalers |

| Market Trends and Innovations | 40 | Product Development Managers, Brand Strategists |

The Kuwait Sun Care Cosmetics Market is valued at approximately USD 110 million, reflecting a significant growth driven by increased awareness of skin health, rising disposable incomes, and a growing trend towards outdoor activities among consumers.