Region:Middle East

Author(s):Geetanshi

Product Code:KRAC9401

Pages:82

Published On:November 2025

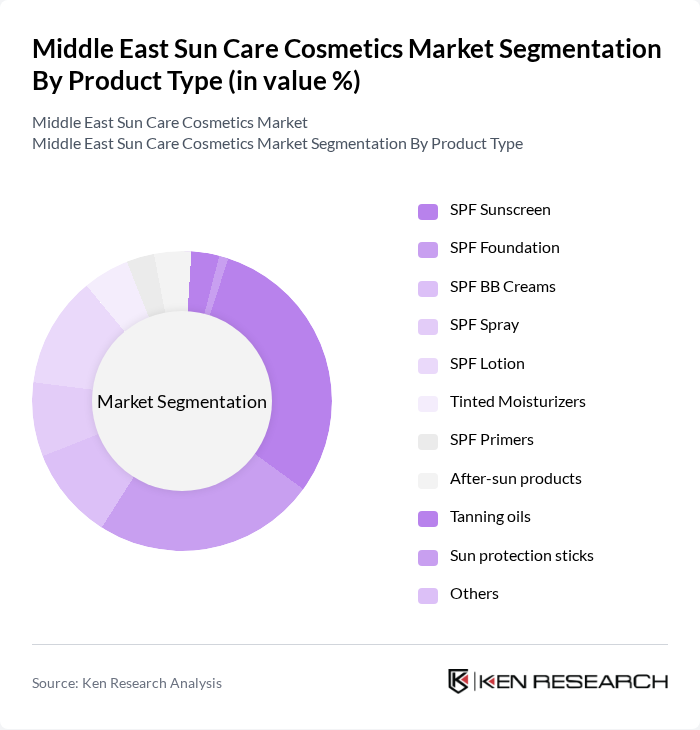

By Product Type:The product type segmentation includes various categories such as SPF Sunscreen, SPF Foundation, SPF BB Creams, SPF Spray, SPF Lotion, Tinted Moisturizers, SPF Primers, After-sun products, Tanning oils, Sun protection sticks, and Others. Among these, SPF Foundation was the largest revenue-generating product segment, while SPF Sunscreen is the fastest-growing sub-segment, driven by heightened awareness of skin protection and the increasing incidence of skin-related issues due to sun exposure. Consumers are increasingly opting for products with higher SPF ratings and multifunctional benefits, contributing to the growth of these segments.

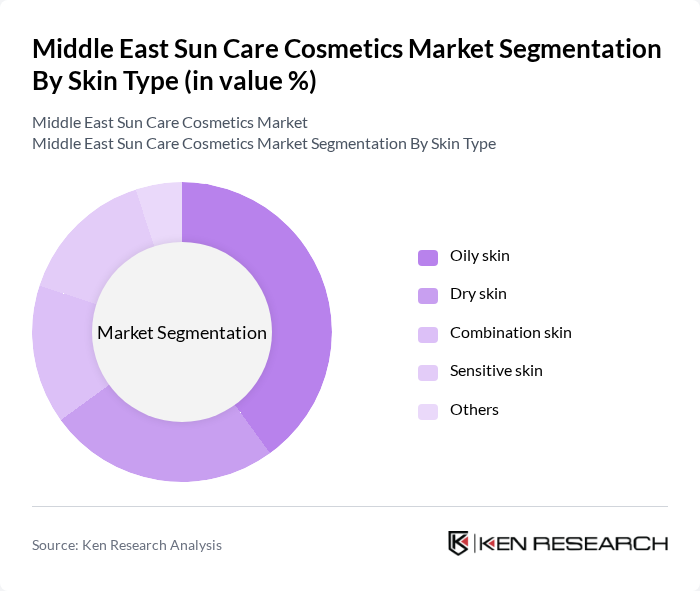

By Skin Type:The skin type segmentation includes Oily skin, Dry skin, Combination skin, Sensitive skin, and Others. The Oily skin segment is currently dominating the market, as consumers with oily skin often seek lightweight, non-greasy formulations that provide sun protection without exacerbating their skin condition. This trend is further supported by the increasing availability of specialized products catering to different skin types and the growing preference for mineral-based sunscreens suitable for sensitive and oily skin.

The Middle East Sun Care Cosmetics Market is characterized by a dynamic mix of regional and international players. Leading participants such as L'Oréal Middle East, Nivea (Beiersdorf AG), Neutrogena (Johnson & Johnson), Garnier (L'Oréal Group), Bioderma (NAOS), La Roche-Posay (L'Oréal Group), Vichy (L'Oréal Group), Eucerin (Beiersdorf AG), Coppertone (Beiersdorf AG), Banana Boat (Edgewell Personal Care), Hawaiian Tropic (Edgewell Personal Care), Aveeno (Johnson & Johnson), Piz Buin (Johnson & Johnson), Sun Bum (Sun Bum LLC), Supergoop (Supergoop LLC), Shiseido Middle East (Shiseido Co., Ltd.), Clarins Group, Unilever Middle East, The Estée Lauder Companies Middle East, Coty Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East sun care cosmetics market appears promising, driven by evolving consumer preferences and technological advancements. As awareness of skin health continues to rise, brands are likely to invest in innovative formulations that cater to diverse skin types and concerns. Additionally, the expansion of e-commerce platforms will facilitate greater accessibility to sun care products, enabling brands to reach a broader audience. This dynamic environment is expected to foster growth and encourage sustainable practices within the industry.

| Segment | Sub-Segments |

|---|---|

| By Product Type | SPF Sunscreen SPF Foundation SPF BB Creams SPF Spray SPF Lotion Tinted Moisturizers SPF Primers After-sun products Tanning oils Sun protection sticks Others |

| By Skin Type | Oily skin Dry skin Combination skin Sensitive skin Others |

| By Distribution Channel | Online retail Supermarkets/Hypermarkets Specialty stores Pharmacies Others |

| By Consumer Demographics | Age group (Children, Adults, Seniors) Gender (Male, Female, Unisex) Income level (Low, Middle, High) Others |

| By Packaging Type | Tube Bottle Spray Jar Others |

| By Brand Positioning | Luxury brands Mid-range brands Mass-market brands Others |

| By Geographic Region | GCC Countries Levant Region North Africa Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Sun Care Products | 100 | Store Managers, Beauty Advisors |

| Consumer Preferences in Sun Care | 120 | General Consumers, Skincare Enthusiasts |

| Dermatological Insights on Sun Protection | 40 | Dermatologists, Skincare Professionals |

| Market Trends in Outdoor Activities | 80 | Outdoor Enthusiasts, Tour Operators |

| Brand Loyalty and Awareness | 60 | Brand Managers, Marketing Executives |

The Middle East Sun Care Cosmetics Market is valued at approximately USD 710 million, reflecting significant growth driven by increased awareness of skin protection, rising disposable incomes, and a growing beauty consciousness among consumers in the region.